What is the Full Form of BDCBDC: Business Development CompanyBDC stands for Business Development Company. Investors looking for greater yields which are income-hungry, frequently look for unusual alternatives. They might be satisfied by a lesser-known investment form called a business development company (BDC). BDCs frequently offer dividend yields of 5% to 14% or higher, which are excessive. Particularly in the current low-interest climate, certain outperforming BDCs may occasionally offer dividend hikes, making them desirable investments for income seekers and retirees. However, greater returns also come with higher risks, so before including BDCs in your portfolio, do some research.

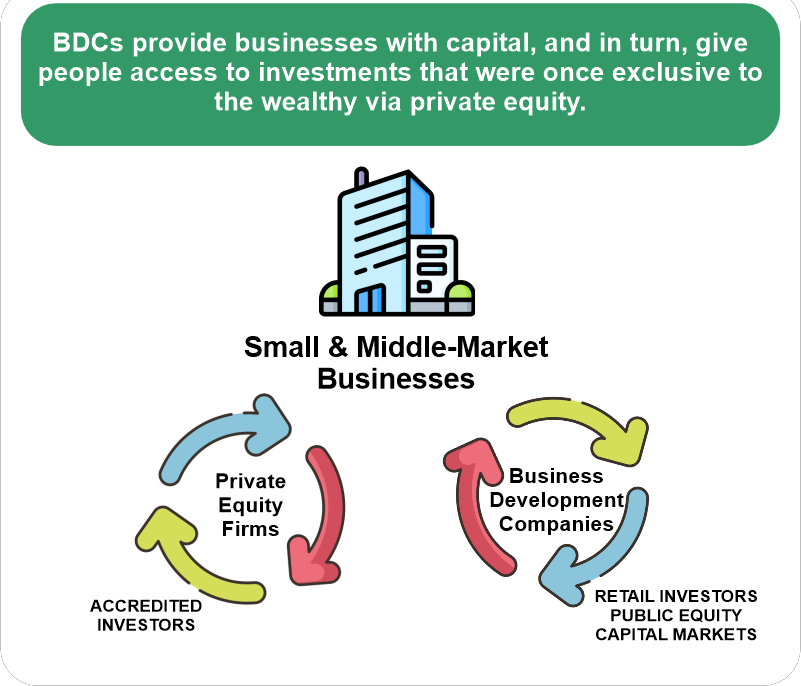

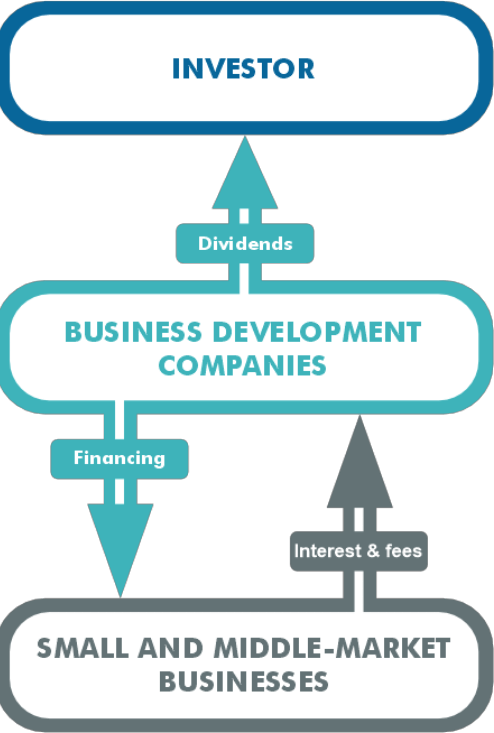

An unregistered closed-end investment firm known as a "business development company" (abbreviated "BDC") makes investments in small and medium-sized businesses. Congress amended the Investment Business Act of 1940 to include this type of company in 1980. If publicly listed companies meet certain Investment Company Act standards, they may choose to be regulated as BDCs. A business development corporation (BDC) is an organization that makes investments in struggling small- and medium-sized businesses. In the early phases of their development, a BDC supports the growth of these businesses. The BDC works with struggling businesses to help them get back on solid financial ground. Many BDCs are public corporations whose shares trade on significant stock exchanges, similar to closed-end investment funds, the Nasdaq, the American Stock Exchange (AMEX), and other exchanges. They come with a high level of risk and bigger potential rewards as investments. BDCs were established to help private equity funds join the public capital markets and give small, and emerging businesses access to funding. A BDC is required by law to invest at least 70% of its assets in privately held U.S. companies with a market value of less than $250 million. By law, a BDC must allocate at least 70% of its resources to privately held American businesses with a market cap under $250 million. A BDC is exempt from corporate taxation, just like REITs, if it distributes at least 90% of its profits to investors. Anywhere in the capital structure is open to BDC investment. Still, most of their investments have been in debt because they frequently leverage their equity with debt (up to two times their equity) and fixed-income investing. The business pays little or no corporate income tax depending on its revenue, diversification, and distribution needs. Since they have a pass-through tax structure, RICs must pay investors dividends equal to at least 90% of their taxable income.

