Cost Accounting

Cost accounting is a branch of accounting in which all the costs which are related to any process, project, or product are recorded and analyzed. Such analysis is used by the management to take strategic and profitable decisions. In other words, cost accounting is the classifying, recording, and appropriate allocation of expenditure to determine the costs of products and services. These costs are related to every order, job, contract, process, product, service, and all other costs which occur during the production, selling, and distribution.

Characteristics of Cost Accounting

- It is an accounting process that deals with all types of costs.

- Cost accounting provides data to management to prepare the budget of the business and make decisions. It also makes certain standard budgets and costs for the business.

- It provides the correct data and information in terms of cost ascertainment and presentation.

- The system of cost accounting is elastic, i.e., it can be expanded or altered as per the needs of the business.

- The records provided by the cost accounting are comparable and work as a guide for the future.

- The data provided by the cost accounting is in the analytical form which is helpful in checking the growth of the business.

- In an effective system of cost accounting, various forms and documents are uniform in size and quality of the paper.

- Cost accounts are reconciled with the financial accounts to check the accuracy of both the systems.

Objectives of Cost Accounting

Cost accounting is a very important branch of accounting that fulfills the following objectives:

- Ascertaining the cost.

- Classifying the cost.

- Controlling the cost.

- Ascertaining the profitability.

- Determining the selling price of the goods or services.

- Determining total cost and unit cost.

- Facilitating the preparation of financial and other statements.

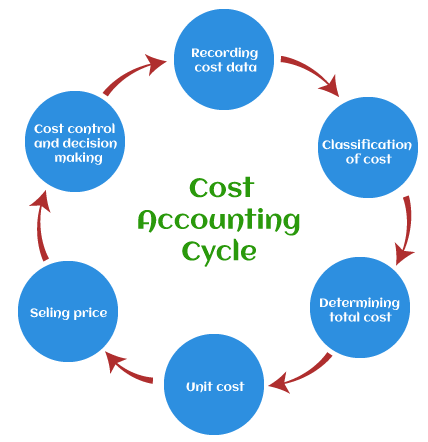

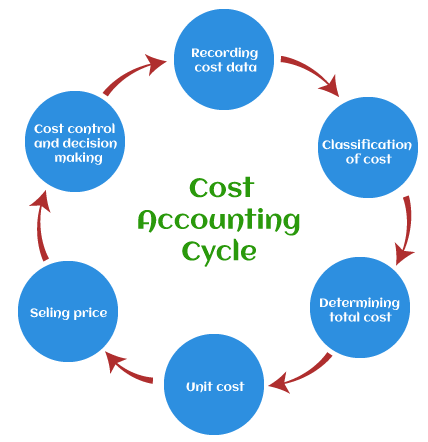

Cost Accounting Cycle

It is a process that is done while recording data, classifying it, determining total, product cost, selling price, controlling cost, and decision making.

1. Recording Cost Data

This is the first and most important step of cost accounting. In this step, the elements of cost accounting are ascertained and recorded to determine the cost of production.

2. Classification of Cost

At the second step, the costs are classified on the basis of their function, nature, and behavior.

3. Determining Total Cost

In this step, the accountant calculates the cost of goods sold of a product during a particular period. This cost is obtained by adding all items of expenditure incurred in production for the goods which are sold.

4. Determining Unit Cost

To determine the unit cost, the cost of goods sold is divided by the total number of units or quantity sold.

5. Determining Selling Price

To determine the selling price, the profit margin is added to the cost of sales.

6. Cost Control and Decision Making

This is the last step of the cost accounting cycle. At this step, the cost is controlled by applying standard costing and budget and budgetary control system. This also helps in making effective and efficient decisions. And after completing this step, the first step is repeated to work on the cost data for next month.

Methods of Cost Accounting

- Job Costing

With the help of this method, the costs incurred for a particular job can be identified. Job costing is mainly suitable for advertising businesses.

