Best Mutual Funds to InvestIf you are someone looking to enter the domain of investing in mutual funds, it is easy to face dilemmas at every step and be confused about which one to invest in. This list will give you some of the current top equity, debt and hybrid mutual funds which are recommended to invest into. Keep in mind that these are unordered because of the nature of mutual funds being ever so changing. NOTE: This list only gives the current best options; it is simply not possible to guarantee that an investment will be successful. As such, stay aware that you are taking a risk here, and no one will be responsible for whether you fail or succeed.

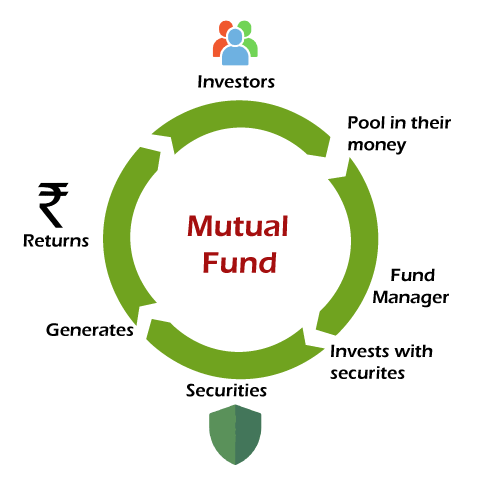

What is a mutual fund?A mutual fund, as the name suggests, is a fund which is made by several willing investors adding up their money to further invest into stocks or debt securities. Investing in a mutual fund means pooling your money with other people who are also part of the mutual fund scheme, which the fund uses to invest and shares the profit with the members. This is mutually beneficial for both the investors and the fund organisers. Best Equity Mutual FundsEquity Funds are those types of mutual funds that mainly purchase stocks, and their main assets are also in stock. These are recommended as your best bet if you are someone looking to make a long-term investment. 1. Tata Digital India Fund Direct-Growth

Tata Digital India Fund's Direct-Growth scheme has shown to have above-average abilities when controlling falling market losses. This is a mutual fund scheme offered by Tata Mutual Fund. It was launched on 4th December 2015 and currently holds INR 5,500+ Crores worth of AUM. It currently has 28.76% trailing returns for a period of 3 years and 28.99% trailing returns for a period of 5 years. The expense ratio for this scheme is 0.34%. 2. ICICI Prudential Technology Direct Plan-Growth

ICICI Prudential Technology Direct Plan-Growth scheme has shown to have above-average abilities when controlling falling market losses. ICICI Prudential Mutual Fund offers this mutual fund scheme. It was launched on 1st January 2013 and, as of now, holds over INR 8700+ Crores worth of AUM. It currently has 31.95% trailing returns for a period of 3 years and 28.03% trailing returns for a period of 5 years. The expense ratio for this scheme is 0.71%. 3. SBI Technology Opportunities Fund Direct-Growth

SBI Technology Opportunities Fund Direct-Growth scheme has shown to have only average abilities when controlling falling market losses. SBI Mutual Fund offers this mutual fund scheme. It was launched on 1st January 2013 and currently holds over INR 2400 Crores worth of AUM. It currently has 27.11% trailing returns for a period of 3 years and 25.8% trailing returns for a period of 5 years. The expense ratio for this scheme is 0.9%. 4. Quant Tax Plan Direct-Growth

Quant Tax Plan Direct-Growth scheme has shown to have a fairly high ability when controlling falling market losses. This mutual fund scheme is offered by Quant Capital Finance & Investments Private Limited. It was launched on 1st January 2013 and currently holds over INR 1300 Crores worth of AUM. It currently has 31.58% trailing returns for a period of 3 years and 21.04% trailing returns for a period of 5 years. The expense ratio for the scheme is 0.57%. 5. Axis Small Cap Fund Direct-Growth

Axis Small Cap Fund Direct-Growth scheme has shown to have only average abilities when controlling falling market losses. Axis Mutual Fund offers this mutual fund scheme. It was launched on 11th November 2013 and currently holds over INR 8900 Crores worth of AUM. It currently has a 26.15% trailing return for a period of 3 years and a 19.38% trailing return for a period of 5 years. The expense ratio for the scheme is 0.48%. 6. Franklin India Technology Fund Direct-Growth

Franklin India Technology Fund Direct-Growth scheme has shown to have a low ability when controlling falling market losses. Franklin Templeton Mutual Fund offers this mutual fund scheme. It was launched on 1st January 2013 and currently holds over INR 650 Crores AUM. It currently has 21.93% trailing returns for a period of 3 years and 20.23% trailing returns for a period of 5 years. The expense ratio for the scheme is 1.46%. 7. Aditya Birla Sun Life Digital India Fund Direct-Growth

