Cheque DefinitionA cheque is a document that allows a bank (or credit union) to transfer a certain sum of money from a person's account to the person on whose behalf the Cheque is issued. On the Cheque, the drawer writes various information, including the amount, the date, and the payee, and signs it and instructs the bank to pay the specified amount of money to the payee. The person writing the Cheque, or the drawer, has a transaction bank account (often called a cheque, or draft account) where the money is held.

Even though cheques have existed since at least the ninth century and maybe earlier, their use peaked in the 20th century when they became a very common non-cash payment option. Automated check processing led to the writing of billions of cheques annually by the second half of the 20th century; the peak was achieved in or around the early 1990s. Since then, cheques have decreased and been partially supplanted by electronic payment methods like debit and credit cards. Cheques have either been phased out or reduced to a supplemental payment method in many nations. Features of a ChequeA cheque has the following specific features:

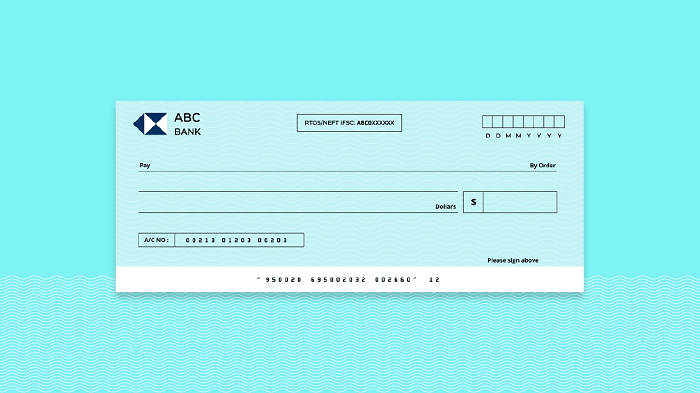

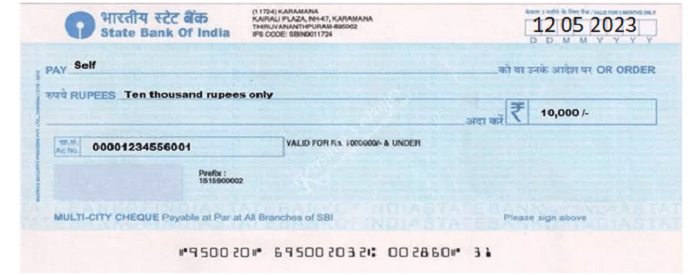

Elements of ChequeAlthough they are less often used in the digital era of payment applications and online bill pay, cheques can still help send money through the mail or make official payments. You may also use them to seek data like your bank routing and cheque account numbers, which you'll need for operations like setting up direct deposit or connecting to a payment service. You should know these many cheque components before filling or depositing one.

