Accrual AccountingWhat is an Accrual?There might be no want for accruals if businesses obtained coins bills for all sales once they had been earned and made coins bills for all charges on the equal time they had been incurred. However, because most businesses have some revenues in the year that are earned (i.e., provide goods/services) but not paid for, they must account for such unpaid revenues. The same is true for costs. Companies must accumulate expenses if they incurred them (i.e., received goods/services) but not pay for them in cash. Accrual accounting aims to suit sales and charges to the intervals wherein they had been incurred in preference to the timing of the corresponding coin flows. The accrual foundation of accounting is certainly considered one among accounting methodologies, the opposite being the coins foundation of accounting. The accrual foundation of accounting is a barely extra complex technique for documenting transactions.

It relies on the concept that transactions are recorded as they happen. Organizations that use the accrual foundation of accounting need to file sales and charges as quickly as a transaction occurs, irrespective of whether the price is obtained or made. Accrual accounting adheres to the matching principle, which asserts that charges and sales must be diagnosed within an equal period. It is an important accounting technique for massive groups and people that deal in credit. What Exactly Is Accrual Accounting?Accrual accounting is a monetary accounting technique that permits an enterprise to file profits earlier than receiving a price for items or offerings bought or charges to be recorded as incurred earlier than being paid for. Accrual accounting is considered one of the accounting procedures; coins accounting is the opposite. Cash accounting only captures revenue when a cash transaction for goods and services occurs. In other words, regardless of when cash transactions occur, revenue is reported on the company's accounting books. Key Points:

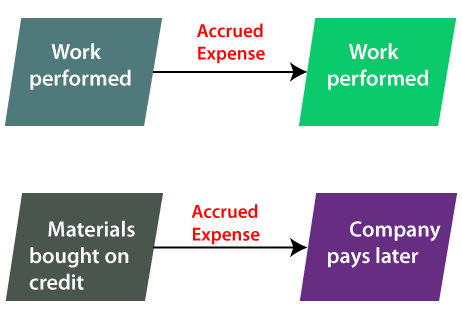

Accounting InfrastructureThe main principle of accrual accounting is that financial transactions are recorded by allocating revenues to expenses when the transaction occurs, not when the transaction is paid or received. This strategy combines current cash inflows and outflows with future cash flows to provide a more realistic picture of a company's financial position. The accrual basis was adopted because of the rising complexity of financial operations and the need for a more accurate representation of the business. What exactly is the Accrual Method?Sales are recognized in the income statement using accrual accounting when they occur, even if the customer pays after 30 days. When revenues are earned, the corporation credits a revenue account and debits the asset account 'Accounts Receivable' (When a customer pays 30 days after revenue is collected, the corporation deducts Cash and Credits Accounts Receivable). Accrual accounting requires that expenses and losses be recognized in the income statement when incurred, even if they are not due within 30 days. Suppose the company makes a Rs.15,000 repair on December 15, and the seller accepts the payment on January 15. In this case, as of December 15, the company is aware of a $ 15,000 repair cost and a Rs.15,000 obligation. (The corporation will credit Cash and debit the liabilities account on January 15.) Large organizations should use accrual accounting. (Individuals and small businesses may employ the cash method of accounting.) The accrual approach and associated adjustment entries produce a more complete and accurate report of a company's assets, liabilities, capital, and income for each accounting period. Different Types of AccrualsReserves are income that the company has not yet received and expenses that the company has not yet paid. The four categories of accruals commonly reported on the balance sheet when using the accrual accounting method are as follows. 1. Earned RevenuesAccrued revenues are income or assets (including non-cash assets) that have not yet been received. In this instance, a business may provide services or provide items on credit. Example Power consumption is an example of accrued revenue. Consumers consume power and meters register meter readings. Before receiving payment for the utility and electricity, firm normally gives it to its customers. Consumers will be billed at the end of the billing period. The corporation pays its staff throughout the month, fuels its generators, and incurs logistical and other costs. Even though it has expenses during the month, the electrical company must wait until the end of the month to get its income. Meanwhile, it must declare that it anticipates future earnings. Accrual accounting, as a result, allows the organization to track its financial status more correctly. Consumers will be billed at the end of the billing period. 2. Accrued expensesAccrual interest expense has not been paid but has not yet been paid. When a company makes a purchase with credit and posts a liability to the general ledger, the company recognizes its obligations to the creditor.