Aditya Birla Sun Life Digital India Fund Direct-Growth scheme has shown to have a below average in controlling falling market losses. Aditya Birla Sun Life Mutual Fund offers this mutual fund scheme. It was launched on 1st January 2013 and currently holds over INR 3000 Crores AUM. It currently has 30.19% trailing returns for a period of 3 years and 27.35% trailing returns for a period of 5 years. The expense ratio for the scheme is 0.86%. 8. Quant Active Fund Direct-Growth

Quant Active Fund Direct-Growth scheme has shown to have a high ability when controlling falling market losses. This is another mutual fund scheme offered by Quant Mutual Fund. It was launched on 1st January 2013 and currently holds over INR 2300 Crores worth of AUM. It currently has 28.81% trailing returns for a period of 3 years and 20.75% trailing returns for a period of 5 years. The expense ratio for the scheme is 0.58%. Best Debt Mutual FundsDebt funds are typically invested in corporate or government bonds or other types of debt securities. These are ideal for a medium-term investor. 1. ICICI Prudential Credit Risk Fund Direct Plan-Growth

ICICI Prudential Credit Risk Fund Direct Plan-Growth is a mutual fund scheme offered by ICIC Prudential Mutual Fund. It has proven to possess a high ability to control losses due to a falling market. It was launched on 1st January 2013 and, as of now, holds over INR 8000 Crores worth of AUM. The trailing returns for this scheme are 8.31% for a period of 3 years and 8.06% for a period of 5 years. This fund scheme has a 0.88% expense ratio. 2. IDFC Government Securities Fund Constant Maturity Direct-Growth

IDFC Government Securities Fund Constant Maturity Direct-Growth is a mutual fund scheme being offered by IDFC Mutual Fund. It is a gilt mutual fund and hence focuses on debt funds to primarily invest in government securities. The ability to control losses in cases of a falling market has proven to be average for this scheme. This mutual fund scheme was launched on 1st January 2013. It currently holds about INR 233 Crores worth of AUM and has trailing returns of 5.64% for a 3-year period and 7.86% for a period of 5 years. This fund scheme has a 0.49% expense ratio. 3. IDFC Banking & PSU Debt Fund Direct-GrowthIDFC Banking & PSU Debt Fund Direct-Growth is another mutual fund scheme offered by IDFC Mutual Fund. Just like the previous option, this fund is also currently well-performing. The ability to control losses due to a falling market has proven to be high in this scheme. The fund scheme was launched on 26th February 2013 and, as of now, holds over INR 16000 Crores worth of AUM. The fund scheme has trailing returns of 7.28% for a period of 3 years and 7.53% for a period of 5 years, and the expense ratio for this fund scheme is 0.32%. 4. Edelweiss Government Securities Fund Direct-Growth

Edelweiss Govt. Securities Fund Direct-Growth is a Gilt offered by Edelweiss Mutual Fund. The fund scheme was launched on 5th February 2014. As of now, this scheme has over INR 100 Crores worth of AUM under its belt. It has even been shown to possess high abilities in controlling losses due to a falling market. The trailing return for a 3-year period is 7.07%, while for a period of 5 years, it is 7.75%. The scheme has an expense ratio of 0.69%. 5. SBI Magnum Medium Duration Fund Direct-Growth

This is a medium-duration mutual fund scheme that SBI Mutual Fund offers. It is one of the oldest ones as it was launched on 1st January 2013, like many others on this list. It holds over INR 9500 Crores worth of AUM and has above average ability to control losses due to falling markets. It has trailing returns of 7.74% for a period of 3 years and 7.67% for a period of 5 years. The scheme has an expense ratio of 0.68%. 6. Axis Banking & PSU Debt Direct Plan-Growth

A Banking and PSU, Mutual funds scheme offered by Axis Mutual Fund. This fund was also launched on 1st January 2013, and as of now, it holds over INR 14000 Crores worth of AUM. It has proven to possess a high ability to control falling market losses. The trailing returns are 6.88% for a period of 3 years and 7.41 % for a period of 5 years. This scheme has an expense ratio of 0.33 %. 7. Edelweiss Banking and PSU Debt Fund Direct-Growth

The Edelweiss Mutual Fund offers this banking and PSU mutual funds scheme. The fund scheme was launched on 26th August 2013 and, as of now, holds INR 407 Crores worth of AUM. However, the ability to control losses due to a falling market is proven to be below average for this scheme. It has trailing returns of 7.53% for a period of 3 years and 7.59 % for a period of 5 years. The scheme has an expense ratio of 0.34 %. 8. HDFC Credit Risk Debt Fund Direct-Growth

