Advantages and Disadvantages of Process CostingProcess costing is employed when producing large quantities of identical goods since it is impossible to distinguish between the costs of various output units. In other words, it is assumed that the price of each produced good is identical to the price of every other good. According to this idea, expenditures are gathered over a certain amount of time, summed up, and then uniformly distributed across all the quantities manufactured during that time. Instead, job order costing is utilized to accrue expenses and allocate them to goods when items are made one at a time. A hybrid costing method is utilised when a production process combines mass production components with customised parts.

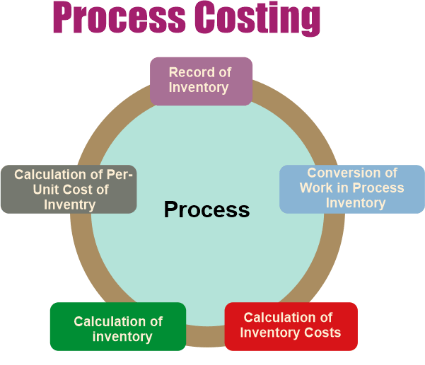

In many businesses, process costing is the only method that makes sense for estimating product costs. There is no need to significantly rearrange the chart of accounts as it employs numerous of the same journal entries as a job costing the environment. This makes it simple to convert from such a process costing system to a task costing one when necessary or to employ a hybrid strategy that incorporates elements of both systems. Main pointsProcess costing is a crucial product costing technique for manufacturing firms that mass manufacture several identical goods or units of output. Many businesses, including those that produce food, chemicals, textiles, glass, cement, and paint, employ process costing extensively. When adopting process costing, businesses track the costs associated with each step of the manufacturing process and divide the sum by the number of things produced to arrive at the item cost. Companies can determine costs in a variety of ways, including First In First Out (FIFO), standard costing, and weighted average costing. Homogeneous products cannot be identified from one another, such as a bin of identical fasteners that are the same size and kind. During the course of production, these related items often pass through a variety of stages. Companies calculate the direct expenses and production overhead for every one of those processes to employ the process costing method in accounting. Direct and indirect expenditures are involved in these phases. Raw materials and the salary of machine operators are examples of direct manufacturing expenses. Indirect expenses like building rent and equipment upkeep are sometimes included in overhead, along with salaries paid to administrative workers who aren't directly involved in producing the goods. Direct materials and conversion costs are two common breakdowns used by businesses. Conversion costs are expenses associated with the process, such as labour costs and overhead in the production process, whereas direct materials are the components used at each stage. Each stage of the production process is often handled by a distinct department at many businesses. The expenses of each department's direct materials, direct labour, and manufacturing overhead are included in a report that is created. The business then combines these statistics to examine the overall cost of the product. Significance of Process CostingMostly in oil, chemical, timber, textile, and food processing sectors, process costing is especially crucial. These businesses can evaluate the appropriate prices for their goods and if expenses are tracked in line with expectations by getting a grasp on manufacturing costs. They can assess the expenses associated with each stage of the manufacturing and distribution process using a process costing, and then utilise the results to pinpoint areas where costs can be cut. Key features of the Process Costing

Advantages of Process Costing

1. Simple to use In comparison to certain other cost allocation techniques, process costing is simpler to utilise when pricing homogeneous items, which is one of its key benefits. The amount of production system procedures that each thing goes through determines how much money business owners allocate for those operations. Direct materials, labour, and manufacturing overhead are added to the overall production cost during each procedure. Management accountants divide the overall cost of the process by the total quantity of commodities that exit the process. This yields a straightforward average cost for every product produced. 2. Flexible Process costing is used by business owners because it results in a flexible manufacturing process. Businesses that need to improve their processes can easily add or delete a procedure as needed. Additionally, it enables businesses to minimise the cost of producing each commodity. To boost cost reductions, business managers frequently seek ways to improve production processes. Getting rid of duplicate procedures frequently accomplishes this. Companies can make slightly different things or raise the calibre of their products by adding a procedure. If any cost reductions are possible in the production system, management accountants may examine the number of materials and labour required in each step. This flexibility makes sure businesses may manufacture at the most affordable price in the market. 3. Quick Assessment Step costing aids in the quick assessment of costs for each process and the finished product. Unit costs may be quickly established even at monthly or weekly intervals if overhead rates are specified. 4. Uniformity When the production processes are standardised, the average cost may be simply estimated. The uniformity of procedures enables quicker submission of price quotes. 5. Cost-effective It costs less and requires less administrative effort than job costing. Finding costs is less complicated and expensive. 6. It is simple to allocate costs and establish precisely how much each procedure costs. 7. Standard costing systems are quite useful for process costing. 8. The accessibility of cost information in the manner of quick and precise cost reports facilitates performance assessment and managerial control to a larger extent. Disadvantages of Process Costing

1. Cost inefficiencies The possibility of costly mistakes building up in the production process is one of the drawbacks of process costing. Cost accounting systems sometimes suffer from severe disadvantages due to production cost inaccuracies. Direct allocation is not used in process costing to allocate company expenses to specific products. Applying a particular quantity of manufacturing overhead, production labour, and raw materials to products or services are known as direct allocation costing. Non-production costs could be able to be accounted for in the overall process cost thanks to process costing. The cost of each item will be arbitrarily increased by including non-production charges; this also raises the price of the final product for consumers. Production expenses may sometimes be omitted by management accountants, resulting in under-priced goods. Because under-costed items are more costly than claimed, businesses often make less money. 2. Comparable units When using the process costing methodology, management accountants must determine comparable units. At the end of the accounting period, the number of unfinished items still in process is represented by equivalent units. Management accountants may only be using this figure as a best guess or an approximation. On a company's balance sheet, this information is listed as work-in-process. Totals for finished goods may be misrepresented as a result of inaccurate work-in-process accounting. As a result, controlling inventory and figuring out how many items the business needs to offer in the marketplace become challenging tasks. 3. The basis for process costing is historical cost. Future management decision-making may not benefit from the cost data now accessible. 4. After the period, incomplete units (work in progress) are stated in comparable production units. This adds a subjective component to the analysis of costs in science. 5. Average costs are the foundation of the process costing system as a whole. Average prices might not necessarily represent actual prices. A mistake in cost estimation in one process will have an impact on cost estimation in the following processes, the price of work-in-progress, and the price of finished goods. 6. When 2 or more items are created using the same method, the joint expenses are divided among them according to some weight, such as several points. Point-based weighting is a subjective choice that will result in approximative cost and cannot be relied upon. The process costing is insufficient for management objectives due to the lack of a scientific foundation. 7. The process costing approach assumes that a factory's manufacturing activity is segmented into processes. A workflow is an organisational unit or division inside a business where a particular, repetitive activity is carried out. As a result, a process becomes a useful unit for production management but frequently a subpar unit for cost accounting. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share