Accounting Rate of Return

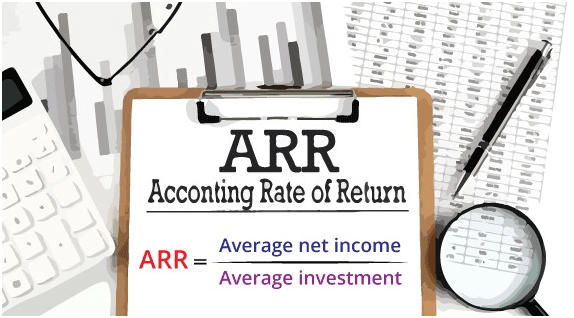

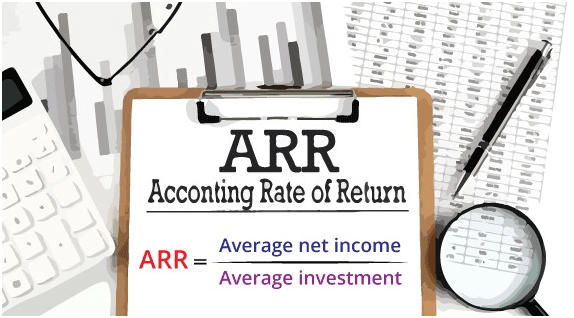

The accounting rate of return is a formula that represents the percentage rate of return on an investment or asset in comparison to the initial investment cost. One of ARR's largest flaws is that it ignores the time value of money or cash flow, both of which are important aspects of running a firm. The ARR formula calculates the ratio or return that may be expected during the life of an asset or project by dividing the asset's average revenue by the company's initial investment.

The Accounting Rate of Return: An Overview (ARR)

The accounting rate of return is a capital budgeting indicator that may be used to quickly determine the profitability of a project. Businesses use ARR to evaluate multiple projects and establish the expected rate of return on each, as well as to aid in the decision-making process for investment or acquisition.

ARR takes into account any potential yearly project expenses, such as depreciation. Depreciation is a beneficial accounting rule that allows the cost of a fixed asset to be spread out, or expensed, throughout the item's useful life. This allows the company to profit from the asset straight away, even if it is in its first year of operation.

How to Calculate the Accounting Rate of Return (ARR)?

The accounting rate of return is a basic formula that can be used by any organization to determine the earning potential of an asset. "Average yearly revenue" divided by "original investment" is the ARR formula. Keep in mind that each figure should have its line item, and you can organize the figures using Excel spreadsheet templates. An example of an ARR computation is shown below.

- The first step in the process of ARR calculation is to figure out the investment's average annual profit. This amount should indicate your asset's net income, less any annual expenditures or expenses such as taxes or COGs. Your asset, for example, could be a rental property with a net present value of $200,000 and $100,000 in revenue. The annual net profit for that year would be $75,000 if the asset cost the company $25,000 in repairs (which are your operational expenses). Simply divide the net profit by the investment period, or the number of years you will be using the asset for income, to get the average yearly profit. For this example, we'll look at the asset's ARR.

- The next step is to subtract the cost of depreciation. If the investment is a fixed asset (such as a new machine, real estate, or other equipment), you must modify your net profit to account for the asset's value degradation over the product's useful life. To calculate your net annual profit, subtract the amount of depreciation from your annual profit. The annual net profit will be $25,000 ($75,000 - $50,000) if the rental property (from the example above) was purchased for $200,000 at the beginning of the year but is now valued at $150,000.

- After it, you are required to divide the annual net profit by the asset's initial cost. The total profit will be divided by the investment's starting cost, which in our example is $200,000 for the property. $25,000/$200,000 = 0.125.

- At last, the above result will be multiplied by 100 so that the answer can be received in percentage. By multiplying your decimal amount by 100, you can now calculate the percentage rate of return on your investment. To get 12.5 percent in our example, we would simply multiply 0.125 by 100. Over a year, our rental property would provide a 12.5 percent internal rate of return.

