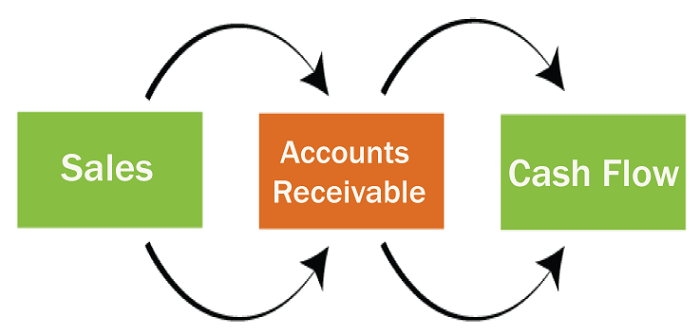

Accounts Receivable (AR): What It Is and How Businesses Use It, With ExamplesUnderstanding Accounts ReceivableAccounts receivable refers to the sum of money due to a company for goods or services delivered or used but have yet to be paid for by customers. Accounts receivable are listed as a current asset on the balance sheet. The term "AR" refers to any amount that customers owe for purchases they made using credit.

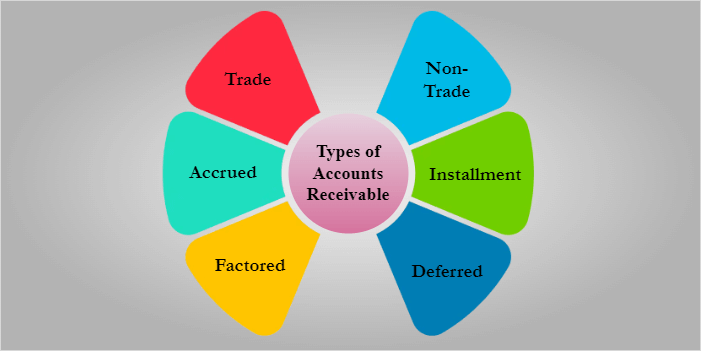

The unpaid invoices or cash that clients owe to a company are known as "accounts receivable". The phrase refers to accounts that a business is due after offering a commodity or service. A company's line of credit, also known as its receivables or accounts receivables, requires payments to be made within a somewhat short period of time. It may range from a few days to a fiscal or calendar year from company to company. Businesses list accounts receivable as an asset on their balance sheets since the client has a legal obligation to pay the debts. They may be used as collateral against a loan to pay urgent costs, and that is why they are considered liquid assets. Receivables are part of a business's operating capital. Accounts receivable are, moreover, a current asset, necessitating that the debtor settles the whole balance of the account in a year or less. Receivables are evidence that a company has made a credit sale but has yet to get payment from the client. In essence, it represents that the client has issued a short-term IOU (I owe you) to the company. Types of Accounts ReceivableThe different types of accounts receivable are listed below:

1. Trade Account ReceivableTrade Account Receivable refers to the amount of money owed by customers for goods or services sold on credit. For example, if a company sells goods or services to a customer on credit, then the outstanding amount owed by the customer is classified as trade account receivable. 2. Non-Trade Account ReceivableNon-Trade Account Receivable refers to other receivables that are not related to the company's primary business. Some examples of non-trade account receivables include employee loans, tax refunds, or supplier advances. 3. Accrued ReceivablesAccrued Receivables refer to the amount of money that is owed to the company but has not yet been invoiced or recorded in the books. For example, if a company has completed work for a client but has not yet issued an invoice, the outstanding amount is classified as accrued receivables. 4. Installment ReceivablesInstallment Receivables refer to the amount of money owed to the company for goods or services sold on an installment basis. In this type of arrangement, the customer pays for the goods or services in installments over a specified period. 5. Factored ReceivablesFactored Receivables refer to the amount of money that a company has due to receive from a third-party financial institution or a factor after selling its receivables (invoices). The factor purchases the receivables at a discounted rate and collects the payments directly from customers on behalf of the company. 6. Deferred ReceivablesDeferred Receivables refer to the amount of money owed to the company for goods or services sold on credit, but the payment is deferred to a later date. For example, a company may agree to provide goods or services to a customer, and the payment is deferred to a future date, such as six months or one year later. Accounts Payable vs. Accounts ReceivableThe debts a company owes to its suppliers or other stakeholders are accounts payable. Accounts payable is the polar opposite of accounts receivable. For instance, suppose that Company A cleans Company B's carpets before sending a bill. In this case, Company B reflects the invoice in the accounts payable column since Company B owes the money to another party, i.e., Company A. While waiting for payment, Company A records the invoice in its accounts receivable column. Advantages of Accounts ReceivablesReceivables are a crucial part of a company's fundamental analysis. Accounts receivable, more like a current asset, represents a company's liquidity or ability to meet short-term obligations without further cash inflows. Fundamental analysts use the word "turnover" to refer to the frequency with which a company collects on its accounts receivable balance throughout an accounting period. Another method of analysis would include the approach of days sales outstanding (DSO), which calculates how long it typically takes to recover money after a transaction has been made. Challenges in Account ReceivablesAccount receivable management is crucial to the financial health of a business. However, managing account receivables can present several challenges that need to be overcome to maintain a healthy cash flow. Now, we will discuss some of the common challenges in accounts receivable and how to overcome them. They are: Slow Payment from CustomersOne of the most significant challenges in account receivable management is slow payment from customers. Slow payment can lead to cash flow problems, making it challenging to pay suppliers and employees on time. To overcome this challenge, businesses can implement a system to monitor payment due dates and follow up with past-due customers. Offering incentives for early payment or charging interest for late payment can also help encourage customers to pay on time. Difficulty in Collecting DebtAnother challenge that businesses face is difficulty in collecting debt. Sometimes, customers may refuse to pay, dispute the payment or declare bankruptcy, making it challenging to recover the debt. To overcome this challenge, businesses can hire a debt collection agency or a lawyer to pursue legal action against the customer. However, legal action should be the last resort as it can be costly and time-consuming. Inaccurate BillingInaccurate billing can lead to delayed payment, customer dissatisfaction and disputes, and potential loss of business. To overcome this challenge, businesses should ensure that invoices are accurate and delivered on time. It is crucial to provide detailed information about the goods or services provided with the payment terms and contact information in the invoice. Inefficient Receivables ManagementInefficient receivables management can lead to errors, delays, and missed opportunities. To overcome this challenge, businesses can implement a receivables management system that automates invoicing, monitors payment due dates, and provides real-time reporting. An efficient receivables management system can help businesses reduce errors, save time and resources, and improve cash flow. Credit RiskGranting credit to customers always carries a degree of risk. A customer may not be able to pay or may default on payment, leading to a loss for the business. To overcome this challenge, businesses can implement credit policies that assess the creditworthiness of potential customers before granting credit. It is crucial to set credit limits, monitor payment behavior, and enforce credit terms. Accounts Receivable ExampleAn electric firm that invoices its customers after they use the power is an example of an accounts receivable. The electric company keeps track of outstanding invoices as account receivables while it waits for its clients to make payments.

The majority of businesses function by allowing some of their sales to be on credit. Businesses may grant this credit to regular or special clients who receive recurring invoices. Customers may avoid the trouble of physically paying for each transaction thanks to this approach. In other situations, companies often provide their customers the option to pay after obtaining the service. What types of debt are receivables?A receivable is created whenever a business is owed money for products or services that have been delivered but not yet paid for. An installment payment plan, a subscription payment due after getting the goods or services, or a transaction to a customer utilizing shop credit might cause this. Where can I locate the company's receivables?On a company's balance sheet, you may see accounts receivable. They are recorded as an asset since they reflect money owing to the business. What happens if clients fail to make payments when they're due?When it is clear that a client won't pay, accounts receivable must be written off as a bad debt expense or one-time charge. What distinguishes accounts receivable from accounts payable?The money owed to the company by customers for services delivered is represented by accounts receivable, which is recorded as an asset. Contrarily, accounts payable indicate the money that the company owes to other parties, such as payments to creditors or suppliers. They are recorded as liabilities. The Bottom LineAccount Receivable is a vital component of a business's financial health. It represents the amount of money that customers owe to a business for goods or services provided on credit. Effective account receivable management is required to maintain a healthy cash flow, thereby reducing bad debt and increasing profitability. It involves managing payment due dates, following up with customers, implementing efficient invoicing processes, and assessing creditworthiness. Businesses can overcome common challenges such as slow payment, difficulty in collecting debt, inaccurate billing, inefficient receivables management, and credit risk by implementing appropriate strategies. By effectively managing account receivable, businesses can ensure financial stability and growth. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share