Threat to E-CommerceE-Commerce refers to the activity of buying and selling things over the internet. Simply, it refers to the commercial transactions which are conducted online. E-commerce can be drawn on many technologies such as mobile commerce, Internet marketing, online transaction processing, electronic funds transfer, supply chain management, electronic data interchange (EDI), inventory management systems, and automated data collection systems. E-commerce threat is occurring by using the internet for unfair means with the intention of stealing, fraud and security breach. There are various types of e-commerce threats. Some are accidental, some are purposeful, and some of them are due to human error. The most common security threats are an electronic payments system, e-cash, data misuse, credit/debit card frauds, etc. Electronic payments system:With the rapid development of the computer, mobile, and network technology, e-commerce has become a routine part of human life. In e-commerce, the customer can order products at home and save time for doing other things. There is no need of visiting a store or a shop. The customer can select different stores on the Internet in a very short time and compare the products with different characteristics such as price, colour, and quality. The electronic payment systems have a very important role in e-commerce. E-commerce organizations use electronic payment systems that refer to paperless monetary transactions. It revolutionized the business processing by reducing paperwork, transaction costs, and labour cost. E-commerce processing is user-friendly and less time consuming than manual processing. Electronic commerce helps a business organization expand its market reach expansion. There is a certain risk with the electronic payments system. Some of them are: The Risk of FraudAn electronic payment system has a huge risk of fraud. The computing devices use an identity of the person for authorizing a payment such as passwords and security questions. These authentications are not full proof in determining the identity of a person. If the password and the answers to the security questions are matched, the system doesn't care who is on the other side. If someone has access to our password or the answers to our security question, he will gain access to our money and can steal it from us. The Risk of Tax EvasionThe Internal Revenue Service law requires that every business declare their financial transactions and provide paper records so that tax compliance can be verified. The problem with electronic systems is that they don't provide cleanly into this paradigm. It makes the process of tax collection very frustrating for the Internal Revenue Service. It is at the business's choice to disclose payments received or made via electronic payment systems. The IRS has no way to know that it is telling the truth or not that makes it easy to evade taxation. The Risk of Payment ConflictsIn electronic payment systems, the payments are handled by an automated electronic system, not by humans. The system is prone to errors when it handles large amounts of payments on a frequent basis with more than one recipients involved. It is essential to continually check our pay slip after every pay period ends in order to ensure everything makes sense. If it is a failure to do this, may result in conflicts of payment caused by technical glitches and anomalies. E-cashE-cash is a paperless cash system which facilitates the transfer of funds anonymously. E-cash is free to the user while the sellers have paid a fee for this. The e-cash fund can be either stored on a card itself or in an account which is associated with the card. The most common examples of e-cash system are transit card, PayPal, GooglePay, Paytm, etc. E-cash has four major components-

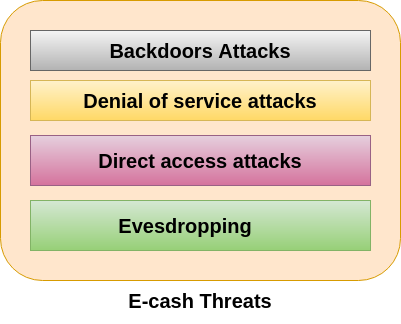

In e-cash, we stored financial information on the computer, electronic device or on the internet which is vulnerable to the hackers. Some of the major threats related to e-cash system are-

Backdoors AttacksIt is a type of attacks which gives an attacker to unauthorized access to a system by bypasses the normal authentication mechanisms. It works in the background and hides itself from the user that makes it difficult to detect and remove. Denial of service attacksA denial-of-service attack (DoS attack) is a security attack in which the attacker takes action that prevents the legitimate (correct) users from accessing the electronic devices. It makes a network resource unavailable to its intended users by temporarily disrupting services of a host connected to the Internet. Direct Access AttacksDirect access attack is an attack in which an intruder gains physical access to the computer to perform an unauthorized activity and installing various types of software to compromise security. These types of software loaded with worms and download a huge amount of sensitive data from the target victims. EavesdroppingThis is an unauthorized way of listening to private communication over the network. It does not interfere with the normal operations of the targeting system so that the sender and the recipient of the messages are not aware that their conversation is tracking. Credit/Debit card fraudA credit card allows us to borrow money from a recipient bank to make purchases. The issuer of the credit card has the condition that the cardholder will pay back the borrowed money with an additional agreed-upon charge. A debit card is of a plastic card which issued by the financial organization to account holder who has a savings deposit account that can be used instead of cash to make purchases. The debit card can be used only when the fund is available in the account. Some of the important threats associated with the debit/credit card are- ATM (Automated Teller Machine)-It is the favourite place of the fraudster from there they can steal our card details. Some of the important techniques which the criminals opt for getting hold of our card information is: Skimming- It is the process of attaching a data-skimming device in the card reader of the ATM. When the customer swipes their card in the ATM card reader, the information is copied from the magnetic strip to the device. By doing this, the criminals get to know the details of the Card number, name, CVV number, expiry date of the card and other details. Unwanted Presence- It is a rule that not more than one user should use the ATM at a time. If we find more than one people lurking around together, the intention behind this is to overlook our card details while we were making our transaction. Vishing/Phishing Phishing is an activity in which an intruder obtained the sensitive information of a user such as password, usernames, and credit card details, often for malicious reasons, etc. Vishing is an activity in which an intruder obtained the sensitive information of a user via sending SMS on mobiles. These SMS and Call appears to be from a reliable source, but in real they are fake. The main objective of vishing and phishing is to get the customer's PIN, account details, and passwords. Online Transaction Online transaction can be made by the customer to do shopping and pay their bills over the internet. It is as easy as for the customer, also easy for the customer to hack into our system and steal our sensitive information. Some important ways to steal our confidential information during an online transaction are-

POS Theft It is commonly done at merchant stores at the time of POS transaction. In this, the salesperson takes the customer card for processing payment and illegally copies the card details for later use.

Next TopicCyber Security Policies

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share