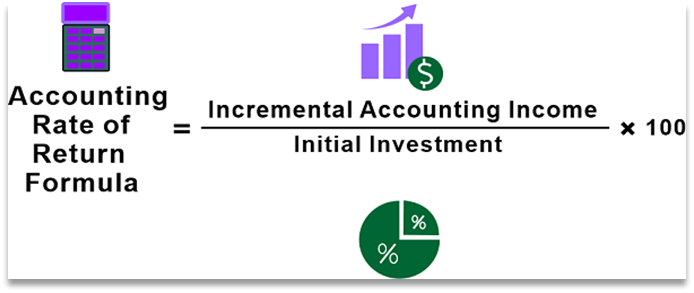

Advantages And Disadvantages of Accounting Rate of ReturnAccounting Rate of Return (ARR) is the yearly percentage difference between the average net income an asset is anticipated to produce and the average capital cost. To determine capital spending priorities, the ARR formula is employed. It is applied when businesses weigh the predicted future net earnings against the capital cost when selecting whether or not to engage in a venture, an acquisition, or another type of asset. The formula for calculating ARR is: ARR can be calculated by dividing Average Annual Profit by Average Investment. Where: Average Investment = (Book Value at 1st year + Book Value at End of Useful Life) / 2 Average Annual Profit = Total profit over Investment Period / Number of Years

The accounting profit is determined using this method as the project's profit after deducting all accruals as well as non-cash expenses required by GAAP or IFRS standards. The project's cost savings serve as the numerator if the project's goal is cost reduction rather than financial gain. Thus, accrual basis accounting, not cash basis, is used to determine profit. Additionally, any adjustment in working capital brought on by the investment is added to the fixed asset investment to determine the initial investment. Components Of Accounting Rate Of ReturnARR of 5% indicates that the venture is anticipated to return $5 for every dollar spent annually. In terms of decision-making, the project is suitable if the Accounting Rate Of Return is equal to or greater than the firm's needed rate of return because the company would profit at least that amount. The venture should be rejected if the ARR is lower than the acceptable rate of return. As a result, the firm will grow more lucrative with the greater the ARR. Advantages Of Accounting Rate Of ReturnThe following are the main advantages or benefits of using the accounting rate of return approach to assessing investment proposals: 1. Simple Method The Accounting Rate of Return (ARR) is a commonly used, straightforward method of comparing capital projects that anybody can understand. Since it is based on accounting data, further specific reports are not necessary to calculate ARR. 2. Easy Calculation The ARR approach is straightforward to compute and comprehend. Calculating the ARR of multiple projects is quite simple. It is relatively simple to grasp and calculate, similar to the payback period. Over the course of the project's economic life, the overall earnings or savings are taken into account. 3. Measures Profitability ARR assesses the profitability of an investment because it is based on accounting profit. This approach takes into account the idea of net earnings or profits after taxes and depreciation. For computing the rate of return, this technique alone takes the accounting notion of profit into consideration. Additionally, it is simple to determine the accounting profit from the accounting records. This is a crucial element in evaluating an investment proposal 4. Easy Decision Making Making a choice about an appropriate capital project is simple. ARR is useful in calculating a project's annual percentage rate of return. The project with the lower ARR is disregarded in favour of the one with a higher ARR. 5. Comparison Between Multiple Projects The projected rate of return from each project is provided by ARR, making it useful for comparing various projects. This strategy makes it easier to compare projects for new products to initiatives for cost-cutting or other projects with a competitive nature. 6. Return on Investment Since owners are very interested in returns on investment, this approach meets their needs. The firm's present performance may be measured using this way. Disadvantages Of Accounting Rate Of ReturnAlthough the ARR concept is fairly simple to use, this strategy also has a number of drawbacks. 1. Ignores the Time Value Of Money One of the greatest issues with the ARR is this. This way of prioritizing utterly disregards the "time's worth of money," a crucial idea in the business world. The idea is that money that is physically in your possession is worth more than the same amount after a certain amount of time. This is true because an investor may invest the cash they already have and generate income or interest from it. Therefore, it makes no difference whether the earnings are bigger in the early years or the latter years under this strategy. The project that was earlier profitable should have generally been selected since the average return would have equalized both investments. However, this strategy does not give the project that priority. 2. Ignores the Cash Flow After covering all cash and non-cash expenses, net earnings are used as the basis for the concept and computation of ARR. The cash flow is entirely disregarded throughout the procedure. Whether an investment generates returns quickly or slowly has no bearing on how ARR is calculated. For instance, early returns on investment can be zero or very low. In subsequent years, it may produce positive returns. As a result, the investment won't produce useable cash until much later. Even if the circumstances are reversed and it provides superior returns in the beginning years, the ARR will remain the same. For every rational investor, the second scenario makes more sense and is superior. The temporal worth of money is fully disregarded by ARR. 3. Ignores Risk and Uncertainty The uncertainty and risk associated with any investment are not taken into account by the ARR concept. It treats every one of them equally. Any project's risk can change depending on its length, the type of work involved, the setting in which it is carried out, etc. Even if investment returns somewhat decline, every investor wants to reduce their risk. Such characteristics are disregarded by ARR, which determines the superiority of a project solely based on its ability to generate returns 4. Multiple Time Frame for Investments For projects when the capital investment is spread out over several years, this technique is not helpful in appraising the project. It just determines the total earnings and average return, regardless of when and how much money has been invested. 5. Arbitrary Cut-Off The majority of businesses who favour ARR as an evaluation method limit the projects using an arbitrary cut-off yardstick. The firm's current return on assets, or book value, is typically used as the measure. This results in profitable initiatives being rejected by growing businesses receiving extremely high rates on their current assets, while profitable projects are chosen by smaller companies earning lower rates from their assets. Despite the fact that ARR is commonly employed to assess investment projects, its results are typically unfavourable. Its application frequently results in the improper allocation of funds to subpar initiatives since it is an unreliable method of gauging investments. ConclusionUnquestionably, the ARR is an easy-to-use tool for assessing, contrasting and selecting the best among many capital expenditure alternatives and projects. The only objective of any investor is to increase their profits. ARR completely handles everything and assists in selecting the best course of action with the biggest returns.

Next TopicAdvantages and Disadvantages of Capsules

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share