1. Your InformationYou may discover the name and address on your bank's records in the upper left corner of your Cheque. You should still be able to utilize the cheques as long as your account number has stayed the same, even if you've moved and no longer reside there. 2. Cheque NumberThe cheque number is used for tracking and is found in the upper and bottom right corners of the Cheque. For instance, if your checkbook is stolen, you can inform the bank of the numbered cheques that were taken (for instance, cheques 1 through 100), allowing the bank to spot any fraudulent cheque transactions. 3. DateThe transaction date should be written on the dateline when writing a cheque. Remember that placing the cheque date in the future could ensure your receiver deposits the Cheque earlier if you're attempting to post-date a cheque and want the recipient to refrain from withdrawing money from your account before a specific date. 4. The Recipient's NameThe recipient's name should be written on the top, long line in the center of the Cheque. "Pay to the order of" is frequently written after the recipient's name. The recipient might be a person or a company. Anyone can cash a cheque if it is paid to the order "Cash," which is another option. If you need to know the payee's identity, this could be a practical choice, but you have no control over who cashes the Cheque. Usually, it's a better idea to record the name of a specific recipient. 5. Amount of the PaymentThe payment amount should be in one of the two spaces on the Cheque. The first is where you'll write the amount numerically (50,000 /-) directly below the recipient's name in the box in the center of the right-hand side. The second is where you write down the amount in words on the long line that is just below the recipient's name (e.g., Fifty Thousand Rupees only ). If the language or numerical numbers are difficult to understand, this aids the bank in making the entire sum clear. 6. Memo LineYou may put "June rent" or "summer camp costs" in the memo line. It's optional, but it advised you to fill up the line on the bottom left. In addition to ensuring the Cheque's intended receiver understands what it is for, it can also assist you in recalling when you're later reviewing your finances. 7. Bank NameUsually, your bank's logo or address may be found here. 8. Account and Routing NumbersThe bottom of the Cheque has a series of numbers on it. You'll need to refer to these numbers when purchasing cheques or to set up direct deposit. Routing Number Your bank's routing number, the initial set of numbers, serves as its unique identifier inside the financial system (usually denotes regional location). Account Number Your account number, which is exclusive to your account and represents the account from which money will be taken, is included in the second set of numbers. 9. SignatureYou must sign the blank line in the bottom right corner of the front of a cheque. Signing confirms that you agree to withdraw the specified amount from your account. Endorsement Of a Cheque Received By Someone Else If you want to turn over the Cheque you received, you will see a blank line at the top behind one of the short ends. When you're ready to deposit your Cheque into an ATM, Cheque, or mobile banking app, sign your name on the blank line. This indicates that you are the intended recipient and have authorized the deposit. Essentials of a ChequeA few crucial details or characteristics must be acknowledged and understood when utilizing a cheque as a payment method for a money transfer. The following are some crucial information regarding a cheque:

Types of ChequesAlthough crossed and blank cheques are frequently issued, you can also use others. For significant payments, a person or a business writes a cheque. Unlike cash payments, cheque payments are registered with the bank and shown in your bank account. A cheque is a written instruction to your bank to transfer the specified sum to a specific person or entity. In India, there are ten different sorts of cheques that you should be aware of. Below are ten different sorts of cheques :

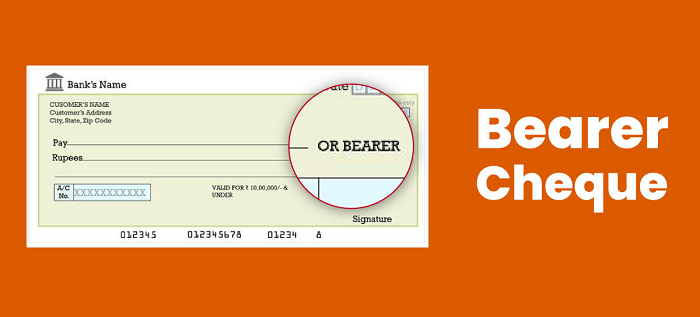

1. Bearer ChequeA bearer cheque is a type of Cheque that allows the bearer or drawer of the Cheque to receive the payment specified in the Cheque. These cheques have the word "or holder" printed before the payee's name. This means that the amount of the issued Cheque can be received either by the payee or the holder. It also makes the bearer cheque transferable, as anyone who bears it can receive payment. The bank does not need to ask the issuer for permission to cash this Cheque.

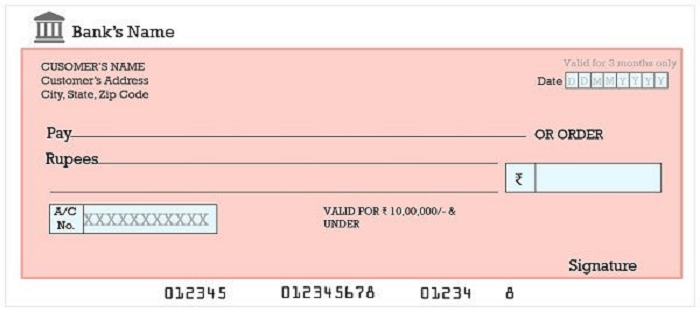

2. Order ChequeThe order cheque represents the second form of Cheque. A cheque is considered an order when the words "or bearer" are crossed out. Hence, only the person listed as the payee can receive the given amount. In this scenario, the bank makes the payment without verifying the bearer's identification.

