GDP DefinitionGross domestic product, or GDP, is the sum of the value of the commodities and services created in a nation during a certain time period. It serves as a benchmark for the size and strength of a nation's economy.

The GDP of a nation accounts for all production and consumption, including public and private. Government spending, corporate and consumer spending, investments, and net exports are all included. GDP may be computed for any time period, but it is commonly done annually. The quarterly GDP data is often quite important for the financial markets. Knowing GDPAlthough while GDP is frequently estimated on a yearly basis, it may also be calculated quarterly. For instance, the government of the United States produces an annual GDP estimate for both the calendar year and each fiscal quarter. Each data point included in this report is presented in real terms, which means that it has been modified for price fluctuations and is thus net of inflation. The total household and public consumption, govt spending, investments, increases in private inventories, paid-in building expenses, and the foreign balance of trade are all included in the computation of a nation's GDP. Imports are deducted from the value while exports are added. The international trade balance is one of the factors that contributes the most to a nation's GDP. When domestic producers' exports of products and services to overseas markets surpass their local consumers' imports of foreign products and services, a nation's GDP tends to rise. A country is considered to have a trade surplus when this circumstance happens. A trade deficit exists when the entire quantity of goods sold to foreign consumers by domestic producers is less than the total amount of goods purchased by domestic consumers from foreign producers. A nation's GDP often declines under this scenario.

GDP can be calculated both nominally and realistically, with the latter taking inflation into account. As real GDP employs constant dollars, it is often a superior way to depict long-term national economic performance. Assume a nation's nominal GDP in 2012 was $100 billion. Its nominal GDP increased to $150 billion by 2022. The same timeframe saw a 100% increase in prices as well. In this case, the country's economy looks to be doing well if you only consider its nominal GDP. Nevertheless, the real GDP (measured in 2012) would only be $75 billion, indicating that real economic performance actually declined overall throughout this period. Types of Gross Domestic ProductThere are various ways to report GDP, and each one offers a little bit of information in a different way. Nominal GDPNominal GDP is a measurement of economic output in an economy that takes into account current prices. It does not adjust for inflation or the rate of price increases, which might overstate the growth rate. All items included in the nominal GDP are evaluated at the prices at which they were actually sold throughout the year. To compare the nominal GDP of other nations on a strictly financial basis, nominal GDP is measured in either the local currency or U.S. dollars at market exchange rates.

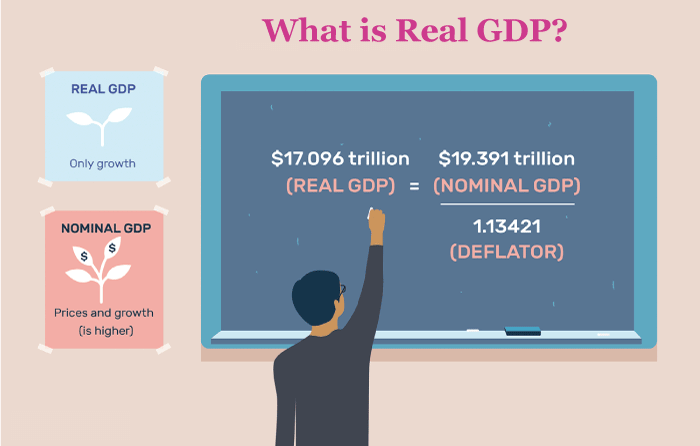

For comparing several production quarters within the same year, nominal GDP is considered. Real GDP is used for comparing the GDP of a period of two years or more. This is due to the fact that the analysis of the various years can now essentially be made only on volume with the impact of inflation removed. Real GDPIn order to distinguish the consequences of inflation or deflation from the pattern in output over time, the amount of goods and services that a nation produces in a particular year is expressed as its real GDP, which is an inflation-adjusted metric. Prices are maintained constantly from year to year. GDP is susceptible to inflation since it is dependent on the monetary worth of goods and services. A country's GDP tends to rise with rising prices, but this does not always mean that the volume or quality of products and services produced has changed. As a result, it might be challenging to determine whether an economy's nominal GDP increased due to an actual increase in output or merely because of higher prices. To determine the real GDP of an economy, economists employ a technique that accounts for inflation. Economists may account for the effects of inflation by adjusting the production in each specific year for the price levels that were in existence in the base year, which is used as a reference. In this approach, it is feasible to assess whether a nation has seen actual growth by comparing its GDP from year to year.

