What is the Full Form of ACHACH: Automated Clearing HouseACH stands for Automated Clearing House. It is an electronic system or a network of payment transfers and is run by NACHA, which stands for National Automated Clearing House Association. The automated clearing house was mainly discovered in the middle of the 1960s, but it was started in development mode in the late 1970s. ACH provides many types of payment systems of transactions, especially batch transactions of credit and debit. It requires both a debit and a credit from the sender as well as from the person receiving. Transactions such as direct deposit, payroll and vendor payments come under ACH credit transfers. In contrast, direct debit transfer consists of payments made by customers on insurance premiums, mortgage loans, and other kinds of bills.

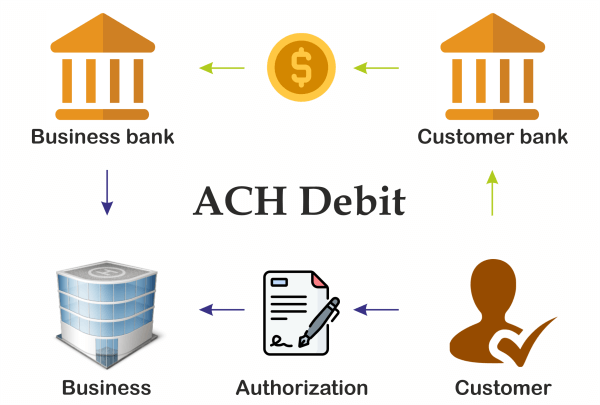

An automated cleaning house is one of the world's biggest, safest and most trustful payment systems. At the start of 2018, the ACH network managed nearly 23 billion payments, adding more than 1 billion for the fourth year in line. If we add the total payments that have been made by ACH, the estimated value is over $51.2 trillion. Still, one of the best benefits of the ACH network is that ACH eliminates the need to write checks (cheques), and with the help of this network, the funds are easily transferred. It also increases the security of your bank. Since the money is sent digitally, your bank information is more secure and check theft or loss is avoided. What are ACH payments?The automated clearing house is the best way to transfer funds and make payments digitally, and the digital transfer of funds to make the transaction is called a "Direct Payment via ACH". With the help of ACH, it has become easy for people to make direct payments using the electronic transfer of money. Sometimes, the company and many businesses use different names and terms for ACH. Other names businesses use to describe it include electronic bill payment, e-check, automated debit, automatic bill payment, and automatic debit. You may use this direct payment system to make payments as either an ACH credit or ACH debit as an individual. An ACH credit is a way to transfer funds as a direct payment, like it sends the money into an account. We can understand this using an example of this: suppose you begin paying a bill with an income from your bank or credit union. When an ACH debit takes money out of a user's account, it is handled as a direct payment. The regular monthly payment for a mortgage or utility bill routinely deducted from your account is an example of an ACH debit. How do ACH payments work?The Automated Clearing House Network is an online service for transferring funds and making digital transactions, and banking institutions also use it in the U.S. to streamline banking transactions. More than 10,000 banking institutions are represented by it, and over 29 billion electronic financial transactions were made possible by ACH in 2020. Transfers made with ACH totalled over $72.6 trillion. ACH is one of the best networks that is used globally, and now this automated clearing house network works as the financial hub. It also helps many people and companies by assisting in transferring money from one bank account to another. In the ACH network, both deposits and payments are available, allowing you to also make B2B (business-to-business) exchanges, government business transactions and consumer dealings payments. In the ACH network, first, the constructor starts a direct deposit and does the immediate payment transaction with the help of an automated network via debit and credit. The originating bank, sometimes called the generating depository financial institution, takes the ACH transaction and combines it with other ACH transactions to be sent out regularly throughout the day.

Automated Clearing House Network ChargesOne of the best things about the ACH network is that they do not take any hidden charges or fees for using direct payment or direct deposit. Therefore, it is also beneficial for most regular payments that you pre-authorize or for allowing a business to do so. This is why several banks and credit groups do not take any charge or fee for using their online bill payment services. There may be a price for accessing an institution's online bill payment services, even though many banks and credit unions don't. Some governmental organizations, electronic tax filing companies, and other service providers could charge a small convenience fee for minor forms of payment. Advantages and Disadvantages of ACHAdvantages:There are many advantages to an automated clearing house. With the help of the ACH network, now, everyone can perform digital financial transactions easily. It also provides high speed to the networks and makes our online transactions quick and straightforward. ACH debit transaction usually settles in one business day, according to NACHA regulations, whereas the specific ACH credit transaction resolves in one to two business days. The primary use of the ACH network is to provide people with easy access to the digital transfer of money. It also improves the speed and efficiency of financial transactions between businesses and the government because of the ACH network's availability of online payments. More recently, ACH transfers have made it simpler and less expensive for people to send money to each other directly from their bank accounts through a direct deposit transfer or an e-check. An automatic clearing house provides the functionality for all the separate and personal banking services accounts. Earlier, the average time for money to clear was two or three business days with the ACH; the same-day fast transaction was unavailable. But, with the help of using ACH, at the start of 2016, NACHA started implementing same-day ACH settlement in three stages. By phase 3, which began in March 2018, RDFI (Receiving Depository Financial Institution) utilized same-day ACH credit and debit transactions accessible to the receiver for withdrawal no later than 5 p.m. Disadvantages:Although ACH is very beneficial for online transactions, there are some drawbacks. Some banking services don't support large amounts of money transfers at once. Still, if you want to do large transactions, you must follow some specific guidelines that the banks provide. For instance, suppose you want to send money to your child in college but are able to send $1,000 maximum at a single transaction. But later on, if the child wants more money, you'll have to perform more than one transfer for his/her need for additional money for things like books and rent. However, some banking institutions may also limit the number of transactions per day. Although ACH transactions are free, specific banks may require some amount of charges or fees for transferring money from one bank to another. This is usually referred to as the per-transaction fee. If you want to do multiple transactions, this fee might start going up and significantly impact your bottom line if you're going to use it to perform several transactions. The major limitation is that the automated transaction only performs well for U.S. accounts. If you don't have the authority to conduct any transaction globally, this implies that you cannot use this payment method to complete the transactions since ACH is intended for international transfers. Therefore, if you need to send money to someone in another country, you must use a wire transfer or another comparable payment processing network. As a result, for other transaction networks, the transaction won't always be carried out on the same day. Utilizing the ACH TransferIt is simple to set up a direct deposit via ACH by speaking up with your employer or bank to obtain the authorization paperwork. The form will ask you for personal and bank account information to set up the payment and approve the regular instalments. The cash, if any is performed, will start appearing in your bank account as soon as the initial work is finished and the form is submitted. You may also register for direct payment through ACH with the firms that send you bills of payment, utilizing your bank to make the payment. You may contact the business or visit the respective website to learn how to sign up for direct payment using your active bank account. You may authorize and schedule the payments via the online banking website or app when dealing with payments.

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share