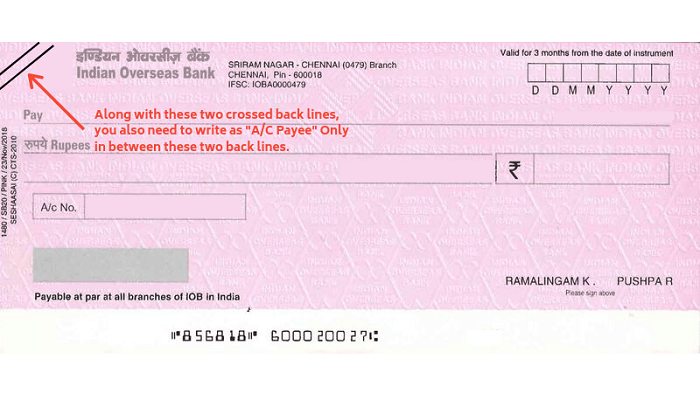

3. Cross ChequeA crossed cheque is one on which the words "a/c payee" are printed on two parallel, slightly curved lines made by the issuer in the upper left corner of the Cheque.

That implies that the specific amount of the Cheque will only be sent to the person or organization whose name is listed as the payee, regardless of who is handing it over. A crossed cheque is also secure because it may be cashed only at the payee's bank. 4. Open ChequeAn uncrossed cheque is sometimes called an open cheque since it needs crossed lines. The payer's or payee's bank are the only two locations where an open cheque can be cashed. Moreover, the payee can change the payee of an open cheque so that they can do so. The issuer must sign on both the front and back of the open Cheque.

5. Post-Dated Cheque

Unlike the day it was issued, a post-dated cheque has a later date. After the payer-specified date, it can only be cashed. After the specified date, but not before, the post-dated Cheque is still good. In light of this, even if provided to the bank, it will process it on the specified date. 6. Stale Cheque

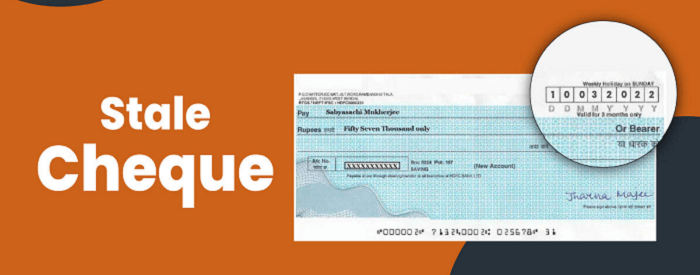

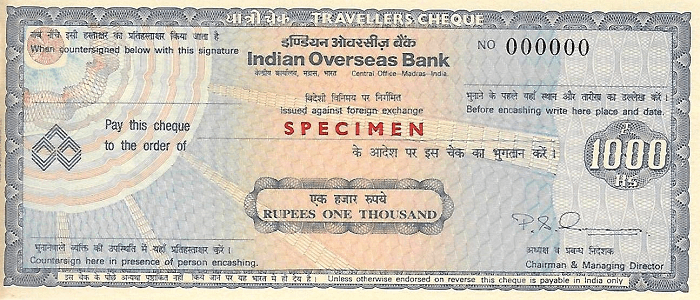

Stale cheques are no longer redeemable since they have passed their expiration date. A cheque is valid for three months after the day it was issued. 7. A Traveler's ChequeThe payee can cash a traveler's Cheque issued by a bank at another bank in another nation. The money of that nation will be used to make the payment. It might be helpful when you are traveling abroad and want to bring only a little cash. A traveler's Cheque has no expiration date.

8. Self ChequeThe word "self" is the payee on a self-pay cheque. A self-cheque may only be redeemed at the bank of the issuer. The issuer uses it to make withdrawals from their bank account.

9. Bankers ChequeOn behalf of the account holder, a bank writes a banker's Cheque to pay someone else in the same city. The bank itself is the one that issues a banker's Cheque. Banker's cheques are only valid for three months but may be revalidated if certain requirements are met.

