What is the full form of IFRS(i) IFRS: International Financial Reporting StandardsIFRS stands for International Financial Reporting Standards. The International Accounting Standards Board (IASB) developed IFRS and is now in charge of it. It was formerly known as the International Accounting Rules (IAS). It is a distinct set of guidelines that businesses use to document their financial operations. One hundred forty-four jurisdictions have implemented it as of right now. However, the United States government adheres to its own policies and regulations known as the Generally Accepted Accounting Principles (GAAP) rather than IFRS. Both standards work well and accomplish the same thing. But, there is always an IFRS vs GAAP contrast.

PurposeIn order for present or potential stakeholders to make educated financing decisions, financial statements are made to provide information about a company's performance and financial status. It serves as a company's main channel of communication with customers. As a result, the information presented in the records needs to be relevant, reliable, accurate, and comparable. To ensure it, businesses started following nationally recognised accounting standards. However, it was difficult to compare numerous firms across different countries due to the lack of standardisation in their accounting methods. Businesses were compelled to provide multiple sets of financial statements for various regulatory agencies as a result. IFRS's Uses

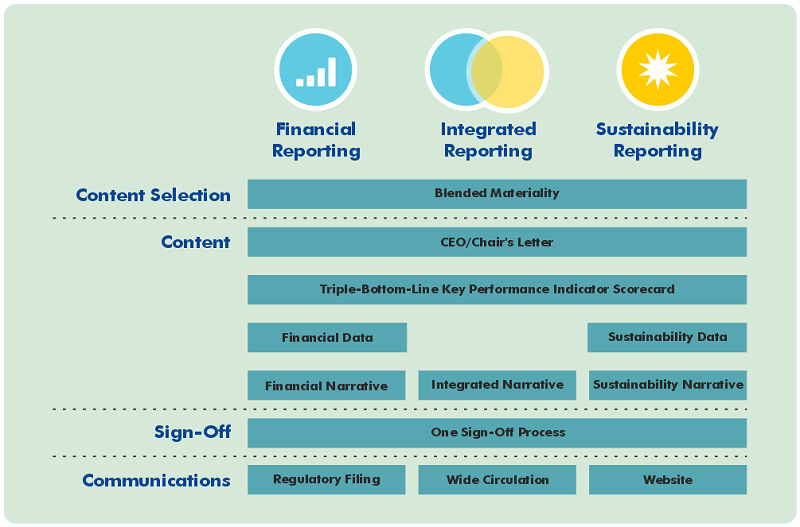

(ii) IFRS: Integrated Fiscal Reporting SystemIFRS also stands for Integrated Fiscal Reporting System. A type of business reporting called integrated reporting aims to explain to stakeholders the financial and non-financial components of an organisation. According to this reporting, social, environmental, and governance challenges directly impact a company's value. It also presupposes that stakeholders have a right to know about these problems and the business's strategies. The International Integrated Reporting Committee (IIRC) established global standards for integrated reporting in August 2010.

Any data not directly related to the company's financial situation is frequently left out of traditional business reports. As a result, stakeholders are aware of the company's annual revenue but unaware of the strategies and directives contributing to that revenue. Issues related to the environment, society, and governance are frequently disregarded because they are irrelevant or impossible to quantify. Integrative reporting proponents contend that a more comprehensive strategy is required. They claim that stakeholders have a right to know how the firm is conducted and if social and environmental considerations are taken as essential components. Business reporting of this nature demonstrates the overall, long-term effects of choices made by the corporation. It describes the relationship between the company's set strategies and overall performance, which reveals the risks and opportunities the organisation is facing. (iii) IFRS: International Financial Reporting Standards FoundationIFRS also stands for International Financial Reporting Standards Foundation. The International Financial Reporting Standards Foundation, or IFRS Foundation, is a non-profit organisation that oversees the creation of financial reporting standards (also known as IFRS). One of its main objectives is the development and promotion of the International Financial Reporting Standards (IFRS) through the International Accounting Standards Board (IASB) for accounting standards and for standards relating to sustainability.

The IFRS Foundation claims that by fostering confidence, development, and long-term financial stability in the international economy, its work serves the public good. The primary goal is to create IFRS Standards that give responsibility, transparency, and efficiency to the financial markets all across the world. About twenty-two trustees make up the foundation's governing body, and they are all overseen by a "Monitoring Board" of public officials. The International Financial Reporting Interpretations Group (IFRIC), a separate committee that produces publications that supplement the IFRS standards and are a component of the IFRS set, is housed by the IFRS Foundation. Separately, the IASB creates IFRS for SMEs to more effectively address the particular needs of SMEs than what is possible with the entire IFRS Standards, which are primarily intended for publicly traded firms. The IFRS Taxonomy, which consists of features that can be used to categorise disclosures in financial statements made using IFRS Standards, is another project that the IASB creates and maintains. By making information computer-readable, tagging is used that makes information readily available to consumers of electronic firm financial reports, including investors. The extensible Business Reporting Language is used to express and transmit the information from the IFRS Taxonomy (XBRL).

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share