How to Achieve Optimal Asset AllocationAsset allocation is a strategy of investment which involves distributing the investible amount among multiple asset classes like gold, equity, debt, etc., intending to reduce the maximum possible risk and enhance the chances of a good return.

It can be done personally, and there is also a professional individual called the Portfolio manager, who applies different strategies for curbing risk associated with the investment and extracting maximum profit out of it. Investment of funds into diversified asset classes reduces the risk because it is said to justify diversification that "don't put all your eggs in the same basket". This diversification is based on the investment objectives of the investors and their risk appetite. Different Types of Asset Classes

Types of Asset AllocationThere are mainly the following types of asset allocation strategies: 1) Strategic Asset AllocationStrategic asset allocation is the strategy of allocating assets in a fixed proportion for the long run, and it is rebalanced periodically. Rebalancing is adjusting the investment portfolio weightage of different asset classes per market conditions and investment objectives.

The motive of strategic asset allocation is to extract targeted returns while considering its risk factors. Example- A portfolio has strategically invested 60% in equity, 20% in gold bonds and the rest 20% in debt instruments; this portfolio depicts that the investor is willing to have moderate risk, with 40% of his investment being hedged. 2) Tactical Asset AllocationTactical asset allocation is the asset allocation strategy which is intended to benefit from the changing market prices. It is suitable for investors with a risk tolerance appetite because these short-term adjustments are made to add value to the investment due to changes in market conditions. It takes advantage of market price fluctuation in the short term by maintaining risk as low as possible, but still, some risks need to be considered. Example- Suppose an asset mix portfolio of 50% equity, 30% debt and 20% gold bonds. If at some point, the portfolio manager realises that there are chances of inflation, the stock market may have a negative impact, and the gold prices may rise. Immediately the portfolio manager may change the asset mix by pulling out funds from equity to safeguard from loss and reinvest the amount in the gold bonds to take advantage of the rising gold prices. So, the new asset mix could appear as 30% in equity, 30% in debt and the remaining 40% in gold bonds, and the unique asset mix will look like 30:30:40. 3) Dynamic Asset AllocationDynamic asset allocation is the strategy used to invest funds to take advantage of investment opportunities and hedge the invested funds. It is used by hedge funds, credit derivatives, mutual funds and credit derivatives. Dynamic asset allocation is the extended form of Strategic asset allocation as it aims to gain additional benefits and hedge its risks by reallocating its funds during market fluctuation for the medium term. It acts as the bridge between strategic asset allocation (SAA) and Tactical asset allocation (TAA). Dynamic asset allocation differs from strategic and tactical asset allocation. In SAA, periodic adjustments are made to get the maximum return in the long run. In TAA, the asset mix is adjusted to benefit from the market opportunities in the short term. However, the dynamic asset allocation differs from the other two by revising the asset mix to get maximum return in the medium term. The asset category that qualifies for getting into the asset mix of dynamic asset allocation is based on specific requirements like-

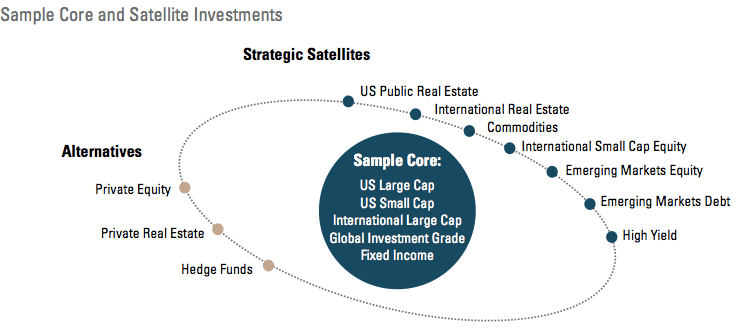

Therefore, the asset classes that fulfil the eligibility criteria are High Yield Debts, Emerging Market Debt, Convertibles, Equities, Bonds, Commodities, Listed Real Estate, etc. 4) Model PortfoliosA model Portfolio is a pre-made portfolio of asset classes to maintain a balanced proportion of high and low-risk assets for maximum possible return with low risk. It includes a diversified asset mix to get high returns with low-risk exposure. The model portfolio strategy has some advantages like diversification, proper research analysis by qualified professionals, periodic readjusting to balance the portfolio, affordability, etc. This asset allocation strategy also has some drawbacks, like loss of control over the management of the assets; it does not guarantee the expected return even though professionals manage it because the performance of the assets depends upon the market forces. Another drawback of the model portfolio is that sometimes it may contain extra costs and fees. There are certain sets of model portfolios in which assets are mixed depending upon the investment objectives and tolerance level of risk exposure, including other different factors varying individually. Some examples of model portfolio are Income portfolio- 70% to 100% in bonds, Growth portfolio- 70% to 100% in equity, Balanced portfolio- 40% to 60% in equity, etc. 5) Core-satellite Asset AllocationCore satellite asset allocation is the strategy in which the main focus of the investment portfolio is on a core element. In contrast, some elements surround the core termed the satellite. It works on the intended exposure of the asset classes. A core portfolio involves the lowest possible risk. It has stability as this fund is usually invested to achieve long-term objectives like retirement or higher education of children, etc.

This strategy provides access to the benefit of investment and value addition without fear of losing funds. It ensures that the long-term goals are secured and do not get disturbed by the prevailing risk factors. This strategy operates so well that the core is secured by investing funds in highly secured asset classes. A few funds called satellites are used for manoeuvring in active asset classes to get a high return. Example- Investment in Index funds is core, carrying low cost and risk. In contrast, the remaining funds are invested in high-return, high-risk asset classes to benefit from potential market fluctuation. Problems associated with Asset Allocation

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share