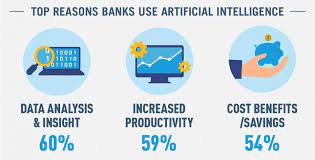

AI in BankingAlmost every industry, including banking and finance, has been significantly disrupted by artificial intelligence. This industry is now more customer-centric and technologically relevant thanks to the use of AI inside banking applications and services. By enhancing efficiency as well as making a judgement based upon information that is incomprehensible to a particular operator, AI-based technologies can assist bankers reduce expenses. Additionally, clever algorithms may quickly detect incorrect facts.

AI in banking and finance sectorsThe environment we live in now includes artificial intelligence, therefore banks have also already begun incorporating this technology into their products and services. Here are several significant AI applications in the banking sector that will allow you to take advantage of something like the technology's many advantages. Let's therefore get started.

Cybersecurity and fraud detectionLarge numbers of online payments happen every day when consumers utilise applications with account information to pay bills, withdraw money, deposit checks, and do much more. As a result, every financial system must increase its operations towards cybersecurity and fraud detection. At this point financial artificial intelligence enters the picture. Artificial intelligence can help banks with eliminating hazards, tracking system flaws, and enhancing the security of online financial transactions. AI and machine learning can quickly spot potential fraud and notify both consumers as well as banks. ChatbotsUnquestionably, chatbots represent some of the best instances of how artificial intelligence is used in banking. They may work any time they want once deployed, in contrast to people who've already set operating time. They also expect to study more concerning a specific customer's usage statistics. It aids in their effective comprehension of user expectations. The banks may guarantee that they remain accessible to their consumers 24 hours a day by introducing bots within existing banking apps. Additionally, chatbots can provide focused on customer attention and make appropriate financial service and product recommendations through comprehending consumer behaviour. Loan and credit decisionsIn order to make better, safer, and more profitable loan and credit choices, banks are trying implementing AI-based solutions. Presently, most banks still only consider a person's or business's dependability based on their credit history, credit scores, and consumer recommendations. Somebody can ignore the fact that these credit reporting systems frequently contain inaccuracies, exclude after all histories, and incorrectly identify creditors. Consumers with little payment history can use an AI-based loan and credit system to analyse existing behavioral patterns to assess its trustworthiness. Additionally, this technology notifies banks from certain actions that can raise the likelihood of bankruptcy. In short, these innovations were significantly altering the way that customer borrowing will be conducted in the future. Tracking market trendsBankers can analyse huge amounts of data as well as forecast the most recent economic movements, commodities, and equities thanks to artificial intelligence in financial institutions. Modern machine learning methods offer financial suggestions and assist in evaluating market sentiments. AI for banking additionally recommends when and how to buy equities and issues alerts when there is a potential consequence. This cutting-edge technology additionally aids in the speed of decision-making and makes trading convenient for both banks and their clients because of its powerful data computational power. Data collection and analysisEveryday, financial and banking institutions record millions of transactions. Due to the vast amount of knowledge gained, it becomes challenging for staff must acquire and register it. This became difficult to structure and collect one such large amount of data without making any mistakes. AI-based alternative approaches can aid in effective data collection and analysis in these kind of circumstances. Thus, the whole user development is achieved. Additionally, the data may be utilised to identify theft or make credit decisions. Customer experienceCustomers are always looking to have a more convenient environment. For instance, ATMs were successful since they allowed clients to access necessary services like money withdrawal and deposit even when banks were closed. More development has merely been spurred by this degree of convenience. Consumers are able to use their smartphones to open bank accounts from the convenience of their own homes. Artificial intelligence integration will improve comfort conditions as well as the customer experience in banking and finance operations. AI technology speeds up the recording of Know Your Customer (KYC) data and removes mistakes. Furthermore, timely releases of new goods and monetary incentives are possible.

Next TopicAI Tools

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share