Human Resource AccountingMeaningThe process of identifying and reporting investments that are made on the human resources by a company that is currently unaccounted for in the conventional accounting practice is known as Human Resource Accounting (HRA). In simpler terms, it is referred to as that type of accounting under which various expenses and cost related to the employees of a company and their salary and wages, recruitment, selection, development, training, hiring, etc. is recognized and calculated. The company can document its assets accurately by assessing, budgeting, and reporting the true value of the human resource that the company has. Objectives of Human Resource AccountingVarious objectives of human resource accounting are as follows:

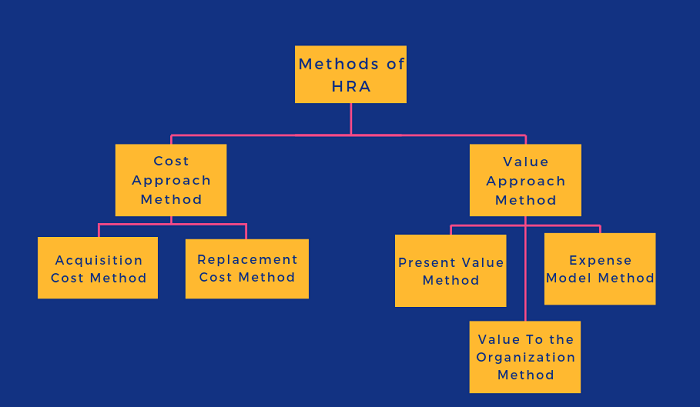

Process of Human Resource AccountingTo execute the human resource accounting effectively and efficiently, it is required for the management to follow a particular procedure. The various steps of this procedure are explained below: 1. HRA ObjectivesThere are certain goals that every company has to accomplish and work on. In the first step, the company determines these goals and requirements to set a foundation for the objectives of the human resource accounting system. 2. Developing HRA MeasurementsThe second step in this process is to develop HRA measurements. For this purpose, the companies can use any of the two methods that are available, i.e., Monetary and Non-monetary Methods. These methods are helpful in calculating the cost and/or value of human resources. The management can use any one or both of these methods for the measurements. But it is a must to check the validity and consistency of any method before applying or implementing it. 3. Developing HRA DatabaseCertain factors work as the basis for human resource accounting. Such factors are time management sheet, the cost of each employee working in the company, different psychological factors, etc. These factors form a database for human resource accounting. 4. Pilot Testing the SystemThis is the fourth step in the process of human resource accounting. At this step, the management conducts a pilot test of the system. A pilot test is a type of sample test which is done on a selected number of people before conducting the main test. This test aims to pre-check the working system before finalizing it as part of the organization or the main research work. Also, pilot testing helps in finding the flaws in the database which can be corrected before the final implementation. But pilot testing can only be successful if there is coordination and cooperation in the management throughout the process. 5. Implementing the Human Resource AccountingThis is the fifth and final step in the process of human resource accounting. Now, the management will implement the human resource accounting in the organization and will introduce the entire workforce and staff to a new system of accounting. But the implementing the system is not enough. The management has to explain the importance and different methods of HRA to the employees so that they can adapt to the new concept and remain satisfied with the organization. Methods of Human Resource AccountingThere are various methods that can be used under the human resource accounting system. Generally, these methods are divided into the following two categories:

1. Cost Approach MethodIt calculates the various cost that the company is expected to spend on its employees. It is a type of monetary model (the model which deals with the monetary aspects). Types The cost approach method is further divided into the following two categories:

Limitations

2. Value Approach MethodIt is also a type of monetary model. This method calculates the value of the employees on the basis of the future service that is expected from him/her till the retirement. Types Under this approach, three methods are included:

Limitations

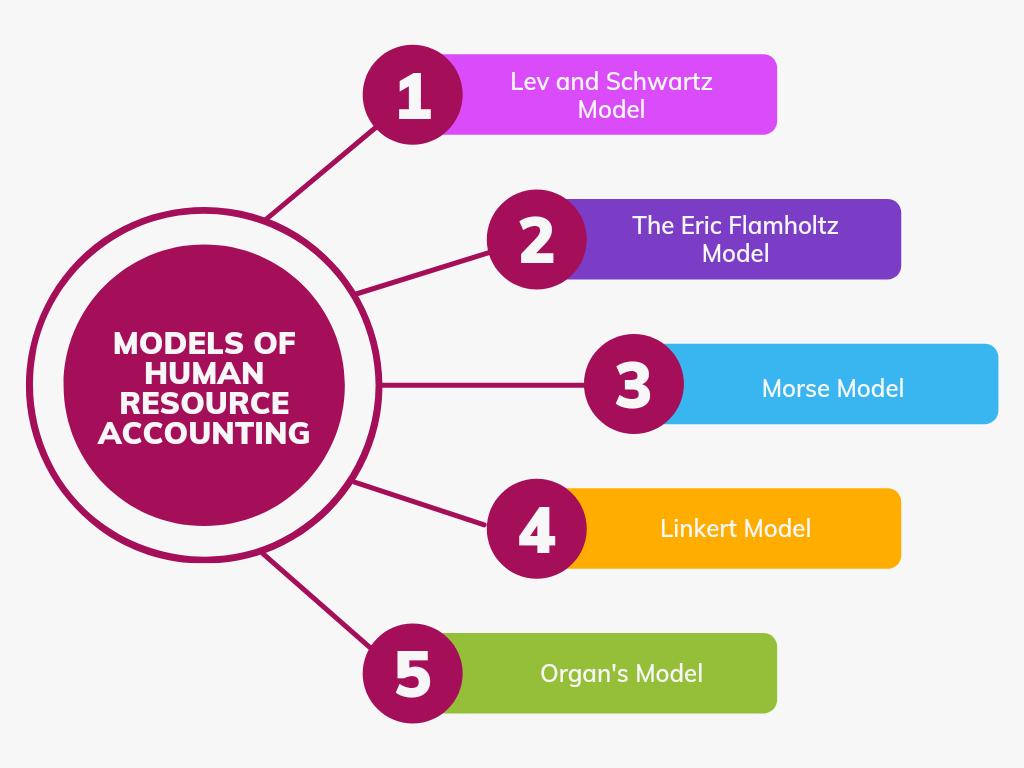

Models of Human Resource Accounting

1. Lev and Schwartz ModelUnder this model, the company determines the present value of future benefits to employees on the basis of the given assumption:

2. The Eric Flamholtz ModelUnder this model, the company also includes the factor of employees leaving the job earlier, voluntary retirement, retrenchment or death of the employee, etc. to calculate the present value of the future benefits. There are some assumptions and facts that the company considers under this model:

3. Morse ModelUnder this model, the company determines the services that are rendered by the employees to the business. Morse model determines all other monetary benefits that are enjoyed by the human resource of the company such as retirement benefits, gratuity, leave encashment or paid leave, perks, bonuses, etc. This calculation is done on proper assumptions and then these values are discounted to calculate the present value of future benefits. 4. Linkert ModelThis model is different from the other models. Here, the company focuses on the non-monetary benefits given to the employees instead of the monetary benefits. The organization considers the benefits such as employees' job satisfaction, productivity, safety, health benefits, etc. to figure out the present value and benefits to the organization. 5. Organ's ModelUnder this model, the company calculates the net benefits from each employee and then multiplies it with an estimated period for which the employee may work for the organization. In short, this method calculates the individual contribution of the employees toward the business during a certain period. Benefits of Human Resource AccountingVarious benefits of the human resource accounting are as follows:

Limitations of Human Resource AccountingOther than the above-given benefits, human resource accounting has certain limitations also. These are as follows:

Next TopicGolden Rules of Accounting

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share