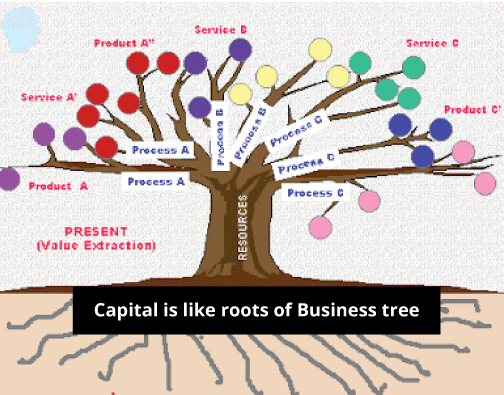

Capital Meaning in AccountingWhat is the Definition of Capital?All assets, including patents, of any individual or organization, can be considered capital. The term capital is also used in accounting to refer to the amount of money that a person or organization invests in their firm as an investment to make a profit. Although the term capital might refer to money, it is not conceivable to consider money to be a person's capital. Capital is very important in running any business. When a person starts a business, the money he invests in that enterprise is considered capital. Suppose a businessman does not have his own money and starts the firm with a loan from a bank or a person. In this case, the amount contributed by the individual is also referred to as capital. A loan from others is a loan for the businessman, but it is considered capital when money is invested in a business. Understanding of Accounting CapitalMany people take the term capital to be money in the broadest sense. To some extent, this is correct. In accounting, capital is the quantity of money that a person has in hand for investing. When a person puts capital into a business, that person expects a profit in exchange for the capital investment, and a person's capital is used to earn more capital.

Any person's goal is to make more money than he has invested. A person uses the money to buy assets and all the required items to reap capital benefits in the future. If a person withdraws money from the capital they have invested, this is referred to as drawing because they withdrew certain amount out for the individual's use. What Exactly Is Capital?DefinitionCapital refers to the following financial resources that a company can use to fund its business: cash, machinery, and equipment. These are the assets that enable a company to produce products or services for its customers. Since businesses require these resources to function, this is an essential source of finance for all organizations. Companies raise capital by selling stocks and bonds to investors who pay in cash or other assets. Money and capital are not the same, so it is essential to distinguish them. Capital lasts longer than money and is utilized to create something and accumulate riches. Property rights give the capital its worth and allow it to generate revenue and prosperity. Patents, trademarks, brand names, buildings, and land are only a few examples of capital. ExampleSneha is the CEO of a large company with operations in the insurance and automobile industries. Her company wishes to construct a new energy plant, which will require funding within the following year. Most of her managers have approached her with various propositions totalling $ 200,000,000. Sneha will need to use various resources to fund this, including cash and short-term investments held by the company and the sale of the company's shares to new investors. It is a significant expense that must cover this year to increase operations. Sneha's company, as a company, must be highly aware of the cost of capital that they obtain and must always strive for the optimal cost structure. She consults with in-house experts and spends $ 20 million in cash, $ 40 million from the company's AAA debt, and $ 40 million in new shares to investors to raise the capital needed for the company. Sneha has raised enough funds to develop a new facility. It allows you to leverage the three resources of cash, investment, and company stock to generate returns for your company and new investors. How Does It Work?Another synonym for ownership is equity. All business owners (except legal entities) have a capital account, which appears on the balance sheet as a capital account. This capital account is added or deleted as follows:

Importance of Capital Accounts'When an owner starts a business and wants a bank loan, the bank wants to see what you have invested in your business. If the owner is not interested in the company, they can leave a money bag and move on. When you establish a business, you must invest some money. The owner may need to take out a personal loan to get the money to invest in their business. FormulaThe formula for a capital account is determined using the accounting equation. So, first, here is the accounting equation, which is very important for calculating assets, capital, and liabilities.

Capital is defined as the difference between assets and liabilities. As we can see, the total amount of assets in any business at any given time is equal to the sum of its liabilities and capital. As a result, if we wish to compute the amount in the capital account, we must use the following formula: We can calculate the quantity of capital by subtracting the number of liabilities from the number of assets on a company's balance sheet.

Next TopicProvision in Accounting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share