Most Asked Finance Interview QuestionsFollowing is the list of most frequently asked Finance Interview questions and their best possible answers. 1) What are the two main categories of finance interview questions?Following is the list of two main categories of finance interview questions you can face to get a financial analyst job:

2) What are the three main financial statements?Following are the three main financial statements:

3) Which statement would you use and why if you are limited to choosing only one statement to review a company's overall health?We should use the cash flow statement if we are limited to choosing only one statement to review a company's overall health. The main reason behind choosing this statement is that cash is king, and the cash flow gives a true picture of how much cash the company is generating. It is a behavioral question, so you can probably pick a different answer for this question, but you have to provide a good justification. For example, you can choose the balance sheet and say that assets are the true driver of cash flow. You can even choose an income statement and say that it shows the company's earning power and profitability. 4) What should be an ideal company's budgeting process look like?This is a subjective question which you can answer in your way. A good budget is a realistic budget that can strive for achievement, has been risk-adjusted to allow for a margin of error, and is tied to the company's overall strategic plan. To get this budget, we need an iterative process that includes all departments. It can be zero-based or building off the previous year, but it depends on what type of business you're running and which approach is better. It's important to have a good budgeting/planning calendar that everyone can follow. 5) What is the full form of WACC? How can you calculate it?WACC is an acronym that stands for Weighted Average Cost of Capital. It is calculated by taking the percentage of debt to total capital, multiplied by the debt interest rate, multiplied by one minus the effective tax rate, plus the percentage of the equity to capital, multiplied by the required return on equity.

6) What is the difference between Audit and Review?The terms Audit and Review are both commonly used in the finance field. People generally use these terms interchangeably, but they refer to different services provided by a certified public accountant (CPA) firm related to examination or verification of a company's financial statements. The main differences between these terms are:

7) When should a company issue debt instead of equity?The main priority of a company should always be to optimize its capital structure. If the company has taxable income, then it can issue debt to get benefits from the tax. Suppose the firm has immediately steady cash flows and can make the required interest payments. In that case, it is advised to issue debt to minimize the company's weighted average cost of capital. 8) Which is cheaper between debt and equity?The debt is cheaper because it is paid before equity and has collateral backing it. Debt is preferred over equity on liquidation of the business. There are pros and cons to financing with debt vs. equity that a business needs to consider. 9) What do you understand by the term working capital?We can define the term working capital as the overall, generalized portrait of an organization's assets. In other words, we can say that the working capital is the current assets minus the current liabilities. Generally, the working capital is total cash present in the organization to run it smoothly. 10) What do you understand by goodwill? Why is it used?Goodwill is an intangible asset associated with the purchase of one company by another. It can be defined as a redundant value of the cost price against the same essential market value. Fundamentally, goodwill qualifies in the category of intangible assets, which is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process. 11) What do you understand by negative working capital?Negative working capital is very commonly used in some industries, for example, grocery retail and the restaurant business. For a grocery store, customers pay upfront, inventory moves relatively quickly, but suppliers often give 30 days (or more) credit. It means that the company receives cash from customers before it needs the cash to pay suppliers. Negative working capital is a sign of efficiency in businesses with low inventory and accounts receivable. In other situations, negative working capital specifies that the company is facing financial trouble if it doesn't have enough cash to pay its current liabilities. 12) When do you capitalize rather than expense a purchase?If you do purchase in business for more than one year, it is capitalized and depreciated according to the company's accounting policies. 13) Is it possible for a company to show positive cash flows but be in grave trouble?Yes, it is possible for a company to show positive cash flows but be in trouble. Following are two examples to show such cases:

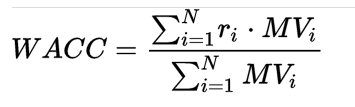

14) Is it possible for a company to show positive net income but go bankrupt?Yes, this may be possible. For example, include deterioration of working capital (i.e., increasing accounts receivable, lowering accounts payable) and financial shenanigans. 15) What do you understand by the term debentures?A debenture is a certificate of loan agreement furnished under the company's stamp. The debenture holder receives a fixed return along with the principal amount at the time of the debenture's maturity. 16) What do you understand by hedging and preference capital?Hedging capital is defined as an instrument to alleviate risks. In other words, we can say that hedging may correspond to the essential purpose of insurance. On the other hand, preference capital is defined as the capital that carries preference over equity capital when the payment of dividend and the winding up of the company. The difference between these two capitals is that hedging is not concerned with augmenting profits but alleviating risks. 17) What do you understand by a deferred tax liability?A deferred tax liability is the opposite of the deferred tax asset. It comes into existence when the concerned amount of tax is shelled at a future date to the IRS. 18) What do you understand by the term composite cost of capital?Composite cost of capital is a cost of a company used to finance its business, determined by and referred to as "weighted average cost of capital" or WACC. 19) Explain the cash flow statement in detail and also specify how it works?The cash flow statement is an important financial statement that specifies the cash inflow and cash outflow. There are two methods to prepare the cash flow: The direct method and the indirect method. Generally, the company uses the direct method to prepare the cash flow statement, as seen in its annual report.

20) What are the different activities used in the cash flow statement?We can categorize the cash flow statement into three activities:

21) If you were the CFO of a company, what would be the top priority that keeps you up at night?This is a very tricky question. It would be best if you answered this question in a very diplomatic way. It would help if you gave a high-level overview of the company's current financial position or companies' position in that industry in general. It is also advised to highlight something on each of the following three financial statements:

22) What do you understand by the term adjustment entries?Adjustment entries are the type of entries passed at the end of each accounting period. As the name specifies, the adjustment entries' main purpose is to adjust the nominal and other accounts to provide a stable account on the balance sheet. In other words, we can say that adjustment entries are used as drafts before the final entries are passed. 23) What do you mean by the term cost accountancy?We can define cost accountancy as the overall presentation of cost control and other account figures used to uphold a particular venture's fairness and help the prospects of grounded managerial decision-making. Apart from the accounting of the costs, cost accountancy is also used for reflecting profitability. 24) If a company purchases a new piece of equipment, then what would be the impact of the purchase on the income statement, balance sheet, and statement of cash flows?Suppose a company has purchased a new piece of equipment, then at the time of the purchase, there is a cash outflow (cash flow statement), and the balance sheet (PP&E) goes up. Over some time, the asset's life will depreciate, then it shows up a reduction in net income (income statement), and PP&E (balance sheet) decreases by the amount depreciated. At the same time, the retained earnings (balance sheet) also go down. However, the depreciation is added back in cash from the operations section (cash flow statement) as it is a non-cash expense the reduced net income. So, only the balance sheet and cash flow statements are impacted by the purchasing of the equipment. 25) Why would two companies merge? What are the major factors that drive mergers and acquisitions?There are a lot of reasons companies go through the mergers and acquisitions process. Some of them are following:

Note: There may also some social reasons, but we have to be careful about mentioning them.26) What do you understand by PP&E? How can you record it, and why is it important?PP&E stands for Property, Plant & Equipment. There are mainly four areas to consider when accounting for Property, Plant & Equipment (PP&E) on the balance sheet:

In addition to these four, we can also consider revaluation. PP&E is responsible for many businesses as the main capital asset that generates revenue, profitability, and cash flow. 27) Why are increases in accounts receive a cash reduction on the cash flow statement?The cash flow statement starts with net income. So, an increase in accounts receivable is an adjustment to net income to reflect that the company never actually received those funds. 28) How does an inventory write-down affect the three financial statements?An inventory write-down affects the three financial statements in the following way:

29) How is the income statement linked to the balance sheet?The bottom line of the income statement is called the net income. The net income links to both the balance sheet and cash flow statement. In terms of the balance sheet, net income flows into stockholder's equity via retained earnings. 30) What do you understand by deferred tax assets, and what can create deferred tax assets?The deferred tax asset comes into existence when a company pays more in taxes to the IRS than it shows as an expense on their income statement in a reporting period. Following are the reasons that can create deferred tax assets:

31) What is the difference between real money and nominal money?The key difference between real money and nominal money is that the real money is loaded with its basic purchasing potency. On the other hand, nominal money is related to the aspect of technical enumeration or counting. So, we can say that the nominal money is reflected in the bill. 32) What is the meaning of treasury bills?Treasury bills can be defined as the money market instruments introduced to sponsor the short-term financial requisites of the Government of India. All treasury bills are discounted securities that are provided at a discount to face value. 33) What do you understand by short-term financing?A company uses short-term financing to fulfill its current cash needs. The company has to repay this short-term source of finance loan within 12 months from the financing date. 34) What are the three sources of short-term financing used by a company?Following are three main types of short-term sources of financing: Trade Credit: The trade-credit can be defined as an agreement between a buyer and a seller of goods. In this case, the buyer of the goods purchases the goods on credit. Here, the buyer pays no cash to the seller when buying the goods, only to pay at a later specified date. The trade-credit is completely based on mutual trust that the goods' buyer will pay the cash amount after a specified date. Unsecured Bank Loans: Unsecured Bank Loan is a type of credit that banks are ready to give and is payable within 12 months. This is called an unsecured bank loan because no collateral is required by the individual or a business entity taking this loan. Bank Over-drafts: Bank Overdraft is a type of short-term credit offered to an individual or a business entity having a current account subject to the bank's regulation. In this case, an individual or a business entity can withdraw more cash than what is present in the account. Interest is charged on the amount of over-draft, which is withdrawn as a credit from the bank. Some other types of some short-term sources of financing are:

35) What is the difference between the clean and dirty prices of bonds?The difference between the clean price and dirty price: The clean price is the price of a coupon bond that doesn't include any accrued interest. In other words, we can say that the clean price doesn't include the accrued interest between coupon payments and is typically the quoted price on financial news sites. On the other hand, the dirty price is the bond price that includes accrued interest between coupon payments. 36) What do you understand by the DCF method, and why is it used?DCF stands for Discounted Cash Flow. It is a valuation method used to estimate an investment's value based on its expected future cash flows. DCF method is an analysis used to figure out the value of an investment today, based on projections of how much money it will generate in the future. 37) What are the key features of discounted cash flow?Following is a list of some prominent features of discounted cash flow:

The list of general HR questions asked in the Finance interview38) Why have you chosen to work in finance?The employers ask this question to candidates to check their passion for the job. While answering this question, the candidates should explain what they enjoy most about a finance job and demonstrate their drive for this type of work. A Sample Answer: Sir, I have chosen to work in finance because I enjoy accounting and number puzzles. I love to play with financial equations with a single answer, but there are many ways to approach it. 39) What are your financial strengths and weaknesses?When the candidate is asked about addressing strengths and weaknesses, it is always very challenging to answer. For a finance position, the candidates should respond to the skills and challenges they can face in this profession. It would help if you always were honest while answering this question. Highlight your strong points and try to balance your weak points diplomatically. A Sample Answer: Sir, I think my biggest financial strength is budgeting. I love to use different budgeting methods and evaluate the right type of budgeting to get accurate forecasting. If I talk about my weakness, it may probably be inconsistency. 40) What is the greatest achievement in your financial career so far?You have to explain your greatest achievement in detail to let the hiring manager know what you are capable of and get an idea of what accomplishments you have achieved. A Sample Answer: Sir, My greatest achievement as a financial planner, was helping one of my clients get rid of a big debt (you can specify an amount) within two years and ensure a good return in the future. It makes me happy to see how my services can transform individuals' lives. 41) What are the short-term financing you can suggest if our company needs immediate cash?Any business can meet a difficult financial situation; it will need a finance professional who quickly resolves the problem. The interviewer asks this question to check if you have a plan for a financial crisis or not. By this question, they can evaluate your ability to identify and solve issues related to paying current liabilities. It also demonstrates how experienced you are. A Sample Answer: Sir, if the company requires immediate cash needs, I would suggest using trade credit, bank loans, or a bank overdraft. These are the best possible options, in my opinion. After solving the immediate cash needs, I would take an in-depth review of all financial statements to prevent this type of cash crisis in the future. |

You may also like:

- Java Interview Questions

- SQL Interview Questions

- Python Interview Questions

- JavaScript Interview Questions

- Angular Interview Questions

- Selenium Interview Questions

- Spring Boot Interview Questions

- HR Interview Questions

- C Programming Interview Questions

- C++ Interview Questions

- Data Structure Interview Questions

- DBMS Interview Questions

- HTML Interview Questions

- IAS Interview Questions

- Manual Testing Interview Questions

- OOPs Interview Questions

- .Net Interview Questions

- C# Interview Questions

- ReactJS Interview Questions

- Networking Interview Questions

- PHP Interview Questions

- CSS Interview Questions

- Node.js Interview Questions

- Spring Interview Questions

- Hibernate Interview Questions

- AWS Interview Questions

- Accounting Interview Questions