- Contract Costing

This method identifies the costs incurred in a contract. It is similar to job costing but the duration of the assignment is comparatively longer. This method is suitable for construction businesses.

- Unit Costing

In this method, those costs are identified that incurred in a fixed quantity. It is suitable for mining businesses.

- Batch Costing

Generally, a batch refers to a fixed number of certain items. So, the batch costing is incurred for a fixed number of units that are forming a batch. It is suitable for the business related to the manufacturing of spare parts.

- Process Costing

With the help of this method, the costs incurred at the different processes which can be related to the production, selling, or distribution stage can be easily distinguished. Process costing is suitable for textile units businesses.

- Operating Costing

It is the method for identifying the costs related to the operating activities or the business services. Operating costing is suitable for hospitals.

Techniques of Cost Accounting

Techniques are helpful for the management in effective and efficient decision making. Various techniques of cost accounting are given below:

- Marginal Costing

In this costing technique, the number of units produced is decided by the management. Here, only the variable cost for the additional units which the company wants to produce to earn more profit is considered. Fixed costs are ignored as they do not change with the number of goods produced.

- Standard Costing

This costing technique makes a comparison between the existing costs and the predetermined cost of the product, process, or project. The difference of these costs is analyzed to bring about cost-effectiveness.

- Historical Costing

In historical costing, a comparison of all costs is done after the completion of a certain process.

- Direct Costing

In this technique, all the direct costs are charged which are related to a particular product, process, or project while the indirect costs are written off against profit and loss.

- Uniform Costing

In this technique, the same costing practices are used across certain units so that a comparison can be done.

- Absorption Costing

In this technique, all costs are charged to the product, process, or project. It is a method of full costing.

Elements of Cost Accounting

Basic elements of cost accounting are given below:

1. Material (Inventory)

Materials referred to the inventory used in the production of goods. Materials are of two types:

- Direct Material

Materials that are directly used in the production process and those which can be easily identified in the finished products are known as direct materials. For example, paper in books, plastic in toys, etc.

- Indirect Material

Various lower-cost items and supporting materials which are used in the production of a finished product are known as indirect materials. For example, the length of thread used in a garment, color used to make a plastic toy attractive, etc.

Furthermore, these materials can be divided into three types of inventories which are: raw materials, work-in-progress, and finished goods.

2. Labor

Any type of wages or salary paid to the workers or a group of workers who are directly involved in any specific activity related to production, maintenance, transportation, and distribution and directly associated with the process of making finished goods from raw materials are called direct labor. Wages or salaries paid to any trainee or apprentices are not included in the category of direct labor due to the absence of significant value. Generally, their income is known as a stipend.

3. Expenses and Other Overheads

Overheads include the following:

- Production or Work Overhead

- Administration Overhead

- Distribution Overhead

- Supplies

- Maintenance and Repair

- Sales Overhead

- Variable Expenses

- Salaries

- Occupancy

- Depreciation

- Other Fixed Expenses

Classification of Costs

1. By Nature or Traceability

It includes direct costs (costs that are directly traceable to cost objects) and indirect costs (costs that are allocated to cost objects).

2. By Function

It includes different costs which are related to the function of the business such as production, administration, selling and distribution, research and development, etc.

3. By Behavior

It includes fixed costs (costs that are not affected by the changes in production volume), variable costs (costs that can be changed with the change in production volume), and semi-variable costs (these are the partly fixed and partly variable costs).

4. By Controllability

It includes controllable costs (cost which can be influenced by conscious management action) and uncontrollable costs (costs that can't be influenced by conscious management action).

5. By Normality

It includes normal costs (costs that incur during day-to-day business operations) and abnormal costs (costs that incur due to any abnormal activity such as theft, fire, natural disaster, etc.).

6. By Time

It includes a historical cost (cost incurred in past) and a predetermined cost (cost that is computed in advance by using the factors that affect cost elements).