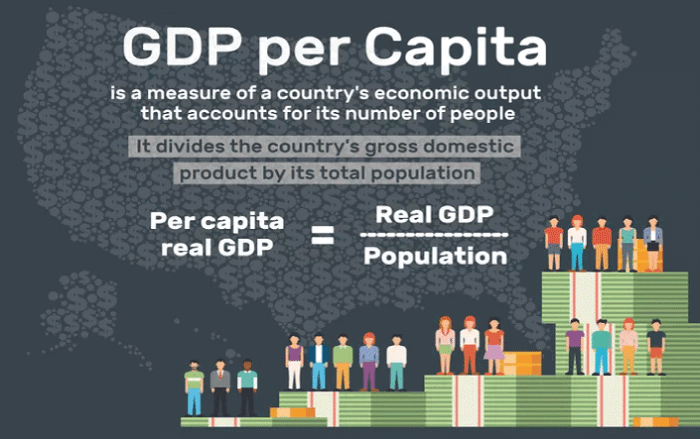

Using a GDP price deflator, that measures the price difference between the present year and the base year, real GDP is determined. For instance, the deflator would be 1.05. If prices increased by 5% since the base year. This deflator divides nominal GDP to produce real GDP. Since nominal GDP is normally greater than real GDP and because inflation is usually positive. The disparity between output statistics over time is reduced because real GDP takes market value changes into account. A big difference between a country's real GDP and nominal GDP may signal serious economic inflation or deflation. GDP Per CapitaA country's population is weighted according to its GDP per capita. It implies that an economy's production or income per person can be a good indicator of average productivity or living standards. Indicators of GDP per capita include nominal, real (inflation-adjusted), and purchasing power parity (PPP) figures. A simple interpretation of per-capita GDP is that it demonstrates the amount of economic value that may be directly associated with each individual person. Due to the fact that GDP market value per person is a convenient indicator of wealth, this also correlates to a measurement of overall national wealth.

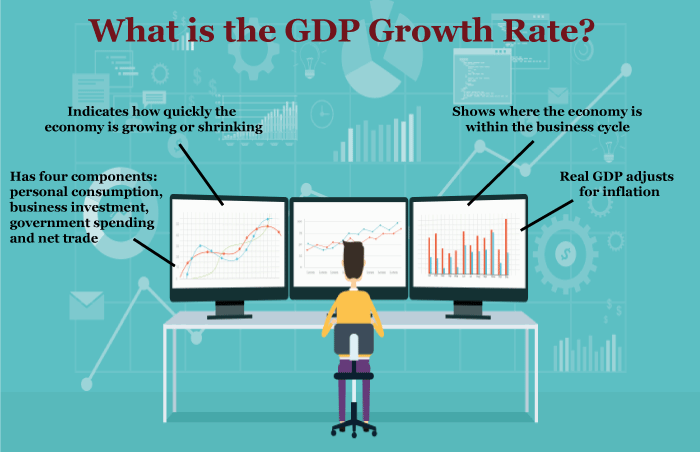

The per-capita GDP is frequently compared to other, more conventional GDP measurements. This statistic is used by economists to gain understanding of both their own nation's and other nations' domestic productivity. Per-capita GDP takes into account both the GDP and the population of a nation. Consequently, it may be crucial to comprehend how each component affects per-capita GDP growth and how it affects the total outcome. For instance, if a nation's per-capita GDP is increasing but its population is remaining consistent, this might be a result of technology advancements that are enabling greater production with the same population. Several nations with tiny populations but high per-capita GDPs have developed self-sufficient economies based on the availability of unique resources. GDP Growth RateTo determine how quickly an economy is expanding, the GDP growth rate analyses the quarterly change in a nation's economic production to year-over-year change. Because GDP growth is believed to be strongly related to important policy aims like inflation and unemployment rates, this metric is well-liked by economic policymakers and is typically stated as a percentage rate.

