Advantages and Disadvantages of BondsEveryone needs money for survival and for a better future they must invest money to attain huge profits during bad times. Various platforms are available to invest in, such as saving money in a bank account, F.D., assets, liabilities, gold, trading, mutual funds, stocks, and bonds. But everything has some advantages and disadvantages. Let's understand bonds.

Bonds are an instrument (high-security debt instruments) issued by the government, municipalities, corporates, states, and other entities to collect funding for their projects. These bonds are issued by central or state governments and corporations when they face a liquidity crisis and need funds for infrastructure development. The bond is a loan taken from the investor by the borrower, such as a company or government, in which an investor receives interest on the investment, but the bond market value can change over time. Bonds lie under fixed income asset class having a maturity date. After completion of time, the borrower or issuer needs to pay back the amount along with the part of the profit called interest to the investor. The final amount of the bond can be calculated using three components: the principal, the coupon rates, and the maturity dates. The investor should remember a few points before investing in bonds:

Features of bond

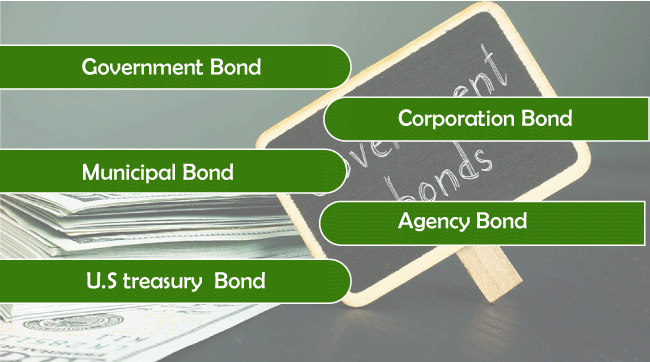

Categories of Bonds

a) Government bond: In India government bond is considered a debt instrument issued by a state or central government. It is a contract between the user and investor for a defined period, after which the profit is served to the investor. In the Indian government, these bonds lie under the broad category of G-Sec (government securities) as a long-term investment tool issued for 5 to 40 years. Government (state or central) issues G-Sec for large investors like companies and commercial banks. The state government issues bonds known as State Development Loans (SDLs). There are various types of government bonds in India, such as:

b) Corporation bond: Every business needs funds (money) to establish and run. Especially in the corporate world, small and large businesses raise money through debt. Bank financing or loans can be way but often accomplished through the sale of the bond. Instead of small-scale businesses, large corporations use the bond market because there are better options than private equity for establishing a firm (it can be of a high cost to them in terms of potential and monetarily loss of control. Corporate bonds are sold to the investors like an IOU. When an investor purchases a bond from the company, that corporation owes periodic interest payments or a lump sum on the bond's maturity date (at the end of life) to the bondholder. Generally, these bonds are issued with a face value (amount paid to the purchaser at the end of the bond's life) can be known as par value. Coupon value or interest payment can be made biannual basis or annually (duration can be any). But in zero coupon bonds, only the face value is paid at maturity. c) Municipal bond: The state and its municipalities (local entities) issued these bonds to finance construction projects (building schools or highways) and provide services. The most important feature of these bonds is, they are mostly tax-free (exempted from state or local taxes) and include higher interest rates than others with low risk. They can be short-term bonds that repay their principal in one or three years or long-term bonds that can mature in 10 years. d) Agency bond: This bond is a security issued by a federal government or government-sponsored enterprise other than U.S Treasury. It is also known as agency debt and is not fully guaranteed like U.S. treasury and municipal bonds. Generally, these bonds have fixed coupon rates but have interest rate risks. These are of two types a) Federal government agency bonds and b) Government-sponsored enterprise bonds (GSE). e) U.S treasury bond: U.S treasury bonds are fixed-rate government debt securities issued by U.S. federal government with a maturity range between 10 to 30 years. Interest paid in T-bond can be periodically, semi-annually, or annually until the bond's maturity, under which the face value of the bond is paid to the owner. Advantages of bonds

