Understanding Liquidity and How to Measure ItWhat exactly is Liquidity?Liquidity is simply the rate at which how fast an asset or security can be sold into ready cash without altering its overall market price. An investment can be sold more quickly (and vice versa) if it is more liquid, and selling it for fair or current market value is simpler.

In general, more liquid assets trade at a premium, and less liquid assets sell at a discount; when everything else is equal. In-Depth Understanding of LiquidityPutting simply, liquidity is the ease with which an asset may be purchased or sold on the market at a price representing its underlying value. In particular, because of the ease with which it can be converted into other assets, cash is considered the most liquid asset. Illiquid physical assets include real estate, fine art, and collectibles. Various financial assets, from shares to partnership units, lie at multiple positions along the liquidity spectrum. Now, take an example of an individual who wishes to buy a double-door refrigerator worth ?20000. In such instances, cash is the asset that is most easily obtained. However, for some reason, suppose the person has no cash but a rare book collection worth ?20000. In such a situation, it's doubtful that the person will be able to find someone ready to exchange the refrigerator for his collection of books. Instead, the person will most likely have to sell the collection and use the proceeds to purchase the refrigerator. This is acceptable if a person has months or years to wait before making a purchase, but it can be a problem if the person only has a few days to finalize a purchase. Instead of waiting to make a purchase, he may have to offer the books at a discount and then add some extra money to make the full payment. Thus, one example of an illiquid asset is rare books. Market LiquidityIt is the degree to which an asset may be bought and sold at predictable, open prices, such as in a stock exchange or a real estate market. In contrast, there is no demand for refrigerators in exchange for rare books in the example above. On the other hand, the stock market has a high level of liquidity. Assume an exchange has a significant amount of transactions that are not dominated by selling. The price offered by a potential buyer per share and the price a seller is willing to take will be close. Investors would no longer have to give up unrealized profits to sell fast. As the spread between the bid and ask prices narrows, the market becomes more liquid; when it widens, the market becomes illiquid. Real estate markets can be far less liquid than stock markets at times. The liquidity of other asset markets, like derivatives, contracts, currencies, or commodities, is sometimes described by their size and the number of open exchanges on which they may be traded. Accounting LiquidityIt simply establishes how fast someone or an organization can fulfill their financial commitments using the liquid assets at their disposal, as well as their capacity to pay off debts when they become due. Considering the same example, the rare book collector's assets were illiquid. In a pinch, they would most likely not be worth the full ?20000. Accounting liquidity is determined through a comparison of current obligations or financial commitments due within a year to liquid assets. Various accounting liquidity indicators differ in their definition of "liquid assets". These are used by analysts and investors to identify firms with strong liquidity, which is also used to measure the depth, value, or worth of the respective firms. What are the ways to measure Liquidity?

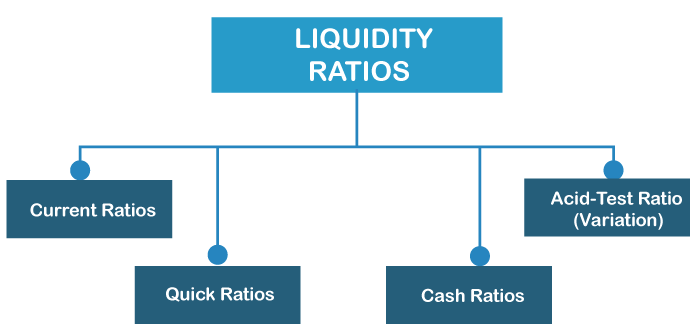

Financial analysts assess a company's capacity to employ liquid assets to meet short-term obligations. When doing these numerical calculations, a ratio greater than one is often considered good. Here are some ways to measure liquidity: 1. Current RatioIt is the most basic and least restrictive. It compares current assets against current liabilities. Therefore, the formula would be:

