Audit CycleDefinition of Audit CycleThe audit cycle is a systematic process that helps organizations to examine their financial and operational activities to ensure they are in compliance with relevant regulations, laws, and internal policies.

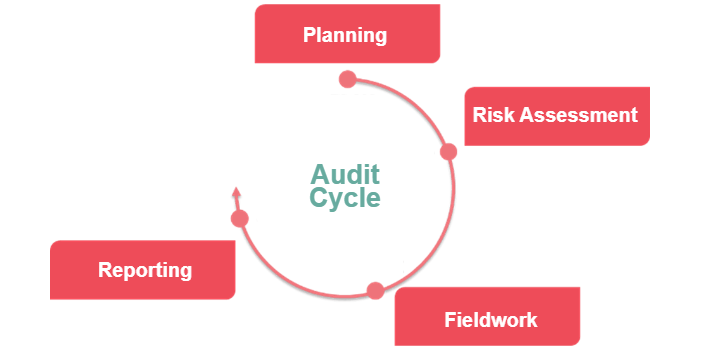

It is a continuous process that starts with planning, followed by risk assessment, conducting fieldwork, and reporting, implementing further recommendations for improvement. Purpose of Audit CycleThe primary purpose of the audit cycle is to identify areas of weakness, inefficiencies, and non-compliance in an organization's processes. It helps uncover potential financial irregularities and resource mismanagement and identify improvement opportunities. The audit results are then used to make informed decisions about the organization's future direction. Importance of Audit CycleAudit cycles play a critical role in maintaining the integrity of financial statements and ensuring that organizations adhere to legal and regulatory requirements. Regular audits can help organizations minimize the risk of fraud and financial mismanagement and ensure that resources are used efficiently. In addition, audits provide organizations with valuable insights into their operations, helping them to make informed decisions about future growth and development. Steps of the Audit CycleA) Planning and Risk Assessment

B) Fieldwork

C) Reporting

Key Considerations in the Audit CycleAudit Standards Audit standards are the guidelines and rules that auditors must follow when conducting an audit. They ensure that audits are performed consistently, reliably, and professionally. Auditors must be familiar with the relevant audit standards in their industry and any standards set by regulatory bodies, professional organizations, and governing laws. Adhering to these standards helps build confidence in the audit results and ensures that the findings are credible and trustworthy. Audit Documentation Documentation is an essential aspect of the audit process. The auditor must maintain accurate and complete work records, including the planning phase, fieldwork, and findings. This documentation is a reference for the final audit report and helps ensure that the audit is repeatable and consistent. Good audit documentation also helps to ensure that the audit results are credible, as it provides a clear trail of the audit process and the evidence that supports the findings. Audit Independence Independence is a critical consideration in the audit cycle. Independence is important to the audit's credibility and helps build trust with stakeholders. Auditors must be impartial and free from conflicts of interest to provide a fair and objective assessment of the organization's processes and systems. To maintain independence, auditors should avoid engaging in activities that could compromise their impartiality, such as accepting gifts or participating in business dealings with the audited organization. Advantages of Audit CycleImproved Process Efficiency: Regular audits can help organizations identify improvement areas, leading to increased efficiency and cost savings. The results of the audit can be used to implement changes and drive continuous improvement, ultimately making the organization more effective and efficient. Enhanced Decision Making: Audits provide organizations with valuable insights into their operations, allowing them to make informed decisions about the organization's future direction. The audit findings can be used to identify opportunities for improvement and make changes that help the organization achieve its goals. Increased Transparency and Accountability: Regular audits help to promote transparency and accountability in an organization's financial and operational activities. This can help to build trust with stakeholders and enhance the organization's reputation, leading to greater success in the long term. Improved Risk Management: Audits help organizations identify and assess potential risks, allowing them to take proactive measures to mitigate those risks and protect their assets. This can include identifying potential financial risks, operational risks, or risks related to compliance with laws and regulations. By conducting regular audits, organizations can ensure that they are aware of potential risks and are taking the necessary steps to mitigate them. Compliance with Regulations: Regular audits help organizations comply with relevant regulations and laws, protecting them from legal and financial consequences. The audit results can identify areas where the organization needs to improve its compliance processes and make necessary changes. This can include compliance with tax laws, financial reporting requirements, and industry-specific regulations. Improved Stakeholder Relations: By conducting regular audits and making the results available to stakeholders, organizations can demonstrate their commitment to transparency and accountability. This can help to build trust with stakeholders, including investors, customers, and employees, and enhance the organization's overall reputation. Cost Savings: Regular audits can help organizations identify areas where they can reduce costs and improve their financial performance. This can include identifying inefficiencies in processes, reducing waste, and improving the management of resources. Continuous Improvement: The audit cycle provides organizations with an ongoing review and improvement process. By conducting regular audits, organizations can identify areas for improvement and make changes to their processes, systems, and controls to continuously improve their operations. This can help organizations stay ahead of their competitors and achieve long-term success. Disadvantages of the Audit CycleCost: Conducting an audit can be time-consuming and expensive, requiring significant personnel and financial resources. Organizations must allocate budgets and resources for the audit process, which can divert resources from other areas. Interruptions to Business Operations: The audit process often involves a significant amount of fieldwork, which can cause disruptions to normal business operations. This can include employees needing time on audit-related tasks, delays in completing projects, and disruptions to customer service and other operations. Resistance to Change: Organizations may be resistant to making changes based on the results of the audit. This can include resistance from employees who are uncomfortable with change and resistance from stakeholders who may not agree with the findings or recommendations. Potential for Conflict: The audit process can sometimes result in disagreements or conflicts between the auditor and the organization being audited. This can include disputes over the findings or recommendations of the audit and disagreements over the interpretation of regulations and standards. Limited Scope: The audit process is limited and only provides a snapshot of the organization's operations at a specific time. It is important to keep in mind that the audit results are only as good as the information available at the time of the audit and may not reflect the full picture of the organization's operations. Dependence on Auditor's Skills: The quality of the audit process depends on the skills and expertise of the auditor. It is important to choose an auditor with the relevant experience and skills, and familiarity with the industry and regulations relevant to the organization being audited. The Bottom LineThe audit cycle is a continuous process that helps organizations in examining their financial and operational activities to ensure they comply with relevant regulations, laws, and internal policies. It is a systematic process that involves planning, fieldwork, reporting, and implementing recommendations for improvement. With the growing importance placed on transparency and accountability, the role of the audit cycle is expected to become even more critical in the future. Organizations can anticipate an increased demand for audits as stakeholders place greater importance on the assurance provided by these processes. An audit cycle is a valuable tool for organizations to ensure that their processes are efficient, effective, and compliant with relevant regulations and laws. By adhering to audit standards, maintaining accurate documentation, and ensuring audit independence, organizations can have confidence in the audit results and use these insights to drive future success. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share