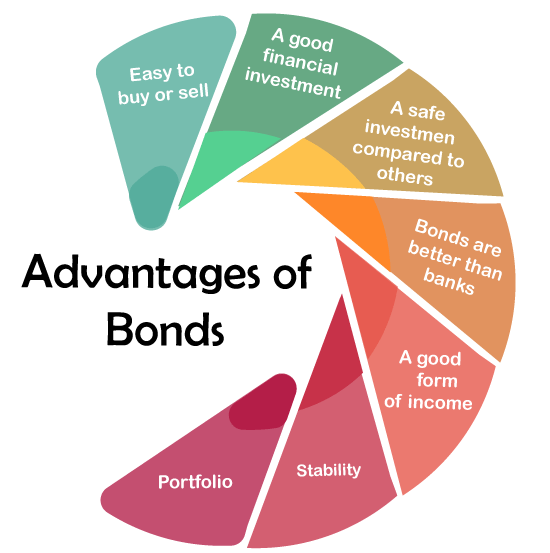

In most ways investing in bonds benefits everyone because of the dependability of interest and principal returns. 1. Easy to buy or sell Bonds are easy to buy, but investors must be aware of their terms, conditions, return policies, and how profitable the bond is. An investor can buy a bond directly through a broker or indirectly through bond mutual funds, and U.S treasury bonds can be bought directly from the department of Treasury Direct website. 2. A good financial investment As we know, bonds are considered less risky investments because they promise their issuer to return the face value of the bond. Bonds yield a meaningful increase in investment and provide investors with an opportunity to earn a decent income. Bonds also offer attractive capital gains. 3. A safe investment compared to others Generally, bonds are considered as a safe investment than stocks because the volatility of bonds, especially short or medium-dated bonds, is lower than stocks (equities). It is an ideal investment for retirees as bonds become a source of income for them by not doing any work as bonds provide the interest for their living expenses and preserve their savings. 4. Bonds are better than banks Few bonds are better than banks' investments (saving accounts and other scheme investments). The interest rates given by banks on deposits (savings) are less than interest on bonds. There is no TDS in corporate bond fund investment, but banks charge TDS on fixed deposits at 10%. 5. A good form of fixed income Interest payments of bonds are more than the general dividend payment as bonds are liquidity for a company or individual because they can easily sell many bonds without affecting the price, which is quite difficult in equities. Rather than less day-to-day volatility, bonds are highly beneficial as they provide a fixed income payment twice a year and a fixed lump sum at maturity. Government bonds are a good source of fixed income as per RBI guidelines, interest earnings on government bonds are disbursed every six months, providing a great opportunity for investors to earn regular income by investing their idle funds. 6. Stability Bonds are tradable at low risk and are long-term investment tools that give assured returns compared to other investment options. Bonds are inelastic compared to cyclical market fluctuation even when equities dividend income is traditionally more than coupon returns. 7. Portfolio diversification User diversification means that an investor is investing in a mix of different types of investment. It reduces the risk of losing money by spreading money across different platforms or asset classes like stocks, bonds, and cash. This could help in the reduction of volatility and overall portfolio risk. As we know, bonds are less volatile than other assets, so many investors include them in their portfolios as a source of diversification. Disadvantages of bonds

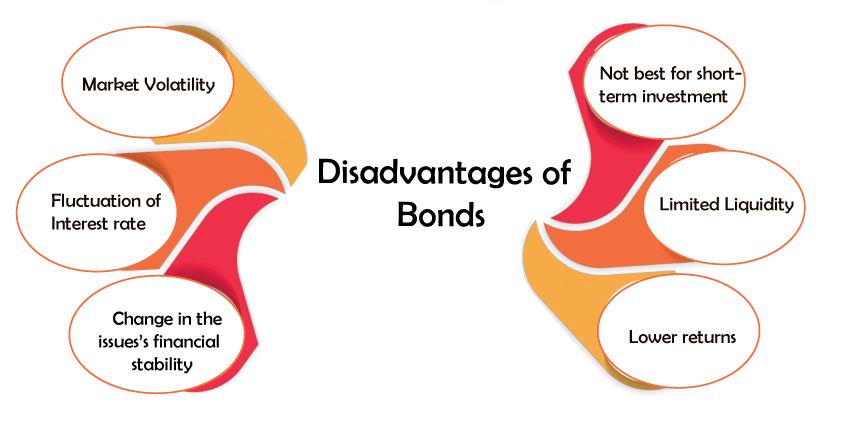

Various aspects of the bond market impact the overall performance of the security, like the period of bond holding, type of security, and nature of the issuer, etc. There are various disadvantages of bonds experienced by the investor. Bonds issued by municipal corporations, local authorities, and government are less risky than corporate bonds, and the same with the period of bonds in which long-term bonds are more volatile than corporate bonds. 1. Market volatility The market is responsible for increasing and decreasing the bond market value, which is affected by two factors, i.e., market volatility and macroeconomics. Bond prices are also influenced by the rating allocated by credit agencies which can either upgrade or downgrade a bond issuer based on its financial health. But these external factors do not impact the bond's interest or coupon interest payment but only affect the market price of bonds. 2. Fluctuation of interest rate Increment and decrement in the bond's interest rate depend on the bond price, as the bond's price is inversely proportional to the interest rate. Interest rate decreases when the bond price increases and vice versa. Due to this, the total value of a bond may suffer from rising interest. This fluctuation or change in bond price impacts the institutional and mutual funds investors with exposure to bonds. This affects professional investors like insurance companies, banks, and pension funds. 3. Change in the issuer's financial stability In India, the bond markets are less developed than the equity market because of a lack of centralized exchange and market regulators and fewer market participants. In the bond market, due to bankruptcy or liquidation case, bondholders have to face a capital risk. When an issuer faces a liquidity issue, it can hamper the bondholder's interest or principal repayment schedule. It also affects the issuer's financial stability, directly impacting bondholders. 4. Not best for short-term investment Bonds are not meant for a 1-year investment because, in the year, the issuer should not receive the maturity amount instead, the investor has to pay the penalty (equal to three months of interest). This condition arises when the issuer cashes out at any time over five years of buying the bond. 5. Limited liquidity Bonds are tradable as shares in terms of liquidity. In most cases, bonds are long-term investments with withdrawal restrictions on the invested amount. If creditors want to withdraw their debt before maturity, their bonds are liable to several fees and penalties. 6. Lower returns Mainly two types of returns are available on two types of bonds in the bond market, i.e., fixed-rate bonds and floating-rate bonds. In fixed-rate bonds, the returns are fixed (pay a predetermined interest rate at regular intervals); in floating-rate bonds, returns fluctuate (fluctuation based on benchmark rate). The customer price index and London interbank offer rate are considered benchmark rates. In India, the long-term investment return for a bond can be less than for equities. For example, the average return on a bond is 7% per annum. Still, equity investments yield about 12%, and the bond tax is more than equity, indicating that the overall return from a bond is significantly lower than equity. Conclusion:Learning about the advantages and disadvantages of bonds concluded that rather than disadvantages, bonds are a profitable method of investment and a source of fixed income. Bonds involve low risk in investment, but it is mandatory to understand the terms and conditions of bonds, their profitable income, how to calculate the returns, and how much time it is profitable. Bonds are one of the best sources for channelizing your savings and getting low-risk returns. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share