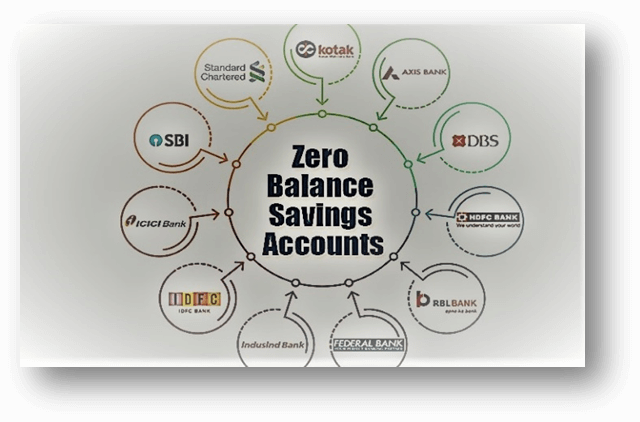

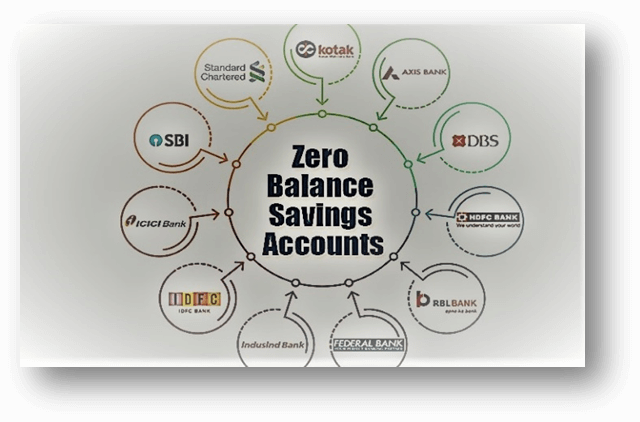

List of Banks with Zero Balance Account

Money is very important for everyone. Everyone wants that their money should be kept in a safe place and they should be able to use their money when needed. In modern times everyone can keep their money safe in the bank and can use their money whenever they want and to deposit money in the bank, we need to open a savings account in the bank.

There are many types of savings accounts, out of which, we have described Zero Balance Saving Account. Let us see how many banks provide us with the facility to open Zero Balance Saving Account.

Drawback of Normal Saving Account

If you want to open a savings account in any bank or if you already have a savings account in any bank then you must know that you need a minimum balance to open a savings account in any bank. Each bank has its fixed minimum balance. A minimum balance is the minimum amount of money that account holders must maintain in their savings account, as determined by the bank.

So if you want to open a savings account, you have to keep a minimum amount in your savings account. If you do not do this then you will have to pay a fine to the bank. So, you cannot withdraw that minimum amount unless you want to close your account.

Need for a Zero Balance Bank Account?

We saw in the above paragraph that if we want to open a normal savings account, we need to deposit a minimum amount of money, this creates a lot of problems such as;

- You have to maintain that minimum required amount in your savings account as long as you have an account in the bank.

- Many poor people do not have enough money to deposit the minimum required amount.

- Sometimes in case of emergency, we need to withdraw all the money that we have in our savings account. If we do so we have to pay extra charges to the bank.

What is a Zero Balance Savings Account?

A zero balance saving account is the type of saving account in which we do not have to deposit any amount of money as a minimum required balance. In other words, we can say that many banks provide us with a facility in which we do not have to deposit money in our savings account as a minimum balance. And, we do not have to pay any extra charges to withdraw all the money from our bank account.

The benefits of a Zero Balance Account

- Poor people who were not able to open their bank account due to the problem of maintaining a minimum balance in the bank can now easily open their account in the bank.

- We all know that maintaining a minimum balance is a very difficult task and in a zero balance savings account, we do not have to think more about maintaining an amount as a minimum balance.

- If you withdraw all the money from your savings account in an emergency, you will not have to pay any extra charge to the bank.

List of Banks with Zero Balance Savings Account

Many banks in India provide us with the facility to open zero balance savings account. Some of them are described below;

1. State Bank of India

If we talk about the popular bank in India, the name of State Bank of India comes first. State Bank of India provides us with the facility to open zero balance savings account with the following features and benefits;

- Basic Savings Bank Deposit Account is the name of a zero balance savings account.

- You can easily open a zero-balance savings account in SBI if you have all the basic documents.

- You are allowed to keep as much money as you want in your savings account because there is no limit.

- SBI also gives you an interest of 2.70% per annum for the money you deposit into your account.

- The bank will provide you with a free debit card and also provide you with a chequebook for free for the first time.

