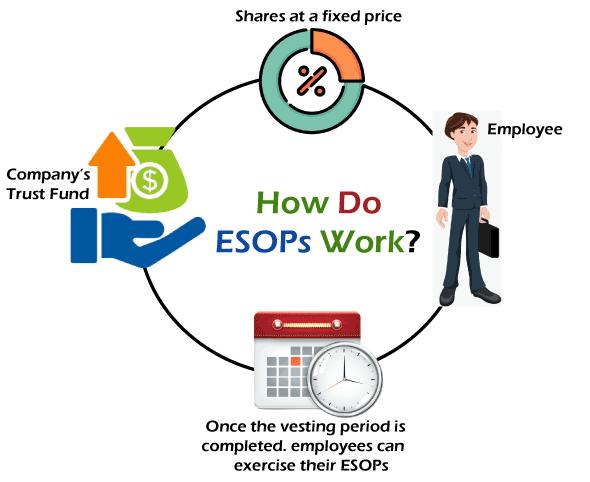

What is the full form of ESOPESOP: Employee Stock Ownership PlanESOP stands for Employee Stock Ownership Plan. Employee Stock Ownership Plan is an employee benefit plan that provides company shares or stock to employees. Company employees are benefited from this type of plan in ways other than a salary slip. It can also be referred to as a financial benefit provided to employees in the form of company shares. Employers usually provide their employees with company stock at a very low cost that can be converted into cash at a specified amount and at a specific time. Staff members feel valued and are often rewarded more for their efforts when such plans are executed. Amazon, Flipkart, Snapdeal, and various other well-known companies are among the first to introduce this concept.

