What is the full form of BPSBPS: Basis PointsBPS stands for Basis Points. They are measurement units used in finance to evaluate percentages. In the financial sector, basis points are frequently used to describe rate changes in financial instruments or the spread (difference) between two interest rates, including the yields of fixed-income assets.

They are frequently reported as a spread over (or under) the index since some loans and bonds may often be offered for some index or underlying instrument. For instance, a loan with interest that is 50 basis points above the London Interbank Offered Rate (LIBOR), sometimes known as "L+50bps" or simply "L+50," is considered to be 50 basis points over LIBOR. The trading of the "basis," or the difference between two interest rates, is where the phrase "basis point" first appeared. Pips in FX forward markets serve as a measuring unit. Since the basis is typically modest, these quotes are multiplied by 10,000. Thus a change in the "basis" that is considered a "full point" is a basis point. Experts describe basis points in mathematical terms, but you can comprehend them even if you're not a qualified accountant or bank. Understanding the BasicsThe Federal Open Market Committee (FOMC) increased the benchmark interest rate by 25 basis points in June 2017, increasing it from 1% to 1.25%. This indicates that rates were raised from a range of 1% to 1.25% by 0.25% percentage points. Basis points are used in the bond market to describe investors' yields from fixed-income securities. How much is the value of Basis Point?

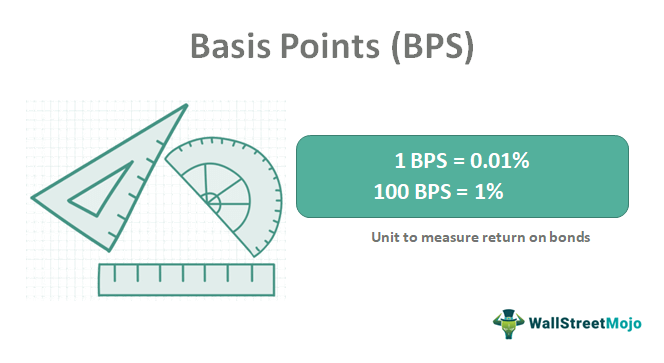

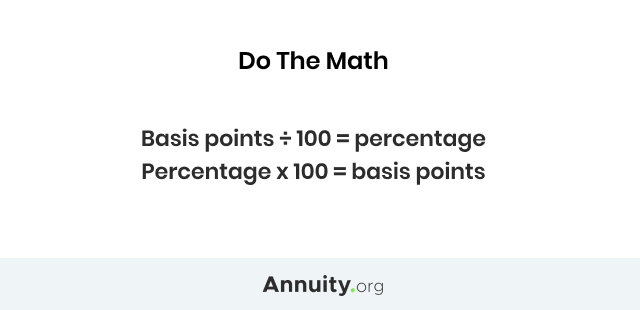

A basis point is the one-tenth part of the percentage. One basis point, for instance, is equivalent to 0.01%, or 0.0001. One percent is equal to 100 basis points. What is The Function of Basis Points in Loans?Your interest rate is the percentage you pay as interest on a loan from a lender for a given time. Your loan payment rises each month as the interest rate does. Depending on your loan, changes in basis points could influence your monthly loan payments. If your mortgage rate is variable, as with adjustable-rate mortgages (ARMs), it may change by market rates. At adjustment dates, ARM payments may go up, and basis point increases will impact the principle (how much you owe) and the interest rate. Let's imagine you have an ARM with a 3.5% interest rate; then, at a later time, the interest rate rises to 3.75%. This indicates a 25-basis point increase in your interest rate. Locking your rate is a smart move while looking for a house. If you don't, your interest rate can increase, costing you basis point increases. How Basis Points are Calculated?Let's now break down the procedure for manually calculating basis points. The first thing to remember is that one basis point is equivalent to 0.01%, or 0.0001 when computing basis points. To determine basis points: Add 100 when converting basis points to percentages. Divide percentages by 100 to translate to basis points. Use 250 basis points as an example. In this scenario we will multiply 0.0001 with 250 to get 0.025 (250 x 0.0001 = 0.025). This figure, multiplied by 100, corresponds to a basis point percentage conversion of 2.5 percent.

Let's imagine you want to know how interest rates translate to basis points. You'll then utilize the opposite of the equation, as mentioned earlier. Let's stick with the 2.5% interest rate. Divide this by 100 to convert it to a decimal first: 2.5/100 = 0.025. After that, divide this number by 0.0001 to acquire 250 basis points. Why Basis Points are Important?Basis points are crucial because they impact various financial instruments (such as bonds, equities, mortgage loans, etc.) that can affect our economy's growth. For instance, when interest rates rise, a slight increase of a few points can significantly impact other financial instruments, such as credit card and mortgage rates. Basis points measure minute changes in yields or interest rates. The Federal Reserve sets the federal funds rate, a benchmark interest rate that impacts how much you pay to borrow money. The following financial products utilize basis points to calculate percentages:

Basis Points or Percentages What to Use?

Basis points eliminate misunderstandings surrounding percentages and simplify conversations regarding interest rates. For instance, a lender informs you that "the interest rate jumped a percentage from 4%." What does this mean? It is considerably easier to understand that the interest rate went from 4% to 5% if you say "a 100-basis-point rise."

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share