7. By Decision-making Costs

These costs are helpful in managerial decision-making. They include the following:

- Sunk Costs

These are the costs that the business can't recover and hence, are not included in future business decisions. For example, if you invested your money into a business that is already bankrupt then this cost is sunk cost for you even though you may recuperate some of your investment with the help of the court.

- Marginal Costs

It refers to the change in total cost that is caused by decreasing or increasing output by one unit.

- Differential Costs

It refers to the difference in total cost that is arising because of selecting one alternative over another.

- Replacement Costs

It refers to the cost at which the company can replace existing items of materials or fixed assets at present or future dates.

- Other Costs

Some other costs include relevant costs, shutdown costs, capacity costs, opportunity costs, etc.

Other Types of Costs

Some other types of cost include the following:

- Opportunity Costs

These are the forgone benefits that would have been driven from an option not chosen. In simpler terms, it is the cost of losing something for gaining something. Opportunity cost is relevant when you have to decide between two or more business opportunities. It is to be understood that there is always a potential superior investment and you should choose that perfect opportunity over the opportunity which is just good. If you are confused between renting and buying a new piece of land to establish your business, then you can calculate the opportunity cost with all the applicable variables.

- Operating Costs

These are the costs that occurred during the daily business activities but are distinct from indirect costs. These are also called operating expenses. There are two types of operating costs: fixed and variable. Fixed operating costs are the costs that are not affected by the number of goods produced. For example, office rent, manager's salary, etc. On the other hand, variable costs are the costs that vary with the number of goods produced. For example, sales commission, direct labor cost, cost of raw materials, etc.

- Controllable Costs

These are the costs which are decided by the company for a particular purpose. For example, bonuses, charitable donations, employee events, advertising, office supplies, etc. but it is a tricky task to calculate the value of controllable costs. However, the company decides these costs but it can't be successful by placing the value of these costs at zero.

General Principles of Cost Accounting

1. Cause-Effect Relationship

This relationship should be established for each item of cost. There should be a clear picture of the cause of any cost that incurs on an item and its effect on various departments should also be ascertained.

2. Charging Cost after its Incurrence

Unit cost should include only those costs which have already been incurred in the business, not those which will be incurred in the future. For example, selling cost is excluded from the unit cost while it is still in the factory because it will take place in the near future.

3. Past Cost should not form part of Future Cost

Past costs which were left unrecovered in the past should not be recovered from future costs as it will affect the true results of future periods and also distort other statements.

4. Excluding the Abnormal Costs

At the time of computing the unit costs, all costs incurred due to any abnormal reason such as theft, negligence, fire, etc. should not be taken into consideration. Because it can distort the cost figures and mislead management.

5. Following the Principles of Double Entry

The principle of double-entry should be followed in cost accounting also. It helps in reducing the possibility of mistakes or errors. So, cost ledgers and cost control accounts should be maintained as per this principle. This will ensure the correctness of the cost sheets and cost statements.

Limitations of Cost Accounting

- Cost accounting is an expensive way of recording costs because a double set of account books is maintained in it and also during the installation stage, cost accounting demands higher funds.

- It involves too many steps in ascertaining costs like collection and classification, allocation and appropriation of expenses, etc. These steps make the system of cost accounting very complex and also cause a delay in the preparation of accounts.

- The technique of costing and single method cannot be applied in all types of businesses. It is based on the nature and size of the business and the type of product that is manufactured by the enterprise. This all makes the applicability of the cost accounting limited.

- Cost accounting does not provide any uniform procedure which is its greatest limitation. Two accountants may derive different results from the same set of information. This makes the system less uniform and reliable.

- There can be confusion arising about including or excluding the non-cost items such as interest on capital, cash discount, etc.

- The social obligation of social accounting is not taken into consideration in cost accounting.

- It is not useful to handle futuristic situations such as inflation or deflation, high or less demand, etc.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now