What is the full form of ADRADR: American Depository ReceiptADR stands for American Depository Receipt. This term is used in the context of stock markets. It is a receipt or certificate that represents shares of a foreign stock. It is issued by a U.S. bank to a person who is interested in buying shares of a foreign stock or non-US Company through the U.S. stock exchange. ADR was introduced in 1927 to offer U.S. investors an easier way to buy stocks of foreign companies.

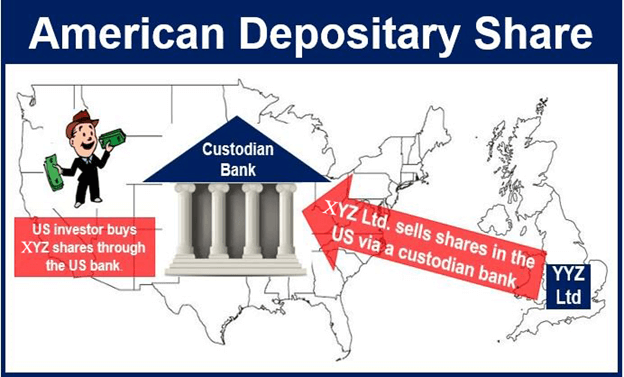

ADR is issued and pays dividends in U.S. dollars which allows domestic investors to own shares of a foreign company without the hassle of currency conversion. It also helps foreign companies attract American investors by trading on U.S. stock exchanges. The shares represented by an ADR are called American depositary shares (ADSs). How does it work?ADRs are shares of a foreign company owned and issued by a U.S. Bank. The U.S. banks buy the shares of a foreign company and then sell these shares on the stock exchanges of the U.S. (NYSE, NASDAQ and AMEX) in the form of ADRs. Each receipt has a certain number of underlying shares (one or more) in a foreign corporation. Investors who want to buy the shares of a foreign company can buy these receipts. So, ADRs are traded just like shares which can be purchased through the stock exchanges of the U.S. ADR Benefits for Foreign Companies:

ADR Benefits for Investors:

Types of American Depositary Receipts:1. Endorsed ADRs A sponsored ADR is issued by a bank on behalf of a foreign business. An agreement in writing is made between the bank and the company. Typically, the bank conducts transactions with investors while the foreign firm covers the costs of issuing the ADR and maintains control over it. The classification of sponsored ADRs is based on how closely the foreign firm adheres to Securities and Exchange Commission (SEC) rules and American accounting practises. 2. Unsponsored ADRs An unsponsored ADR is also released by a bank. However, the foreign corporation has not had any connection, participation, or even approval in the creation of this certificate. The possibility of multiple unsponsored ADRs for the same foreign business issued by various U.S. banks exists theoretically. The dividends offered by these various offerings could also vary. There is only one ADR issued by the bank that is partners with the foreign corporation in sponsored programmes. Where the two types of ADRs trade is one of their main differences. All sponsored ADRs, with the exception of the lowest level, are SEC-registered and traded on significant U.S. stock exchanges. ADRs that are not sponsored will only trade over the counter. Voting rights are never included in unsponsored ADRs. ADR LevelsADRs are further divided into three levels based on how much the foreign firm has access to American markets. Level IThis is the most basic kind of ADR, when foreign corporations either do not meet the requirements or do not want their ADR to be posted on an exchange. Although it cannot be used to raise money, this kind of ADR can be utilised to establish a trading presence. The Securities and Exchange Commission (SEC) has the laxest standards for Level I ADRs, which are only available on the over-the-counter market and are frequently quite speculative. They are a simple and cost-effective way for a foreign firm to determine the level of interest from American investors in its securities, despite being riskier for investors than other kinds of ADRs. Level IILevel II ADRs are similar to Level I ADRs in that they can be used to establish a trading presence on a stock exchange but not to generate money. Although Level II ADRs receive better awareness and trading volume than Level I ADRs, they are subject to a few more SEC restrictions. The most distinguished ADRs are Level III ADRs. An issuer uses them to launch an ADR public offering on a U.S. exchange. The foreign issuer can use them to build a sizable trading presence in the American financial markets and to raise money. Issuers must file complete reports with the SEC. ADR feesIf you invest in an ADR, you can pay extra costs that do not apply to domestic equities. To pay the expense of producing and issuing an ADR, the depositary bank that holds the underlying stock may impose a fee known as a custody fee. This charge, which normally runs between one and three cents per share, will be described in the ADR prospectus. Either the fee is subtracted from dividend payments or it is transferred to the investor's brokerage company.

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share