Above the Market'Above the market' is an order to sell or buy a stock at a higher price than the current market price. The exact opposite of the above the market order type is the 'Below the market' order. Some above-the-market orders include Stop Orders to Buy, Limits Orders to Sell, or Stop-Limits Orders to Buy.

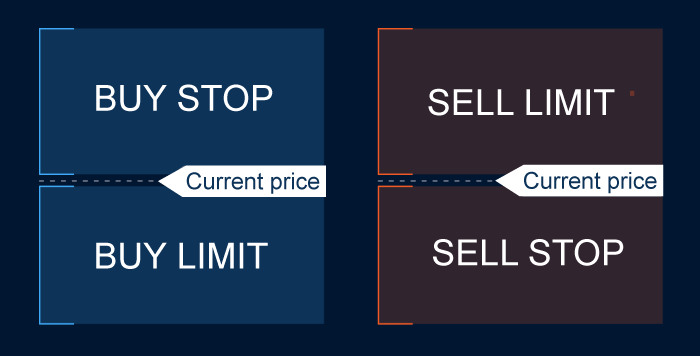

Above-the-market orders are mainly used by momentum traders, which are likely to trade in the same direction as the prevailing trade. However, they do not immediately trade and instead wait for the price to move continuously in the trending direction to make sure to trigger an order to buy or sell. Let us understand it by an example. Suppose a trader buys a stock in which he expects that the price of it will go higher. To sell that stock to make a profit, the trader, in such a case, places the sell order at a price that will be above the current market price, and when the price of the stock breaks that resistance level, then the order will be automatically executed, and the trader will be in profit. This is how the above-the-market approach works. The momentum traders and even the short sellers use above-the-market orders to enter short positions. For example, when a stock reaches a price from which, if it is increased further, it will be overvalued according to the short sellers. Therefore, in such a situation, the short sellers use the above-the-market order and fix it near the price of the stock over which the stock will be overvalued. Let's understand this with a simple example. Suppose a stock is trading at $70; there are chances that it will not go higher than $80; if it goes higher than that, it will be overvalued. In such a case, the short sellers place a limit order to sell somewhere around $80. Doing so puts the short sellers in a position where they are not required to keep an eye on the prices of the stock. Traders not only depend on the above-the-market orders but also use technical analysis along with the above-the-market orders. For example, by looking at the patterns of the chart, the trader may determine any trigger point that he may use to enter or exit a long position. Below the market orders are used by the traders or investors when they want to purchase any security at a price lower than the current price or to sell a security at a price lower than the current market price. There are three types of below-the-market orders; they are Stop Orders to Sell, Limits Orders to Buy, and Stop-Limit Orders to Sell. Types of Above The Market OrdersThe different types of above-the-market orders are listed below, along with how they can be used:

Limit Order to SellA limit order to sell is often used when traders or investors believe that the price of a particular stock will rise for a short period of time and then fall, which means that a bearish trend for that stock may be seen. This order type is used by traders or investors who already own shares, and to sell those shares at a price higher than the current market price, the traders place a limit order to sell. Another name for this type of above-the-market order is Take-Profit order (T/P), as the traders fix or book profits for them using this order. This order type can also be used when the trader wants to enter a short position if the stock price reaches the order price. Suppose you are a trader, and you check the patterns of the chart for the shares of Google. You come to the conclusion that soon, the stocks of Google will show a bearish trend because of facing heavy resistance at around $700. Therefore, you, as a trader, fix a sell limit order somewhere around $700 to sell 100 shares of Google. Doing this may save you from loss, and you may make profits too. Stop Order to BuyStop order to buy is the order the traders place to buy a stock at a price higher than the current market price. Now, the question arises as to why a trader is not buying a stock at the current market price but at a higher price. It is because the traders check the stock that if it will break the resistance level of the market or not. If they think that the price of the stock will go higher than the price on which they are purchasing the stock, then in that case, they place a stop order to buy. The traders only place this order when they are sure that the security will break through the resistance and has the momentum to reach the order. Let's understand this with an example, suppose there is a security named ABC, and the current market price of it is around $13. The trader checks the chart and finds out that the resistance level of the market is $14, which means that if the price of the stock breaks this resistance level, then the price of the stock will increase further. Therefore, in this case, the trader may usually place a stop order to buy at $14. Stop Limit Order to BuyThis type of above-the-market order is used by traders in a case when they want to buy any share at a certain price since placing the stop limit order to buy helps the traders in the purchase of the shares without paying any unexpectedly high prices for the share because of spillage. It is the same situation when the traders place a stop order to buy but are scared that the stock gaps are too much above the resistance level, and they will have to pay much for the stocks. Therefore, they may instead place the stop limit orders to buy to overcome this situation. Benefits of Using Above The MarketThe benefits of using above-the-market orders in selling or buying securities are listed below:

The Bottom LineAbove-the-market orders are placed in situations where traders want to buy or sell a stock when the stock reaches a desired price. Placing such orders help the traders automatically buy or sell the stocks as the orders automatically get executed when the stocks reach the desired price. These orders become important for the traders as it makes trading easier for the traders and investors because they are no longer required to keep an eye on the chart continuously. It is also important that the trading strategies and chart patterns are aligned with the above-the-market order types.

Next TopicAbsolute Return

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share