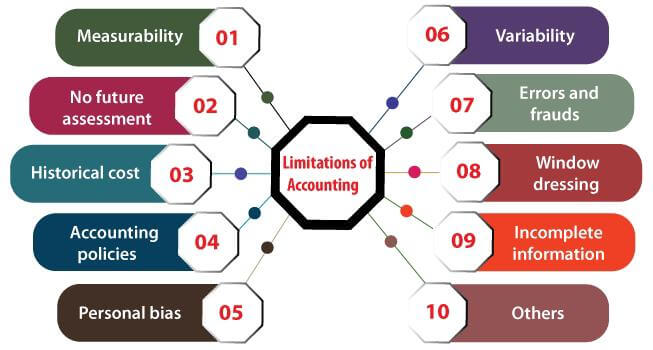

Limitations of AccountingNothing can be perfect in this world and the same statement applies to accounting also. There are some misconceptions formed about the accounting like the fact that P&L A/c presents the true picture of profit and loss taking place in the business, or that a balance sheet perfectly shows the financial position of a company.

Whereas accounting is not yet a perfect science, art, or profession. It has so many limitations which reduce its effectiveness in the business world. These limitations are as follows: 1. MeasurabilityIt is among the biggest limitations of accounting. In accountancy, one cannot measure the value of non-monetary terms, things, or events. In other words, if certain factors cannot be expressed in terms of money then they cannot be included in accounting no matter how important it is for the company. Some important but non-monetary qualities are management, loyalty, reputation, hard work, employees' and customers' satisfaction, the firm's ability to develop new products, cordial management-labor relationship, etc. are not mentioned in the company's balance sheet or income statement. Hence, accounting focuses on the quantities only not on the qualities. 2. No Future AssessmentFinancial statements are the presentation of the company's financial position as of the date of preparation. The users of these statements are more interested in getting information about the company's future performance in the short and long run. However, it is not possible with accounting to make any such estimates. As we know, how dynamic the business environment is. It can change very quickly due to changes in demand for the product, technology, customers' tastes and preferences, competitors' position, policies adopted by the firm, market inflation or depression, etc. Auditors sometimes rectify the limitations of accounting by disclosing the important events or changes that occur after the balance sheet date. 3. Historical CostsThe value in accounting is often measured by using the historical data or costs which ignores the current factors or market conditions such as inflation, price changes, demand and supply effect, etc. Because of this the accounting records and information get skew the relevance and reduce the originality and reliability of the accounting data. 4. Accounting PoliciesAccounting policies do not work on a global standard. For example, in India, accounting standards are used, in USA GAAP and some international standards named IFRS are used, and so in other countries. So if a company is operating its business in more than one country then it can be confusing to apply a particular standard and even if the company does not choose a single standard then the results can fluctuate. This is because all accounting policies do not follow the same line of thinking which may cause conflicts. 5. Influenced by Personal JudgmentsAn accountant can't determine the exact amount of an asset. That's sometimes estimation is required in accounting also. But the problem is that these estimations are based on the personal judgment of the accountant and also these are very subjective. In short, these estimates are a person's guess for future events. Such estimates are made for the work related to the provision of doubtful debt, methods of depreciation, etc. 6. VerifiabilityThere is no guarantee of the correctness of the financial statements even after having an audit of them. The auditor can only assure that the statements are free from error as per his knowledge and skills. 7. Errors and FraudsAccounting is completed by human beings so there is always a possibility of having errors in it. Sometimes, there is also a scope of manipulation of accounts to hide fraud. Since fraud is a deliberate activity, it is very difficult to spot it. It is one of the most dreaded limitations of the accounting system. 8. Affected by Window DressingThe practice of manipulating the accounts to disclose the company in a more favorable position than the actual position by the means of its financial statements is known as window dressing. For example, a company may not record the purchases made at the end of the year or the closing stock may be overvalued. Hence, the true position of the company can't be concluded on the basis of such financial statements. 9. Incomplete InformationAnother limitation is that the accounting statements provide incomplete information regarding the profit and loss of a business because logically, the actual profit and loss of a business can only be calculated after the closed down of it. 10. OthersSome other drawbacks or limitations of accounting are as under:

Next TopicDigital Economy

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share