What is the full form of CAGRCAGR: Compound Annual Growth RateCAGR stands for Compound Annual Growth Rate. It refers to the rate of return required for an investment to grow from its initial value to its ending value if the profits were reinvested at the end of each year of the investment's lifespan, i.e., when the investment has been compounding over a period. So, it is a measure of growth over multiple periods that measures the total return on investment by calculating the return every year and compounding them. We can say that it is the annual growth rate of an investment over time when the effect of compounding is taken into account. However, CAGR does not reflect investment risk.

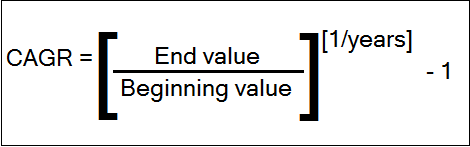

The Formula and Calculation of CAGR:CAGR = (EB/IB) 1/n - 1 Where: EB = Ending Balance To calculate the CAGR of an investment:

Benefits of CAGR:

Mutual Funds and CAGR CalculatorThe CAGR calculator can be quite useful for investors in mutual funds. You can use this calculator to determine how well your fund is doing and to make the required investment decisions. The following are some uses for a CAGR calculator: Improved investment choices: The CAGR calculator is a very helpful tool to use each year as you assess your investing choices. The CAGR calculator, for instance, will show you the average annual return you have received over the last five years if you bought an equity mutual fund five years ago. This could help you decide whether the returns on the fund meet your expectations. If the fund is not doing well, you might want to think twice about making that investment in the future. Compare the performance of various funds and benchmarks: You can compare the returns you get from one fund with those of other funds of the same type using the CAGR calculator. This can aid in your understanding of the mutual fund's performance in comparison to that of its competitors. For added clarity, you can also evaluate against the benchmark indices.

Next TopicFull Forms List

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share