- You can withdrawals money from SBI ATMs and also from other banks' ATMs but from other banks' ATMs you are allowed to withdraw money without any extra charge only four times.

- There is also a nomination facility for the account holder.

- It also provides benefits like mobile banking, internet banking and many more.

2. HDFC Bank

Housing Development Finance Corporation Limited Bank is the most famous private bank in India. HDFC also provides us with the facility to open zero balance savings account with the following benefits;

- You can easily open a zero-balance savings account in HDFC if you have all the basic documents.

- You are allowed to keep as much money as you want in your savings account because there is no limit.

- HDFC also gives you interest of 3.00% to 3.50% per annum for the money you deposit into your savings account.

- The bank will provide you with a free debit card and also provide you with a free chequebook of 25 leaves for every financial year.

- You can also withdraw money from ATMs but you are allowed to withdraw money only four times a month without paying any extra charges.

- You also got a free replacement of your damaged debit card.

3. RBL Bank

Ratnakar Bank Limited is also one of the most famous private banks in India. RBL Bank also provides the facility to open zero balance savings account with the below benefits;

- You can easily open a zero-balance savings account in RBL Bank if you have all the documents required by the bank.

- You are allowed to keep as much money as you want in your savings account because there is no limit.

- RBL Bank gives you interest of 4.50% - 6.25% per annum for the money you deposit into your savings accounts and this is one of the highest interests provided by any bank in a zero-balance savings account.

- The bank will provide you with a free debit card and you are allowed to withdraw 50,000 rupees from ATMs in a single day. It also provides you with two free cheque books of 40 leaves per annum.

- It also provides the facility of mobile banking, internet banking and more.

4. Punjab National Bank

Punjab National Bank or PNB is also a government bank that provides us with the facility to open a zero balance savings account with the following benefits.

- You can easily open a zero-balance savings account in PNB if you have all the basic documents asked by the bank.

- In PNB if your age is more than 10 years, you are allowed to open a zero-balance savings account.

- You are allowed to keep as much money as you want in your savings account because there is no limit.

- Punjab National Bank gives you interest of 3.00% per annum for the money you deposit into your savings accounts.

- The bank will provide you with a free debit card and a free cheque book of 10 leaves for the first time.

- The facility of mobile banking, Internet Banking and withdrawal from ATMs, and more.

5. YES BANK

YES Bank also provides us with the facility to open a zero balance savings account. The benefits are listed below;

- You can easily open a zero-balance savings account in YES bank if you have all the documents asked by the bank.

- You are allowed to keep as much money as you want in your savings account because there is no limit.

- YES bank gives you interest of 4.00% - 5.50% per annum for the money available in your account.

- The bank will provide you with a free debit card and you are allowed to withdraw 30,000 rupees from ATMs in a single day.

- Apart from the basic facilities, the bank also provides us with features like mobile banking, Internet Banking and more.

Government Schemes to promote a Zero-balance Bank Account

Not only the government bank and private bank but also our government understands that even in modern times there are many people who do not have any savings account in any bank. One of the major reasons for this is that many people whether from an urban area or rural area do not want to maintain a minimum amount in their bank accounts forever.

So, to overcome these hurdles, our government started a scheme in 2014, which is named Pradhan Mantri Jan Dhan Yojana under this scheme any person from a rural area or urban area can open a zero balance savings account in any bank.

Features of this scheme

- You are not required to have many documents to open an account under this scheme.

- Every bank has to open zero balance savings account under this scheme.

- Under this scheme bank will provide you with a free debit card and a free cheque book.

- Apart from the basic facilities, the banks also provide features like mobile banking, internet banking, etc., under this scheme.

List of other banks who also offer zero balance savings account

Apart from the above-mentioned banks, there are also so many banks in India that provide us with the facility to open zero balance savings account. Features and interest rates may differ from one another but you are free to keep zero balance in your savings account without paying any fine to the bank.

| 01 |

Industrial Credit and Investment Corporation of India (ICICI Bank) |

| 02 |

Industrial Development Bank of India (IDBI Bank) |

| 03 |

Standard Chartered Bank |

| 04 |

Kotak Mahindra Bank (Kotak 811) |

| 05 |

Bank of Baroda |

| 06 |

IndusInd Bank |

| 07 |

AXIS Bank |

| 08 |

Development Bank of Singapore Limited (DBS Bank) |

| 09 |

Infrastructure Development Finance Company (IDFC Bank) |

Conclusion

A zero-balance savings account is more beneficial for many people. Not only in the government's banks but also in most of the private banks the facility of zero balance savings account is available. Even the government of India also launched several schemes under which anyone can open zero-balance savings account in the banks.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now