Working on an ESOPs

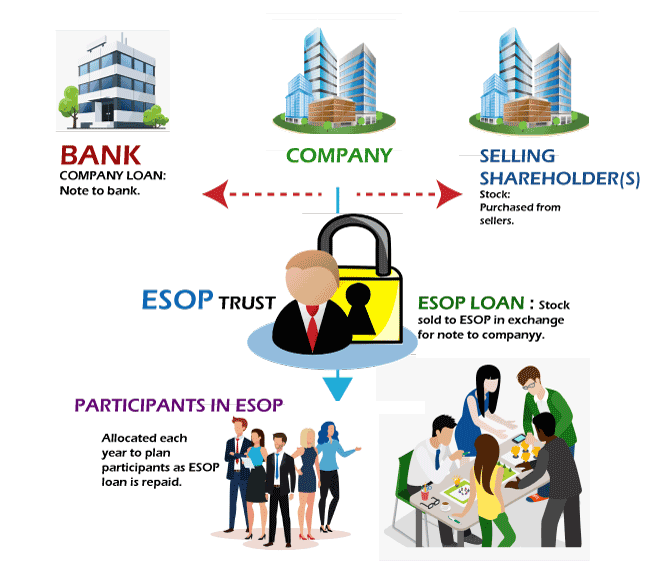

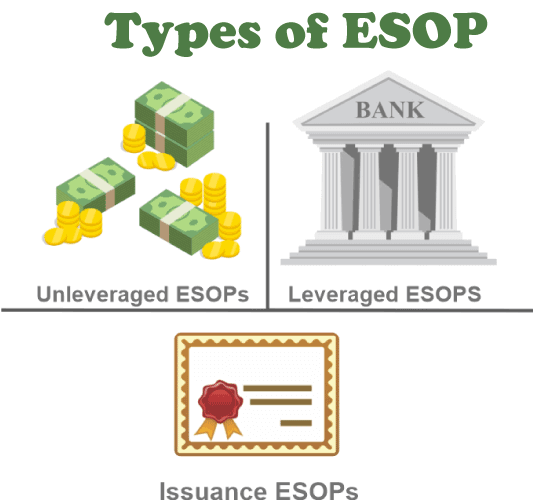

Advantages of ESOPsThere are various advantages offered through ESOPs, some of them are listed below: Ownership in the company: Through ESOPs employees are usually credited with some shares of the company which gives them the benefit to own a part of the company's income. Higher productivity: Individual employees will benefit directly from a company's success and will experience a feeling of ownership because an ESOP gives them a share of the company because of which there is an increase in productivity and overall performance of the employer. Apart from this when an employee has a financial share in the company the trust factor for the organization is also enhanced. Alternative Plan for the Owners: Through ESOPs company owners can trust that in future their business will be owned by the employees by creating an ESOP; they won't have to sell it to a third party and their information can be kept private and not disclosed to new consumers. Shares at a Nominal price: The employees can buy the shares of the company at a nominal rate when exercising an ESOP, which is an investment for the employees at a very low rate. Ease in transfer: ESOPs provide the convenience of transfer, making them a great choice for retirement planning. Employers can simply encourage pay-out and output by rewarding employees with a portion of the business in the form of incentives. This enhances the work culture of the company and continues to help employees even after they retire. Staff Engagement: After purchasing an ESOP in an organization, the staff members have to wait constantly for the vesting period to get over and to avail the benefit of the ESOP. This becomes easy for employers to keep their staff engaged with them for a longer period of time. Disadvantages of ESOPsPer Share Price: The overall performance of the company affects the share price. Without good returns, the company's value decreases, which could cause the share price to fluctuate. Employee stock ownership plans are good for workers in businesses that have established effective management that produces consistent and predictable financial returns. Inaccurate timing of Resignation: Employees may have to plan their resignation based on company performance in order to maximize the value of their ESOPs, leaving the company at a lower stock price will result in a lower pay-out. As a result, when deciding when and how to sell shares, it is important to consider that. Inconsistent Share Price: The prices of the shares change with time, and this can make retirement challenging. Because of this inconsistency, an employee should always keep exploring other options for savings and financial stability. Options such as Retirement Savings Plan or opening a Tax free savings Account can aid additional benefits other than ESOPs. Types of ESOPs1. Non Leveraged ESOP The most basic type of ESOP is an unleveraged ESOP. A company uses an unleveraged ESOP to make quick contributions to the scheme, which are then used to purchase shares in the company from existing shareholders. These plans are also useful for rewarding employees who have been with the company for a long time rather than employees who have only been with the company for a short time. 2. Leveraged ESOP This ESOP takes one or more loans from a bank or other lender. These funds are used to invest in the company's present owners. The company then makes a significant contribution to the ESOP on a regular basis, which is used to repay the loans. Generally, business owners can use a leveraged ESOP to structure a loan for the ESOP to buy huge quantities of shares in the company all at once instead of in small pieces over time. 3. Issuance ESOPs These types of ESOPs are the most unusual type of ESOP. The issuance ESOP makes regular contributions to the plan in the form of newly issued company stock rather than cash. An issuance ESOP is a great choice for company owners who would like to issue additional shares to the plan rather than contribute profits to the plan.

Other ESOP Plans:4. Direct-purchase programsA direct-purchase scheme enables a person or staff member to purchase shares from the company directly. This means that they can do so without the help of a broker. Some companies also provide it directly to their employees, while others may only provide it through a third-party official who manages all transactions of the organization. 5. Stock options planWith a stock option, an employee can purchase and sell their shares at a predefined price and time. Puts and calls are the two different options to think about, and they effectively function like bets that people place. A put is when you bet on a share that you estimate decreases, and a call is when you bet on a share that you estimate increases. 6. Restricted stock planIn such a plan company ownership share stocks approved by corporate partners, such as a director or executive, are referred to as restricted stock. Because limited stock cannot be transferred, any transaction must be approved by the securities regulators in each state and territory. These restrictions help to prevent any early selling that could result in loss of the company. 7. Phantom stock planA phantom stock plan is a plan that provides the advantages of company shares to specific employees in upper staff or senior staff. However, they are not required to receive any company shares in order to enjoy the advantages. They give mock stock to these upper management employees instead of physical stock. Tax Benefits under ESOPEmployee ESOP taxes are extremely low. Employees do not pay taxes on employer contributions to the plan, and there are no tax implications as employees collect ownership through the ESOP. Employees in an ESOP only pay taxes on profit distributions, and participants who are eligible for an IRA i.e. individual retirement account can sometimes turn distributions into an IRA to develop tax-free. It includes the following:

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share