Difference between Direct and Indirect Tax

Taxation may be complicated, but it is more perplexing with the phrases "direct" and "indirect tax." These two tax categories are relevant, but the distinction between them is how individuals relate. So, how does direct and indirect tax differ?

What is tax?

Taxes are a levy placed on people or companies charged for general financing operations by a government body. The economic impact is imposed onto anybody who pays tax, whether the taxable organization, company or the final consumers. It is not a personal payment or charity but a compelled government commitment.

Why taxes are charged:

The principal reason for the taxation is that it is the governments' fundamental source of income for costs, like the defense, health care, schooling, infrastructural amenities, such as roads, barracks, roadways, etc.

Direct taxes

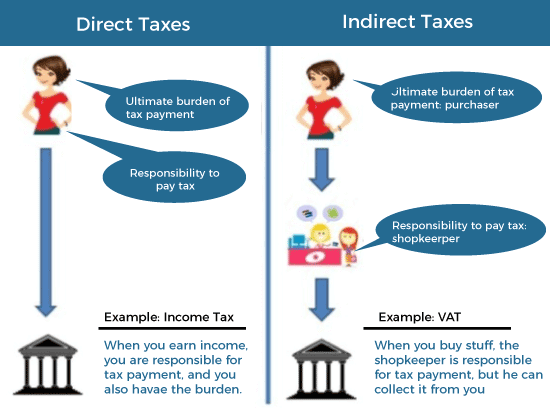

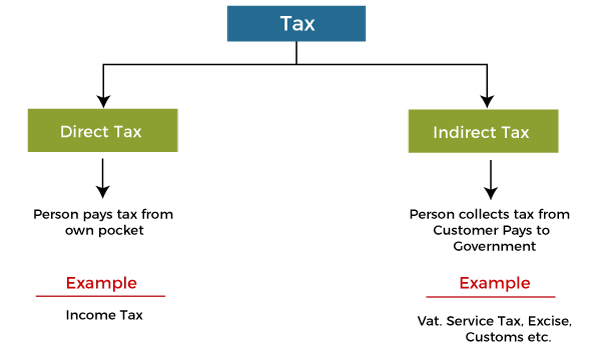

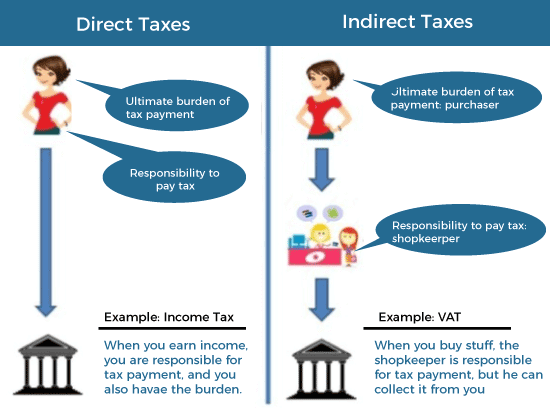

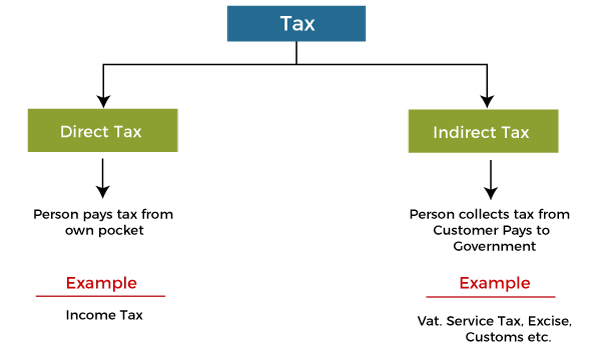

Direct taxes are levied on the taxpayers and paid by them to the government. The taxpayer cannot transfer it to someone else to pay.

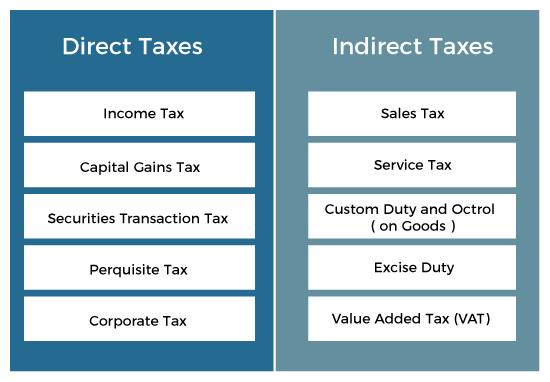

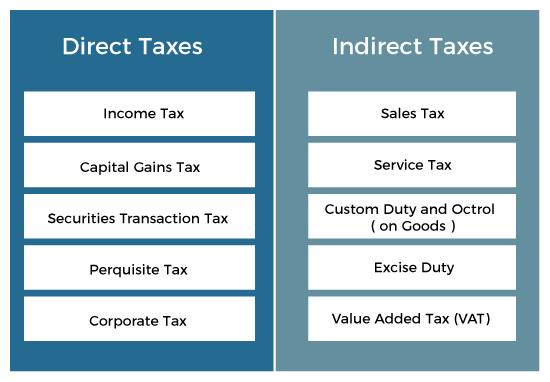

Some of India's significant direct taxes are as follows:

- Income tax: The individual will be charged according to the various income groups set by the income tax department. The government decides all money earned by the different entities within its authority. To establish if taxes are owed or any tax refund is qualified, all people and companies must file an annual tax return.