If GDP growth rates pick up, the economy may be overheating and the central bank may attempt to hike interest rates. In contrast, central banks view a contraction in GDP growth (or a recession) as an indication that rates must be cut and that further stimulus may be required. GDP Purchasing Power ParityAlthough PPP is not a direct measure of GDP, economic experts use it to determine how one country's GDP compares to others in terms of international dollars by using a method that accounts for regional price and living standards variations to compare output growth, real income, and standard of living across nations. GDP FormulaThree main approaches may be used to calculate GDP. When computed correctly, all three techniques should provide the same result. These three strategies are sometimes referred to as the expenditure strategy, the production strategy, and the revenue strategy.

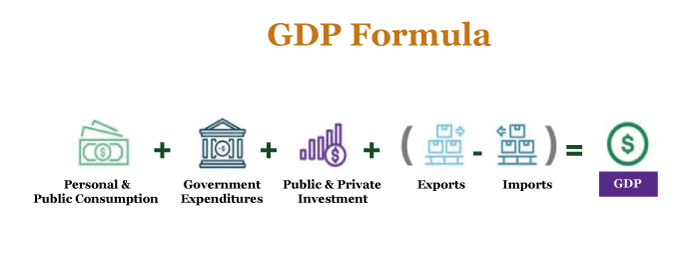

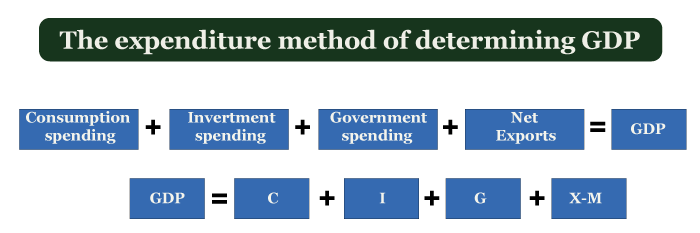

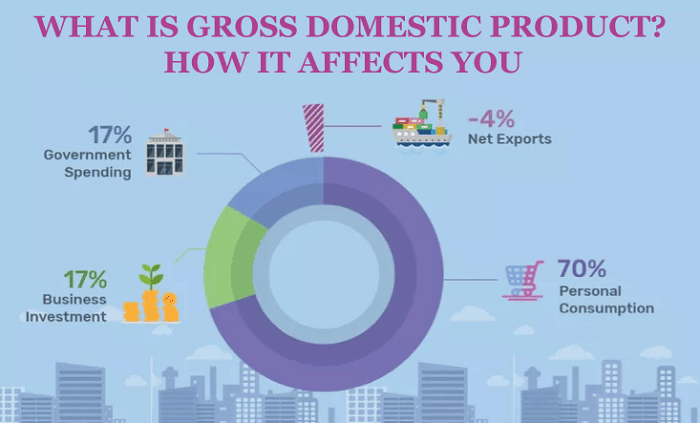

1. The Expenditure MethodThe expenditure strategy, commonly referred to as the spending approach. This determines how much each group involved in the economy spends. The spending technique is used to calculate the U.S. GDP most frequently. The following formula may be used to compute this strategy: GDP=C+G+I+NX where: C stands for Consumption G stands for Government expenditures I stand for Investment NX stands for Net exports Each of these actions helps a nation's GDP grow. Household consumption expenditures or consumer spending are referred to as consumption. Spending money on food and haircuts is one example of how consumers purchase products and services. More than 66 percent of the U.S. GDP is made up of consumer expenditure, which is the largest part of the GDP.