Most BDCs disperse 98 percent of their taxable income to avoid corporate taxes. (REITs are governed by Internal Revenue Code Section 856. RICs are governed by Section 851). At least two BDCs have declared their intent to pay REIT taxes. Distributions to investors are often taxable for investors depending on the sort of income made by the BDC because income is not taxed at the corporate level. Investors must pay taxes on their regular income to the BDC at ordinary income rates. However, their capital gains income must provide companies with a quicker method of raising money for investments than V.C. funds. Key LessonsA closed-end fund called a "business development company" (BDC) invests in growing and struggling businesses. Retail investors can invest in many BDCs listed on public markets. High dividend rates and some possibility for capital growth are offered to investors by BDCs. BDCs are considered particularly high-risk investments because of their extensive use of debt and focus on small or troubled companies. Recognizing Business Development Organizations (BDCs)To spur job creation and help American start-up businesses raise capital, the U.S. Congress established business development companies in 1980. BDCs invest in privately held businesses and public start-up companies struggling financially or with low trading volumes. They raise funds by issuing company bonds, stocks, or other hybrid investment vehicles to investors and through initial public offerings. Since it is in a BDC's best interest to see their portfolio companies succeed, they actively mentor and develop them. The funds raised are then used to finance the failing businesses. BDCs can raise funds using a variety of financial instruments, but in general, they either provide loans to businesses or buy their stocks or convertible securities. How to Become a BDCA business must be registered following Section 54 of the Investment Company Act of 1940 to be eligible to become a BDC. A domestic company that has registered its class of securities with the Securities and Exchange Commission is also required.

The BDC must invest at least 70% of its assets in U.S. companies, whether public or private, with market values under $250 million. These businesses are frequently start-up's looking for funding or ones that are going through financial difficulties. The BDC must also help the businesses in its portfolio with managerial tasks. BDCs vs Venture CapitalBDCs are venture capital funds if that makes sense. There are some significant changes, though. One looks for the type of investors they are looking for. Large institutions and affluent individuals typically have access to venture capital funds through private placements. BDCs, on the other hand, permit smaller, unaccredited investors to invest in them and, consequently, through them, in small growth companies. To avoid being labelled as regulated investment businesses, venture capital funds must maintain a strict restriction on the number of investors they retain and pass certain asset-related standards. On the other hand, BDC shares are frequently exchanged on stock exchanges and are continuously accessible to the general public as investments. The same rules apply to BDCs listed on an exchange and to BDCs that choose not to list. Venture capitalists who previously were reluctant to adopt the onerous regulation of an investment company now find the BDC to be an appealing form of incorporation due to its less demanding borrowing limits, related-party transactions, and equity-based pay rules. Benefits of BDC InvestmentHigh Dividend YieldsBDCs must pay over 90% of their revenues to shareholders because they are regulated investment companies (RICs). Because of their RIC status, companies are exempt from paying corporate income tax on profits before sharing them with shareholders. Dividend yields that are above average are the outcome. Accessible to Small InvestorsBDCs expose investors in private businesses that are generally closed to ordinary investors yet accessible to them.

LiquidityBDCs have a respectable level of liquidity and transparency because they trade on public marketplaces. DiversificationBDC investments may add securities to an investor's portfolio with significantly different returns than equities and bonds. Drawbacks of BDC InvestmentHigh RiskBDCs have a lot of benefits, but they also carry certain dangers. A BDC is liquid in and of itself, but many of its securities are not. The holdings in the portfolio are mostly either small, lightly traded public companies or private businesses. As a result of their aggressive investment strategy in businesses that promise both current income and future capital appreciation, BDCs rank rather high on the risk spectrum. Sensitive to Increases in Interest RatesA rise in interest rates, which makes borrowing money more expensive, might hurt a BDC's profit margins. BDCs are vulnerable to increases in interest rates, which can make borrowing money more expensive, limit their ability to invest, and increase profit margins. Uncertain or illiquid HoldingsBecause most BDC holdings are often made up of illiquid securities, a BDC's portfolio has arbitrary fair-value assessments and is susceptible to jarring losses. The target companies in which the BDC has invested often have neither a problematic track record nor one.

