Machine Learning in FinanceMachine learning is one of the most popular technologies in this digital era. It is a subfield of artificial intelligence that allows machines to learn and predict accurately without being much human intervention. It is being used almost everywhere, such in sectors including finance, marketing, trading, healthcare, banking, infrastructure, education, etc. Every industry wants to move its business with machine learning and associated technology.

Due to the popularity of machine learning across the world, all organizations are adopting this technology. Similar to other industries, the finance sector also has seen exponential growth in the use cases of machine learning applications to get better outcomes for both consumers and businesses. In this topic, "Machine Learning in Finance", we will discuss various important concepts related to the finance industry using machine learning algorithms, benefits of ML in finance, use cases of ML in finance, etc. Before starting this topic, firstly, we will understand the basic introduction to machine learning and its relation to the finance sector. What is Machine Learning?Machine Learning is a subset of artificial intelligence (AI) that allows computer software or algorithms to learn and predict accurately for the future. It enables machines to learn from past experience or old data, and based on that; it predicts outcomes. Types of Machine LearningBased on various learning methods, machine learning is primarily categorized into 4 types. These are as follows:

Machine Learning in Finance IndustryIn recent few years, the use of machine learning in the finance sector has exponentially increased, and it is considered the key factor in various financial services and applications such as credit score calculation, personal loans, mortgage, risk categorization of the customer, etc. Initially, machine learning was adopted by very few financial service providers, but in recent past years, the use of machine learning and its application has been seen in several areas of the finance industry like banks, fintech, banking regulators, insurance sectors, trading, etc. Further, with the rise in big data, machine learning in finance has become more prominent; hence leading banks and other financial services are deploying ML technologies to optimize portfolios, streamline their business, and manage financial assets across the globe. Why Machine Learning in Finance?Machine Learning is the technology that helps machines to be automated so that they can learn and predict accurately. Also, with the integration of big data, it is being used to handle large and complex volumes of data in the finance industry. In the finance sector, machine learning algorithms are used to detect fraud, money laundering activities, trading activities, and various financial advisory services to investors. It can analyze millions of data sets within a short time to improve the outcomes without being explicitly programmed. Below are a few reasons to use Machine Learning in the finance industry:

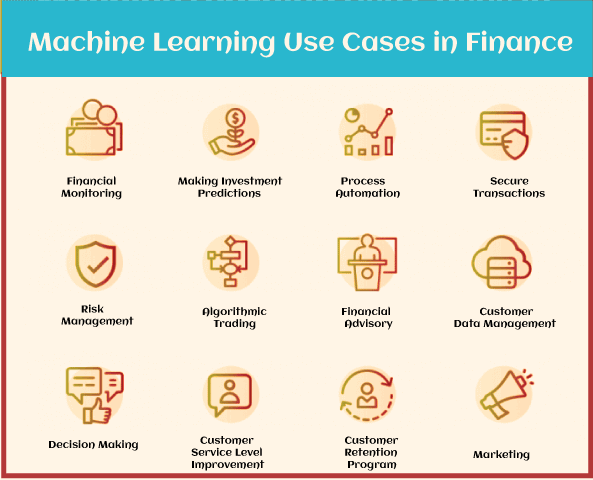

Use cases of Machine Learning in FinanceMachine Learning is being used in the finance industry to make businesses automated and more secure.

Here are a few important use cases where ML algorithms are being used in the finance industry as follows:

