What is the Full Form of MICR?MICR: Magnetic Ink Character RecognitionThe full form of MICR is Magnetic Ink Character Recognition. MICR is a technology that was invented to identify the authenticity and individuality of a document using special ink and characters. The MICR is a convenient and human-friendly pattern recognition system. MICR readers can directly scan and read the information into a data collection device. Hence, the use of MICR technology ensured a more well-organized way of document processing.

Discovery of MICRBefore the invention of the MICR code, the clearance of cheques and documents consumed a lot of time due to its manual processing. Moreover, because of the processing difficulty, the pending number of cheques was increasing day by day. To avoid such a situation, so that documents can't be forged easily, the MICR was discovered. Origin of the MICRBy the Mid 1950s, the General Electric Computer Laboratory, altogether with the Standard Research Institute, brought the first-ever MICR automized system to process cheques with the E- 13B font system. In 1957, in France, The CMC-7 font was created by the Groupe Bull, which was later adopted by many European countries.This attempt was very much effective in reducing the manual effort and subtract the chances of any error. Representation of MICR CodeGenerally, the banking industry uses the MICR technology to identify the originality of the documents and disburden the processing and clearance of the cheques and documents. The MICR code is printed on the bottom of cheques and contains the following:

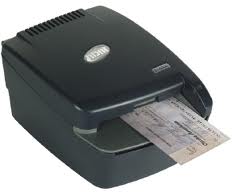

Working of MICRMICR works on two fonts: MICR font- This is used to read documents and is printed with the magnetic ink prepared by iron oxide.

Any one of these fonts is printed on documents that require evidence of authentication magnetic ink or toner are used in the printing of fonts. The magnetic ink or toner is concretely prepared with iron oxide so that reader can capture it speedily. The documents are made with the formation of waveforms, the MICR reader perceives the characters. Even if the printing has been spoiled or overprinted, the magnetic scanning technology still assures the systematic reading of the document. Characteristics of MICR cheques/ documents

Features of MICRFollowing are the main features of the MICR Code:

Roles of MICR Code in the banking systemIn the real world banking system, we can find the applications of MICR code in the following places:

Next TopicFull Forms List

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share