Increase LossesBecause BDCs frequently use leverage, that is, they borrow the money they invest in or lend to their target companies, losses can be exacerbated. Leverage can be used to raise the rate of return. ROI may also result in cash flow issues if the value of the leveraged asset drops. Dividends Subject to Income TaxDividends taxable as income include those from BDCs since they don't meet the requirements for eligible dividends. Relatively Less Performance HistoriesThe BDC format was invented in the 1980s, but it has only been widely used since the early 2000s. As a result of their recent histories, prospective investors have little data to weigh when evaluating their options. Significant Debt ExposureBDCs heavily rely on borrowing when they invest in their portfolio companies, which are mostly illiquid, privately held, or thinly traded. The portfolio companies could go out of business and potentially default on their debts in the event of an economic collapse similar to the one we suffered due to the Covid-19 outbreak. Increased Tax RatesBDCs themselves are exempt from paying taxes, but you are not. Since BDC dividends are taxed as ordinary income rates or the standard rate you pay on income like your salary, you'll likely pay more on your BDC dividends than other dividends in your portfolio pay check. For instance, the tax rate on any BDC dividends received in 2021 for a single person with an annual income of $50,000 would be 22%. The tax rate on "qualified dividends" from other income assets, such as stocks and bonds, may be lower in this case, 15% than that on capital gains. Investing in a BDCA business development company is a publicly traded organization with shares available for purchase through your broker because they trade on public exchanges. Mutual funds and exchange-traded funds both contain certain BDC stocks. Retail investors can purchase the VanEck BDC Income ETF, which several brokers distribute. How Does a BDC Generate Revenue?Business development firms have several strategies to generate revenue. Purchasing equity from the companies they work for is among the most popular. Finance it, then sell it when it increases in value. A BDC may get yields on convertible bonds it purchases from a business it has invested in and then convert those bonds into stock in the future. Once converted, the equity can either be kept for growth or sold for a profit. Another revenue stream for BDC's is lending. A BDC charges interest on the loans it makes, much like a consumer borrows from a bank. What Advantages Does a BDC Offer?Higher yields and returns are offered to investors by business development businesses. How Does a BDC Generate Revenue?BDCs profit by funding the businesses in their portfolio and buying their stock or bonds. What is BDC Lending?Lending to business development companies occurs when a business that BDC has invested in receives financing. The Verdict Organizations specialize in business development work with smaller, less financially stable companies. BDCs use fundraising strategies to obtain capital from investors, then invest that capital in these smaller enterprises. Congress established them in 1980 to support the expansion of small businesses while aiming to protect them from the predatory practices occasionally employed to take over failing companies.

BDCs often offer larger returns than mutual and exchange-traded funds, but these profits are accompanied by an equal rise in risk and volatility. Consult a seasoned financial advisor if you're considering investing in BDCs to determine if they align with your investment objectives and risk tolerance. How to Invest in Companies that Develop Businesses?BDCs can be bought and sold similarly to stocks or exchange-traded funds (ETFs). You can buy shares in each company using a brokerage account or an IRA. Each has its ticker symbol (IRA). An ETF that invests in numerous BDCs on your behalf is an option if you're new to BDC investing or want to diversify your portfolio quickly.

Examples include Ares Capital (ARCC), Main Street Capital (MAIN), and Prospect Capital, which are some of the bigger, more well-known BDC players that are tracked by the VanEck Vectors BDC Income ETF (BIZD) (PSEC). They are all publicly traded businesses with dividend yields ranging from 5% to over 8%. As of late April, BIZD offers an 8.5% dividend yield. Options traded on an ExchangeETNs, or exchange-traded notes, offer an additional choice. ETNs resemble ETFs, but they behave more like bonds. ETNs are unsecured notes that can be kept till maturity or bought and sold at will. Institutions issue them. An ETN may be subject to the risk of having its issuing institution's credit downgraded, which could result in a decrease in the share price of the ETN unrelated to the underlying asset it monitors. ETFs and ETNs may provide the best of both worlds for investors looking to buy a portfolio of BDCs instead of individual securities. However, Duane Batcheler, a writer and research analyst who conducts research for BDC investors at BDCBuzz.com, warns that they are not a cure-all. He claims that "BDCs are still a specialized industry. There are a few (ETFs/ETNs), but they consistently perform poorly and pay substantially smaller distributions because of fees and bad allocation. Frequently, the top five or six allocations, which typically are BDCs with constrained income and price appreciation potential, make up 50% of the fund." Do You Want to Invest in a BDC?Tax Consequences of BDC InvestmentAs with any investment, conducting your research is crucial before deciding. Considering BDCs for tax-advantaged accounts like IRAs is a good idea, in Batcheler's opinion, due to their potential for long-term profits. Investors can profit from the aggressive income-producing compounding returns (instruments like BDC's), according to Batcheler. You won't have to pay annual taxes on any income they generate if you keep them in a tax-advantaged account. Consequently, if you make wise decisions, returns might be compounding and expanding your portfolio more quickly. But not everyone should use BDCs. More risk-averse investors might not be able to handle the hazards. But income-focused investors who are prepared to do their homework and understand the risks associated with greater dividend yields may find that BDCs make a tasty addition to a well-diversified portfolio.

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share