What is the full form of IMPS in banking

IMPS : Immediate Payment Service

IMPS stands for Immediate Payment Service. It is the online 24*7*365 instant inter-bank fund transfer service launched by NPCI (National Payments Corporation of India) on 22nd November 2010. It is accessible through multiple channels like mobile, internet, SMS, ATM, etc. IMPS is thus a real-time fund transfer facility launched with the following objectives:

- To allow customers of the bank to utilise mobile as an instrument for accessing bank accounts and transferring funds.

- Easing fund transfer using mobile number.

- Enabling transfer of funds electronically.

Need for launching IMPS

Before the launch of IMPS, India's banking sector faced the problem of inter-bank transfer of funds on a real-time basis. Although other methods of inter-bank transactions were available, like RTGS and NEFT, these services were available only during banking hours, which was its biggest shortcoming.

The other need for IMPS was to create a robust structure of instant mobile payment available 24*7. The non-availability of online instant payment services ushered the way for launching IMPS.

Features of IMPS

- It allows instant transfer of funds through net banking, mobile, ATM and SMS.

- It enables transactions 24*7*365.

- IMPS provide real-time notifications of the occurrence of transactions.

- IMPS transactions are safe and secure as it is done through encrypted servers and follows muti-step verifications.

- The transactions through IMPS are done with minimum information like mobile number, recipient name and MMID.

- Through IMPS, the users can pay their bills for various applications like insurance bills, book tickets, mobile and DTH recharges, etc.

- It is the most cost-efficient means of inter-bank transactions as banks charge minimal cost from the user, and in some cases, it is even waived off by the banks.

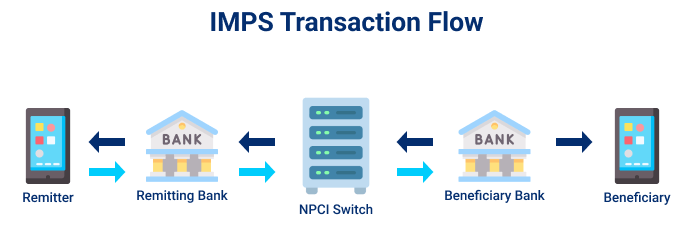

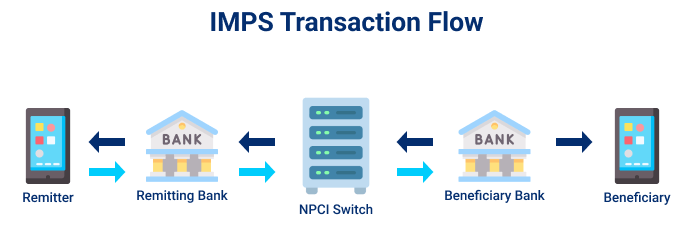

Parties involved in transactions through IMPS

- Sender of funds

- Receiver of funds

- Banks of sender and receiver

- National Financial Switch-NPCI

Methods of transfer of funds through IMPS

Funds via IMPS are transferred using two methods, such as:

- With the mobile number and MMID (P2P)

In this method, both sender and receiver of funds need to register their respective mobile numbers along with their bank accounts and get the Mobile Money Identifier (MMID). This combination of mobile numbers and MMID is used to transfer funds.

- With account number and IFSC (P2A)

If the sender's mobile number is registered, but the mobile number of the recipient is not registered, in this case, the funds are directly transferred to the recipient's bank account with the help of the account number and IFSC.

Role of NPCI in IMPS transactions

- NPCI is the operator, service provider and nodal agency for IMPS. NPCI has the sole rights over the operation and maintenance of the IMPS network and forms the required policies regarding IMPS.

- NPCI acts as the settlement agent and arranges the settlement credit and debit to the respective bank accounts.

Use cases of IMPS by different users

Use cases of IMPS by retail customers:

- Transfer of funds to remote locations where banking services are not readily available.

- For remittance of funds by the people living abroad to India.

- For secure payment of purchases of high amounts.

- Instant payment at retail shops.

Use cases of IMPS by Corporates:

- Corporates like NBFCs and other lending institutions use IMPS to verify and validate borrowers as it helps them to validate the bank accounts of the loan applicant.

- Corporates use IMPS to disburse the bulk salary of employees across the nation.

Essential factors need to be considered while using the IMPS service

- One must have access to the mobile banking service provided by the bank, and the application of the bank's mobile banking or the PPI should be on the phone as well.

- One must carry out IMPS transactions very carefully as the errors while the payment is irreversible.

- One must have stable internet connections to undertake transactions through IMPS successfully.

- Users of IMPS service must not share their MPIN, OTP, and other login credentials related to their bank accounts with anyone to be safe from any fraudulent transaction from their bank accounts.

IMPS Transactions Limits

- Minimum limit- There is no minimum limit for transferring funds through IMPS; even one can send Rs. 1 to another bank account.

- Maximum limit- The maximum limit for the transfer of funds via IMPS is set by the respective bank of the beneficiary. HDFC bank has set the maximum transaction limit through IMPS as Rs. 5 Lakh. In contrast, Axis bank has a maximum limit of Rs. 2 lakhs.

IMPS charges by the Banks

The amount charged by the banks for IMPS transactions are of two types:

- Transaction charges- This amount is charged on every transaction and set by the banks, generally between Rs.2.5 to Rs.15.

- GST charges- It is the GST applicable on IMPS transactions, which varies as per the applicable rates on IMPS.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now