Example Consider a start-up company (Y) with one employee (Joe) who is subject to a vesting plan for the after five years of work, Cliff receives an incentive for the vesting plan. Joe develops into a dependable, hardworking, and conscientious employee while working for the company. He completes the first year and receives his cliff vesting bonus and the remaining five years of his vesting schedule bonuses. However, Joe is not substantially earning his bonuses throughout this time, as would be the case with cash paid at the transaction. Joe's bonuses, on the other hand, have been steadily increasing. At the same time, Company Y's liabilities have been growing. When a company pays a bonus to be paid to Joe, the transaction is documented by debiting from the debit account and crediting to the cash account. In this instance, it is self-evident that Company Y becomes Joe's debtor for five years. Therefore, to keep an accurate record of Joe's bonuses, businesses need to create a bonus liability ratio to account for those bonus costs. 3. Deferred RevenueWhen a corporation receives cash before delivering a product or service, it opens a deferred revenue account, also known as unearned revenue. Therefore, to keep an accurate record of Joe's bonuses, businesses need to create a bonus liability ratio to account for those bonus costs. Assume you bought $1,200 for a year's membership at a gym ($100 each month). Jim creates a $ 1,200 deferred revenue account (liability) to indicate that he has received the money but has not yet provided the service in accrual accounting. This account is a liability because the entity will need to deliver goods or perform services in the future. Jim may deduct $ 100 from his deferred income account during the monthly course to indicate that he has provided the service for a month. It can simultaneously record $100 in revenue each month to demonstrate that the revenue has been collected through the provision of the service. 4. Paid-in-Advance ExpensesA prepaid expense account is created if a company pays cash before receiving goods or services. It is an asset account because it demonstrates that the corporation is entitled to receive a good or service in the future. The dental office spends $ 144 ($ 12 / month) on an annual magazine subscription to read while the client is waiting for an appointment. The dental clinic creates a $144 prepaid expense account at the time of payment to reflect that it has not yet received the items but has already paid the cash. The dental office may deduct $ 12 from the prepaid account throughout the year to indicate that it has "used up" a month of prepaid (assets). It can simultaneously record a $12 monthly charge to prove that the expense was incurred due to getting the magazine. Accrued Expenses vs. Prepaid ExpensesPrepaid expenses are the inverse of incurred expenses in terms of payment. Rather than deferring payment until a later date, a corporation pays for services and commodities upfront, even if it does not receive the entire amount of goods or services at the moment of payment. For example, a corporation may pay for its monthly internet services in advance before using the services at the beginning of the month. How does Accrual Accounting Work?Unlike cash accounting, income-based accounting records income and expenses, which records income when you receive cash payments (credit card slips, checks, or other forms of payment) from consumers and records expenses when you pay cash to vendors. As a result, all transactions are recorded regardless of when the currency changes. For example, suppose you sell products on store credit to a customer in October. In this case, the accrual approach requires the transaction to be recorded as a receivable statement as soon as the payment is received. The transaction must be recognized as revenue in October, even if the consumer does not pay for the item until December. The same is true for any goods or services purchased on credit. Even if you don't make a cash payment on those items until May, materials purchased on credit in April are reported as costs under the accrual method. As a result, when you purchase a product or service, your operating costs will be recognized, even if you haven't paid yet or for the future. According to the IRS, businesses can use either the cash method or the accrual basis approach to calculate taxable income and maintain books for the tax year. Certain businesses, however, must use the accrual method in their accounting if they manufacture, purchase, or sell items or if their total sales exceed $5 million. Benefits of Accrual AccountingCash transactions should be recorded depending on when services are finished, products are delivered, and expenses are made to create a more realistic picture of your company's performance. The following are the primary benefits of accrual accounting: Accrual accounting reconciles revenue and expenses.One of the primary advantages of accrual accounting over cash accounting is that it properly tracks corporate activity and profitability. Accrual accounting is especially useful for determining profitability during a given month or tax year if your company invoices consumers later for services previously completed or sells things on store credit to customers. The same is true for expenses such as insurance premiums, which are paid in advance but needed afterward. Consider the following example:

Regardless of the time gap between service delivery and payment, the event's expenses are matched with the event's revenues, regardless of when the consumer pays. Accrual accounting might help you postpone your tax burdenYou can give your tax planning flexibility in both cash and accrual accounting. In the case of accrual accounting, if you receive an advance payment in 2015 for services that you agree to execute by the end of the next year, you can postpone paying taxes on that revenue until the following tax year. Accrual Accounting's DrawbacksWhile accrual accounting correctly displays firm success and portrays long-term revenues and expenses, it has a few downsides. Here are some accrual accounting problems to avoid if you're thinking about switching from the cash system. Cash flows are ignored in accrual accountingIf you use the accrual accounting approach, the quantity of cash inflow from your sales may not always match the revenues you're showing on your books. In other words, even though your revenue statement indicates thousands of dollars in sales, your actual bank account balance may be lower if clients do not pay what they owe you. As a result, accrual accounting is ineffective in tracking cash flows. Accrual accounting necessitates greater bookkeeping and personnel resourcesDue to the additional complexity and paperwork required by the accrual method of accounting, small business owners-particularly when establishing a business-view it as more cumbersome and expensive to execute. Revenues are recognized before you receive cash, so you need to track your cash flows individually using an accrual method to ensure that you cover your monthly bills. Investing in automation tools and software, like QuickBooks, is one approach to counteract the people and time resources required by accrual accounting. What Effect does Accrual Accounting have in Financial Statements?The principal impact of accrual accounting is on the income statement because the recordation of accrual basis transactions can significantly alter a company's reported net profit or loss. Because accrual accounting can result in significant variances from cash-basis accounting results, you can look at the statement of cash flows to understand how cash flows have influenced the firm. The accrual provides another layer of accounting information on existing information, but it also changes the way accountants record it. In reality, accruals aid in the deciphering of accounting ambiguity between revenues and liabilities. As a result, firms may typically better predict profits while limiting future liabilities. Accruals help accountants discover and monitor possible cash flow or profitability difficulties and determine and execute a suitable solution to such concerns.

Next TopicShareholders

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share