Aptitude Stocks and Shares Concepts and FormulasPoints to Remember:Stock Capital: The amount of money required to establish or run a company is called stock capital. Shares or stock: The whole capital of the company is divided into equal units each of which is known as a share or stock. Shareholder or Stockholder: A person who purchases shares is called a shareholder or stockholder of the company. The company provides share certificates to its shareholders that contain information about the shares such as the number of shares allocated and the value of each share. Dividend: It is annual profit which is distributed among shareholders annually as per share or as a percentage. It is paid on the face value of a share. Face value: The value of a share or shock which is printed on the share-certificate is called its face value or nominal value or par value. The face value of a share does not change, it remains the same. Market value: The shares of listed companies are traded (sold and bought), in the open market through brokers at stock-exchanges. The price at which a share is traded in the share market is known as its market value.

For example, when a Rs. 100 share is quoted at a premium of 18, then Market value of the stock = 100 + 18 = Rs. 118 Similarly, when a Rs. 100 share is quoted at a discount of 8, then Market value of the share = 100 - 8 = Rs. 92 Brokerage: It is the broker's charge or fee that you have to pay when you are trading in the market through brokers at the stock exchange. This charge is added to the cost price when a stock is purchased and subtracted from selling price when a stock is sold. Tips to interpret question correctly: Buy a Rs. 100, 15% stock at 125 means that:

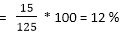

So, in this case, an annual investment of Rs. 125 gives an annual income of Rs. 15 Thus, Rate of interest per annum = Annual income from an investment of Rs. 125

NOTE:

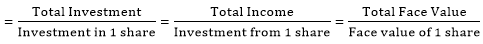

Number of shares held by a person:

Aptitude Stocks and Shares Test Paper 1 Aptitude Stocks and Shares Test Paper 2 Aptitude Stocks and Shares Test Paper 3 Aptitude Stocks and Shares Test Paper 4

Next TopicAptitude Stocks and Shares Test Paper 1

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share