Current Ratio = Current Assets / Current Liabilities

2. Quick Ratio (Acid-test Ratio)This is a little stricter. Because inventory and other current assets are less liquid than cash and cash equivalents, accounts receivable, and short-term investments, they are excluded. The formula is as follows:

Quick Ratio = (Cash and Cash Equivalents + Short-Term Investments + Accounts Receivable) / Current Liabilities

3. Cash RatioIt is the most stringent of the liquidity ratios. Liquid assets are defined as cash or cash equivalents excluding accounts receivable, inventories, and other current assets. The cash ratio, more than the current or acid-test ratio, assesses an entity's capacity to remain solvent in the worst-case scenario. Even tremendously lucrative companies may encounter difficulties if they lack the liquidity to respond to unanticipated situations. It can be determined using the following formula:

Cash Ratio = Cash and Cash Equivalents / Current Liabilities

4. Acid-Test Ratio (Variation)It basically deducts inventory from existing assets to make it more flexible. The formula is as follows:

Acid-Test Ratio (Variation) = (Current Assets - Inventories - Prepaid Costs) / Current Liabilities

What are the most liquid markets?Cash is the most liquid among all of the assets because it can be readily converted into other assets. Meanwhile, markets dealing in physical assets, such as real estate and fine art, are less liquid since the sale process is considerably lengthier. These are a few more of the most liquid markets:

Liquidity ExampleWhen it comes to investment, stocks are among the most liquid assets. Yet, not all shares are measured equally in terms of liquidity. Certain equities move more actively on stock exchanges than others, indicating that they have a larger market. In other words, they continue to pique the curiosity of traders and investors. The daily volume of these liquid stocks, which may be in the millions, if not hundreds of millions, of shares, is routinely acknowledged. Amazon.com (AMZN) traded 8.4 million shares on the NASDAQ on April 26, 2019. While this appears to be adequate liquidity, it is significantly less than that of Intel (INTC), which led the NASDAQ on that day with 72 million shares, or Ford Motor (F), which led the New York Stock Exchange (NYSE) on that day with 156 million shares, making it the most liquid stock in the United States same year. Why is Liquidity Important?When markets are liquid, selling or converting assets or securities into cash is simpler. For example, one may own an extremely rare and expensive family heirloom valued at $2,000,000. The thing, however, has no market, which translates into no buyers. In such a situation, it is meaningless since no one will pay anything near its rated value-it is illiquid. It may even be required to pay an auction house to act as a broker and discover potential purchasers, which will need time and money accordingly. On the other hand, liquid assets may be readily and swiftly sold for their full worth and at a low cost. Businesses must also have adequate liquid assets to satisfy short-term commitments such as bills or payments. Otherwise, they will suffer a liquidity crisis, which might lead to bankruptcy. What causes some stocks to be more liquid than others?The most liquid stocks get a lot of attention from market players and gather a lot of daily transactions. Such equities will also attract more market makers, resulting in a more balanced market. Illiquid stocks have wider bid-ask spreads and less market depth. These are less well-known brands with lower trading volume, as well as lower market value and volatility. As a result, the stock of a big multinational bank is more liquid than that of a small regional bank. What are some examples of Illiquid Assets or Securities?Over-the-counter (OTC) securities, like some complex derivatives, are typically illiquid. A house, a timeshare, or a car are all illiquid assets. It may take many weeks to months to locate a potential buyer and even much longer to execute the deal and get money. Also, broker fees are typically rather high (e.g., 5-7% on average for a realtor). The Bottom LineFinancial markets require sufficient market liquidity to guarantee that traders may exchange assets and investment instruments efficiently. High liquidity simplifies starting and exiting positions rapidly, resulting in a narrower bid-ask spread. These favorable market conditions simply increase the number of active market participants, enhancing liquidity. Buying and selling items become difficult when a market is not liquid. One might have to wait long for a counterparty or abandon the transaction entirely. Buyers and sellers must agree on a price in an illiquid market, resulting in wider bid-ask gaps and higher execution costs.

Next TopicUnderstanding the Cash Flow Statement

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share