Advantages of Using the ARR

Various advantages of using an accounting rate of return are given below:

- Simplicity

The ARR approach is one of the most straightforward ways to assess an investment. It does not require significant or difficult computations, unlike NPV and IRR approaches. Furthermore, because ARR is simple to comprehend, it is often employed by audiences with limited financial expertise. For non-finance managers, ARR is the favored method of investment evaluation because of its simplicity.

- Use of Accounting Data

Unlike NPV and IRR, ARR does not take cash flows into account. Accounting data can be used to compute ARR. ARR computation is one of the simplest techniques to evaluate an investment because accounting data is easily available. Furthermore, because accounting data is a real depiction of a company's performance, ARR is an excellent tool for assessing a company's performance based on specific investments.

- Accounting Profitability

The complete stream of income and profitability throughout the project is included in the ARR method. As a result, it provides a complete view of an investment project's profitability. Accounting profitability allows businesses to focus on more profitable investment possibilities, making it easier to evaluate investments.

- Others

- It is easy to calculate and comprehend the payback pattern over the project's economic life.

- This method allows for the comparison of various competitive projects.

- Small-time investors would be more likely to use this strategy to evaluate their investment decision.

Disadvantages of Using the ARR

Some of the major disadvantages of usingan accounting rate of return are as follows:

- Cash Flows are Ignored

ARR ignores cash flows in favor of profitability as a metric of investment evaluation. ARR is inaccurate in some investment instances because profitability is an imperfect measure of actual investment evaluation. Accounting gains are frequently based on arbitrary assumptions, and non-cash items may be included. As a result, relying solely on ARR to evaluate an investment project is inadvisable.

- Time Value is Ignored

The time value of money, which states that a specific amount of money today is worth more than the same amount of money tomorrow, is completely ignored by the ARR technique. Because the time value of money is not adjusted, ARR is an ineffective method for assessing investments.

- Arbitrary Cut-off

To limit projects, most organizations that employ ARR as an evaluation technique use an arbitrary cut-off yardstick. The standard is usually the company's current return on assets, often known as book value. As a result, growing businesses with high rates of return on existing assets may reject profitable projects, whereas smaller organizations with lower asset returns may accept less profitable ones.

- Others

- When a project's investment is made over time or in stages, this strategy cannot be applied.

- When comparing different projects, this method does not take into account the life cycle of diverse investments, and hence may not yield the correct findings that are required.

- External effects are ignored by this method, and the findings differ when the same project is assessed using the return on investment method. As a result, it is unsuitable for large, long-term projects.

Difference between Accounting Rate of Return (ARR) and Internal Rate of Return (IRR)

The difference between accounting and internal rate of return can be understood with the information given below:

| Basis of Difference |

Accounting Rate of Return |

Internal Rate of Return |

| 1. Meaning |

The annual average profit that is earned on the initial capital investment of a project or asset is called ARR. |

The yield percentage that a project or asset is expected to give over its life span of called IRR. |

| 2. Calculation |

To calculate the ARR, the average annual profit of the organization is divided by the initial investment of the project, and the value is represented in percentages. |

IRR is the rate at which the net present value of the net cash flows of the project is zero. Net cash flows are calculated by subtracting the present value of future cash outflow from the present value of future cash inflow. |

| 3. Time Value of Money |

The concept of the time value of money is not considered under ARR. It considers that the future profit will have the same value as today. |

The calculations under IRR are based on the concept of the time value of money as it discounts all cash flows to their present value. |

| 4. Profit V/s Cash Flow |

Here, the profit generated from the project is considered which includes the profits related to all non-cash as well as cash expenses. |

Here, only cash inflows generated from the project are considered. Hence, IRR does not consider non-cash expenses such as depreciation and other unpaid accruals during the profit calculation. |

| 5. Complexity of Calculation |

The calculation of ARR is simpler than IRR as it includes just a single mathematical formula for the calculation. |

The calculation of IRR is more complex because of its algebraic formula. To make the calculation easier, the help of several calculations told such as Excel formulas and IRR tables is taken. |

| 6. Weightage to Timing of Profit/cash Flow Generation |

Under ARR, equal weightage is given to the profit earned across all years. |

Under IRR, net values are considered and higher weightage is given to the earlier cash flows. |

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now