1. Financial monitoringFinancial monitoring is a monitoring process by which financial analyst prevents money laundering, enhance network security, detect flags, etc. hence, machine learning helps the analyst to provide improved financial monitoring services to clients. 2. Process automationMachine Learning has replaced most of the manual work in fiancé sectors by automating repetitive tasks through intelligent process automation for enhanced business productivity. Further, with automation, organizations have achieved improved customer service experience at a reduced cost. Chatbots, auto-fill forms, employee training gamification, etc., are a few popular examples of process automation in the finance sector. 3. Secure transactionSince all banking and finance activities are mostly happening with digital payment systems, hence the chances of transactional fraud also increased in a few years. Machine learning has reduced the risk of transactional fraud as well as a number of false rejections. 4. Risk ManagementFinancial Sector is one of the most sensitive industries that may involve lots of risky situations if not managed in a perfect manner. Financial Sector is about lots of cash or credit transactions between different institutions or banks and their customers. Due to this reason, there are various chances of being mishandled. However, to reduce such risky situations, machine learning provides security to institutions by analyzing the huge volume of data sources. To achieve this, the ML system goes through different levels and also analyzes the personal information of users to reduce the chances of risks. We can understand ML in financial risk with an example of a lending loan. The lending loan to an individual or an organization firstly goes through a machine learning process, where the system analyzes the user's or organization's previous data and personal information, which could prevent the fraudulent borrowers from lending the loan. 5. Algorithmic TradingAlgorithmic trading is one of the best use cases of Machine Learning in the Finance sector. In fact, Algorithmic Trading (AT) has become a dominant force in the global financial markets. Machine learning allows the trading companies to make decisions after analyzing the trade results and closely monitoring the funds and news in real-time. With real-time monitoring, it can detect patterns of the stock market going up or down. Some of the other advantages of algorithm trading involve:

6. Financial regulators and advisoryMachine Learning also provides various ML-powered apps to their customers in the financial sector, which can help customers by offering the benefits of advice and guidance. ML algorithms used in these apps enable the customers to keep an eye on their daily spending on the app and also allow them to analyze this data in finding their spending patterns and areas where they can save their money. One of the great examples of such ML apps is Robo-advisor, one of the rapidly growing apps in this sector. These advisors work as regular advisors, and they specifically focus on the target investors with limited resources who want to efficiently manage their funds. These ML-based Robo-advisors use traditional data processing techniques for building financial portfolios and solutions, for example, trading, investments, retirement plans, etc., for their users. 7. Customer data managementFor each bank and financial institution, data is one of the most crucial resources. Efficient data management helps a business to be successful and achieve growth. But nowadays, financial data has become very vast due to its different sources, such as social media activities, transactional details, mobile transactions, and market data. Hence it has become very difficult for financial specialists to manage such a huge amount of data manually. To solve this issue, different machine learning techniques can be integrated with finance systems which can manage such large volumes of data and can offer the benefit of extracting real intelligence from data. Different AI and ML tools, such as NLP (Natural language processing), data mining, etc., can help to get insights from data that make the business more profitable. 8. Decision making and investment predictionBanking and financial institutions can analyze both structured and unstructured data with the help of ML algorithms. Data involves customer requests, social media interactions, different business processes internal to the company, etc. This data analysis help to discover trends for assessing risk and helps customers to make informed decisions accurately. 9. Customer Service ImprovementNowadays, intelligent chatbots are widely being used in almost every sector as they enhance customer service and give benefits to their companies. In the finance sector, with the help of these chatbots, customers can instantly get answers to most of their queries, including finding their monthly expenses, loan eligibility, customer-specific insurance plan, and many more. Moreover, there are various ML-based applications related to a payment system, which can analyze customers' accounts and let them know the ways to save and grow their money. Various ML algorithms help the companies in analyzing the customer's transaction behavior and can generate customized offers for specific customers. We can understand it with an example, suppose a customer is planning to make an investment in some financial plan; then, with the help of ML algorithms, companies can offer him a personalized investment offer after analyzing his existing financial situation. 10. Customer Retention ProgramCustomer retention programs are applied by most companies to prevent switching their customers to other competitors. In this case, also ML has various applications. For example, Credit card companies use ML systems to predict at-risk customers and specifically retain selected ones out of these. On the basis of users' transaction activities and past behaviors, they can easily design specific offers for these customers. The binary classification model is used that determines the customers at risk, which then follows a recommender. 11. MarketingAs AI and Machine Learning models make better predictions on the basis of past/historical data, which makes them the best tools for marketing. These ML tools use different algorithms which can help finance companies for creating a robust marketing strategy by analyzing the mobile app usage, web activity, responses to the previous ad campaign, etc. ConclusionIn this topic, we have seen how machine learning is currently being used and benefiting the Finance industry. The value of ML applications in finance is increasing day by day. However, the real long-term value will probably appear in next coming years. Because of lots of applications of ML tools in the finance sector, various banks, and financial institutions are investing billions in this technology. With these investments, companies are getting various benefits, including reduced operational costs, increased revenue, enhanced customer experiences, and many more.

Next TopicLead Generation using Machine Learning

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share