10. Blank ChequeA blank cheque has the issuer's signature without any other information. Blank cheques are extremely dangerous because, if one is misplaced, anyone may write in any amount and issue it to themselves.

How to Write a Cheque

Step 1DateA cheque has to be correctly dated. If a cheque is written without a date, anyone may add any date and cash it whenever they choose. This might be a serious issue if insufficient money and the Cheque were supposed to be post-dated. In addition, if a date is incorrectly recorded and is more than three months old, such as with the wrong year or month, it may bring shame. Step 2NameFill out the "pay" section with the name of the person or business that will receive the Cheque. Step 3Cross the ChequeIn the upper left corner of the Cheque, two parallel lines should be drawn, and "Account Payee" should be written if you want the amount to be withdrawn from a specific person or organization that has an account with the bank. Step 4Account NumberEnsure your Cheque has an account number and bank address. Today, it is mandatory that every checkbook has your name on it or your name if it is a joint account. Step 5SignatureCarefully place your signature above your name on the Cheque, as it must match the signature you provided to the bank when you opened the account. Always keep your checkbook safe, and never sign blank cheques in advance. Essentials To Remember While Writing a Cheque

Parties to A ChequeDrawer, Drawee, Payee, Endorser, and Endorsee are among the several parties. DrawerThe individual who signs and authorizes the bank to transfer the appropriate sum of money from his account to the person who can draw the Cheque is known as the drawer. The account holder of the Cheque, in other terms. DraweeThe drawee, or specific bank from which the Cheque should be drawn, is listed here. PayeeThe payee is the party the Cheque's owner pays via the bank. EndorserWhen the payee transfers the right to payment to another party, this is referred to as an endorsement, and the payee is referred to as an endorser. EndorseeThis occurs when the payee transfers the right to accept the payment to another party the recipient of the right transfer is referred to as the endorsee. Advantages and Disadvantages of Cheque

Advantages of Cheque

Disadvantages of Cheques

Dishonour of ChequeA cheque is often a written promise the payer gives to the payee in exchange for a quantity of money. The drawee, the payee, deposits this Cheque at the financial institution. In an ideal situation, the payer's bank would transfer the money from the payer's account to the payee. Nonetheless, there are instances where the bank of the payment or the bank of the payee declines to honor this agreement. The Cheque is called a "dishonored cheque" as it bounces. The causes of this 'decline 'are several.

There are several reasons why a cheque cannot be honored. It could be because the account balance of the person who issued the Cheque was insufficient, or it could be because the signature on the Cheque did not quite match. Sometimes, cheques are only honored if the account numbers line up. The bank may also refuse to honor cheques defaced or destroyed. A cheque may bounce if the issue date needs to be corrected or expired. The issuer may decide to halt the payment on occasion. The Cheque is deemed to have been dishonored in that situation as well. There may be several additional reasons for a bank to reject a cheque. What Happens If a Cheque Is Returned Unpaid?A dishonored cheque carries a penalty on the issuer. Depending on the cause of the bounce. The Negotiable Instruments Act of 1881 makes it a crime for a cheque to be dishonored because there isn't enough money in the payer's account. If a cheque is written against an account that doesn't have enough money, the payer might face legal action. The payee can bring legal action against the payer or allow the payer to reissue a cheque within three months. The payer faces a maximum two-year prison sentence by issuing a dishonored cheque.

Banks also impose penalties for cheque dishonor in addition to this. Each bank has a different penalty. Banks also impose a fee for dishonoring a cheque. Several banks impose different penalties. The sums for which a cheque is issued may have varying penalty slabs depending on the bank. ConclusionA cheque or a cheque is a document that instructs a financial institution to debit a sizable amount of money from a person's phone to the person listed on the Cheque. The drawer signs the Cheque after filling out the payee information, the date, and the amount paid to that person or firm. By doing this, the drawer instructs their bank, which is known as the drawee, to make the appropriate charges. The individual who writes the Cheque keeps the funds in a new bank account, often called a share draft, or current account.

Next TopicCommerce Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share