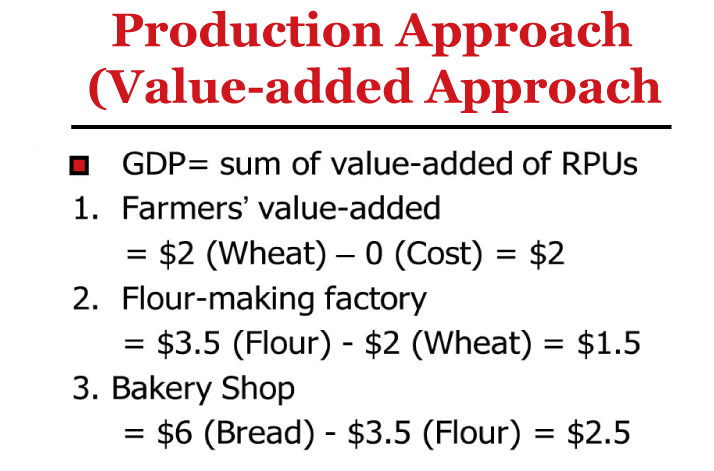

Thus, consumer confidence has a huge impact on economic growth. A high level of confidence reveals customers' readiness to spend, whereas a low level of confidence reveals consumers' worry about the future and their reluctance to spend. Government spending consists of both gross investments and consumption costs. Governments allocates money on things like infrastructure, equipment, and salaries. When consumer expenditure and corporate investment both see significant declines, the role of government spending in a nation's GDP may change in relation to other components. (This may happen, for instance, after a recession.) Domestic private investment or capital spending are referred to as investments. Companies invest money in their operations by making purchases. For instance, a company may purchase equipment. As it enhances employment rates and an economy's capacity for production, business investment is a crucial part of GDP. The net exports formula subtracts total exports by total imports. A nation's net exports are its manufactured products and services that are sold to other nations less its domestic consumer-purchased imports. Even if they're international corporations, all expenses made by local businesses are taken into account in this assessment. 2. The Production/Output MethodEssentially, the output approach is the opposite of the expenditure method. The production approach calculates the entire value of economic output and subtracts the cost of intermediate items that are consumed in the process (like those of materials and services) rather than evaluating the input costs that go into economic activity. The production method looks back from the vantage point of a phase of accomplished economic activity, in contrast to the spending approach, which projects forward from costs.

3. The Income MethodThe income method stands for a form of middle point between the other two methods of calculating GDP. The income method determines the revenue generated by all the forces of production in a nation's economy, such as labour force wages, land rent, interest payments on capital, and business profits.

For those goods that are not recognized payments made to elements of production, the income method makes certain changes. One example is the fact that some taxes, including sales taxes and real estate taxes, are categorized as indirect corporate taxes. The national income is also increased by depreciation, a reserve that firms set aside to cover the cost of replacing equipment that degrades over time. A country's income is the sum of all of these things. How to Use GDP DataMonthly and quarterly GDP releases are common in most countries. A preliminary release of the quarterly GDP is released by the Bureau of Economic Analysis (BEA) in the US four weeks after the quarter ends, followed by a final release three months later. The BEA publications are thorough and packed with information, allowing investors and economists to learn more about the economy and get new perspectives. As GDP is backward-looking and a significant amount of time has passed between the end of the quarter and the release of the statistics, its market impact is often minimal. Markets may be affected by GDP statistics, though, if the actual figures are significantly different from forecasts. Businesses may use GDP as a reference for their company strategy since it offers a clear indicator of quality and economic growth. The rate of growth and other GDP statistics are taken into consideration by government organizations, such as the Fed in the United States, when deciding what kind of monetary and fiscal policy to execute.

They may undertake an expansive monetary strategy to try to stimulate the economy if the rate of growth is slowing. If the growth rate is strong, they may strive to prevent inflation by using monetary policy to slow down the economy. The most significant indicator of the state of the economy is real GDP. Economic experts, investors, analysts, and decision-makers all keep up with it and debate it frequently. The recent data will nearly always alter markets when it is released in advance, although this impact may be restricted. BottomlineWith the help of GDP, central banks and policymakers can determine whether the economy is growing or decreasing, whether it needs to be stimulated or restrained, and whether a threat like a recession or inflation is approaching. Like any measurement, GDP has several flaws. Governments have developed a number of subtle changes in recent decades in an effort to improve the accuracy and precision of GDP. From its inception, methods for measuring GDP have changed continuously to reflect changing assessments of business activity as well as the creation and consumption of novel, emergent categories of intangible assets.

Next TopicGene Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share