This scheme is from HDFC Mutual Fund. It was launched on 6th March 2014 and held over INR 8600 Crores worth of AUM. It has also shown to possess above-average abilities when controlling falling market losses. It has trailing returns of 8.1% for a period of 3 years and 7.53% over a period of 5 years. The scheme has an expense ratio of 0.95%. Best Hybrid Mutual FundsA hybrid fund can invest in multiple asset classes. The asset class it invests in is dependent on the investment objective of that particular scheme. These are generally better for first-time investors for their lower-risk nature. 1. Quant Absolute Fund Direct-Growth

Quant Absolute Fund Direct-Growth is a mutual fund scheme that falls under Aggressive Hybrid funds and is offered by Quant Mutual Fund. The fund was launched on 1st January 2013, and as of now, it holds over INR 400 Crores worth in AUM and is a small fund in this category. It has shown to possess a high ability to control losses due to falling markets. The trailing returns are 24.76% for a period of 3 years and 17.6% for a period of 5 years. The fund scheme's expense ratio is 0.56%. Its current allocations are 15.41% to debt and 78.88% to equity. 2. Quant Multi-Asset Fund Direct-GrowthQuant Mutual Fund offers a Multi-Asset Allocation mutual fund scheme. The fund was launched on 1st January 2013 and currently has over INR 300 Crores worth of AUM. It has proven to possess a rather high ability to control losses due to a falling market. The trailing returns for this fund scheme are 27.13% for a period of 3 years and 17.06% for a period of 5 years. The expense ratio is 0.56% for this fund, and the allocations to equity and debt are 73.33% and 8.17%, respectively. 3. ICICI Prudential Multi-Asset Fund Direct-Growth

ICICI Prudential Multi-Asset Fund Direct-Growth, as the name suggests, is a multi-asset allocation mutual fund scheme offered by ICICI Prudential Mutual Fund. It was launched on 1st January 2013 and is currently having over INR 13000 Crores worth of AUM. The trailing returns for this fund scheme are 16.21% and 13.31% for 3 year period and 5 year period, respectively. The fund scheme has a 61.47% allocation to equity and an 11.12% allocation to debt. The expense ratio for this fund is 1.19%. 4. Baroda BNP Paribas Aggressive Hybrid Fund Direct-Growth

Baroda BNP Paribas Aggressive Hybrid Fund Direct-Growth is another hybrid mutual fund scheme that, as the name suggests, falls under the aggressive category and is offered by Baroda BNP Paribas Mutual Fund. This fund was launched on 17th March 2017, which is much later compared to others on the list. It currently holds AUM worth of over INR 730 Crores. It has proven to possess a high ability to control losses due to falling markets. The trailing returns are 13.94% for a period of 3 years and 12.42% for a period of 5 years. The expense ratio for this scheme is 0.64%, and the allocations for equity and debt in this fund are 71.12% and 23.00%, respectively. 5. ICICI Prudential Thematic Advantage Fund (FOF) Direct-Growth

ICICI Prudential Thematic Advantage Fund(FOF) Direct-Growth is an aggressive mutual managed by ICICI Prudential Mutual Fund. This fund was launched on 1st January 2013, and as of now, it holds over INR 13000 Crores worth of AUM. It has also proven to have a high ability to control falling market losses. The fund has trailing returns of 19.12% for a period of 3 years and 12.75% for a period of 5 years. The expense ratio is only 0.23% which is fairly low, and the fund's allocation is 0% to equity and 94.38% to debt. 6. Kotak Multi-Asset Allocator FoF - Dynamic Direct-Growth

It is a hybrid mutual fund scheme under the conservative category offered by Kotak Mahindra Mutual Fund. The fund scheme was launched on 1st January 2013 and currently has about INR 600 Crores worth of AUM. It has trailing returns of 16.75% for a period of 3 years and 12.56% for a period of 5 years. The ability to control losses due to a falling market is proven to be above average for this scheme. It has a fairly low 0.13% expense ratio and has allocated 13.82% to debt and 70.62% to equity. 7. Mirae Asset Hybrid Equity Fund Direct-Growth

Mirae Asset Hybrid Equity Fund Direct-Growth is a mutual fund scheme which Mirae Asset Mutual Fund offers. The fund was launched on 8th July 2015 and as of now, it holds over INR 6500 Crores worth of AUM. The trailing returns for this scheme are 11.7% for a period of 3 years and 11.83% for a period of 5 years. This fund scheme also has proven to possess an above-average ability to control losses due to a falling market. The expense ratio is 0.42%, and it currently has an allocation of 22.98% to debt and 73.29% to equity.

Next TopicBest Movies in the World

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share