- Core Tax: This is also referred to as a corporate tax. It is the tax on all corporate profits or gains. They are usually collected on earnings. Companies and corporations are charged on their revenue by the regulations of the income tax.

- Heritage (Estate) tax: An inheritance tax, sometimes referred to as an estate tax or death tax, is a tax arising on the death of a person. It is the property tax, or the worth of the individual who is dead, for the whole of the wealth and property.

- Gift tax: The tax payable to the authorities by a person who receives the taxable gift.

Direct tax benefits:

- Economic and social fairness: This tax is a social and economic justice depending on payment ability. The individual's economic position influences the tax rate. The gradual nature of direct taxes can also assist in minimizing inequities in income.

- Tax certitude payable: The tax rates are established in advance. The same is true for the state, where tax revenues from direct taxes may be estimated.

- Expense and cost-effectiveness: It is inexpensive to collect direct taxes. The tax may also be deducted at source (TDS) from the person's revenue or wages, as in personal income tax. Thus, under income tax, the state does not have to spend much on revenue collection.

- Currency controls: Direct taxes can contribute to inflationary pressures. It is because the government can raise the tax rate if inflation increases. As a result of increasing tax rates, the demand for expenditure may decrease, thus reducing inflation.

Direct Tax Drawbacks

- Tax Flight: We have increased tax evasion because of high tax rates and insufficient paperwork. Also, it enables the deletion of the correct financial info and encourages tax avoidance through account management.

- Impacts the development of assets: Savings and business may be affected by direct taxes. Because of tax consequences, individuals' net incomes decrease, and their savings are reduced. Also, low investment leads to fewer savings, which affects the country's capital training.

- Arbitrary Taxation rate: There are arbitrary direct duties. The purpose for establishing direct tax rates is not stated. The exemption limitations are also established personal income tax, wealth tax, etc. The demand for equality cannot always be met by direct taxation.

- Distributional tax imbalance: There is a regional imbalance in India about direct taxation. Some industries are taxed, such as the business sector, while farmland is 100% tax-free.

Indirect Tax

An indirect tax is a tax imposed on taxpayers for goods and services they buy. It is not levied on income, profit, etc. The taxpayer can transfer it to another person. An indirect tax might increase the price of anything if it is increased.

Some of India's significant Indirect taxes are as follows:

1. Import taxes

Import taxes are a levy or taxes on goods carried. It aims to protect the industry, jobs, and the circulation of commodities in the nation and outside, particularly restrictive and forbidden items. It is, thus, the tax on goods exporters and importers.

Several sorts of duties are charged under customs laws:

- Fundamental duty: All items imported are charged.

- Countervailing Duty (CVD): It's the tax decided by the government of the importing nation to the buyer of particular commodities listed by its Foreign Trade Policy.

- Anti-dumping Duty: Disposal is when foreign merchants can export products to India at prices lower than those they charge on their native markets to capture Indian markets. It makes it possible to impose extra duty equal to the margin of dumping on such items to stop dumping.

- Protective Duty: At the rates suggested on certain products. The government may apply anti-dumping protection taxes.

2. Central exchange rate:

The tax is on products made in India for domestic use. Unless they have been excluded, Central Excise tax is required on the products manufactured.

3. Tax of service:

It is levied on the service provider for certain services they provide. However, the customers have to pay this tax.

4. Tax on sales:

Sales Tax in India is a type of tax on the sale or acquisition of a particular product inside the nation imposed by the state. Under both central and state legislation, the sales tax must be applied. Each state usually complies with its own sales tax law and taxes at different rates.

5. VAT (Value Added Tax):

It is a tax on the projected market value associated with a product or resource. It is transferred to the customer. Thus, each entity along the supply chain has multi-point taxation.

Difference between Direct and Indirect taxes

| Basis |

Direct Taxes |

Indirect Taxes |

| Meaning |

It is a tax levied on the income or wealth of the person, and the person pays the tax directly to the Government. |

It's the tax levied on the goods and services of a person, and the person collects it from another person or consumers, then the person pays it to the Government. |

| Incidence and Impact |

It falls on the same person. The person who earns the income pays the taxes. |

Falls on different person. Imposed on the seller but collected by the consumers and paid to the seller. |

| Burden |

Larger the income larger the taxes. The burden of the tax is directly proportional to people's income. |

The rate of the tax is flat for all people. Due to which more income less pay. Tax burden is regressive. |

| Evasion |

Tax evasion is easy compared to Indirect taxes. |

Tax evasion is more difficult. |

| Inflation |

It reduces Inflation. |

It adds to the Inflation. |

| Shift ability |

It can't be transferred to others. |

It can be transferred to others. |

| Examples |

Income Tax, Wealth Tax, Capital Taxes, Gains Tax, Securities. |

GST, Excise Duty. |

Direct and indirect taxes, which are related to the general economy, are vital to our country. In general, the taxes are analyzed based on financial assets and financial liabilities received. Therefore, taxes on income are referred to as direct, and those paid on expenses are referred to as indirect taxes.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now