Organization DefinitionOrganizations are any entity formed to achieve a specific objective or purpose. This may include governments, businesses, charities, political parties, interest groups, sports clubs, etc. They are a fundamental part of modern life and can take many forms.

Organizations reach across the public, private, and not-for-profit sectors and can vary in size from small initiatives to complex multinational networks. Organizations are characterized by using resources-people, goods, services, and capital-to achieve their objectives. They can build strategy, create trust, distribute goods and services, and be powerful vehicles for societal progress. OverviewThe organization coordinates people and resources to accomplish a goal. It involves dividing labor into specific tasks, coordinating activities by an individual or group, and allocating resources to achieve specified objectives. Public and private sector organizations have different sizes, structures, and goals. The four main elements of the organization are purpose, structure, culture, and technology. To be a successful organisation, all four factors must be considered. The purpose of an organisation defines its objectives and the foresight it strives to achieve. Structure determines how resources are allocated and how tasks are delegated. Culture outlines the values, behaviors, and beliefs of the organization. Technology includes the systems, procedures, and processes that run an organization. 1. DefinitionAccording to Spriegel, "in its broadest sense, organisation means the connection between different factors that make up an endeavour." Factory organisation is primarily concerned with internal connections within the factory, such as personnel responsibilities, machine arrangement and grouping, and material control. From the point of view of the organisation as a whole, entity is the structural connection between all the factors in the enterprise." He provided a broad definition of the organisation. He defined it as the interaction of people and factors in the business. All production factors are integrated in achieving organisational goals. 2. Types of organization1. Sole Proprietorship What exactly is a sole proprietorship? A sole proprietorship, also known as a sole trader or a proprietorship, is an unincorporated business with one owner who reimburses personal income tax on business profits. Many sole proprietors conduct business under their own names because registering a separate business or trade name is unnecessary. Due to a lack of government regulation, a sole proprietorship is the simplest type of business to establish or disband. As a result, these types of businesses are very popular among sole proprietors, individual self-contractors, and consultants. Most small businesses begin as sole proprietorships and either remain that way or grow and transition to a limited liability entity or corporation.

Advantages of a Sole Proprietorship

The benefits of being a sole proprietor are numerous, especially if your business is small. One of the initial and most obvious benefits of this registered business type is that you won't must to fill out a lot of paperwork. To clarify, other business types, such as private limited corporations, necessitate registration with your state legislature before you can conduct business. In contrast, sole proprietorships generally do not require registration with the government; instead, users become a commercial business simply by doing business. However, depending on your municipality's or state government's requirements, you may be required to obtain a commercial license or permit. Nonetheless, among the initial advantages of a sole proprietorship is the fact it enables you to scale up your company much faster with fewer government paperwork.

Another significant advantage of a sole proprietorship is that the tax requirements are much simpler and straightforward, especially when compared to other entity types. To begin, unlike other business structures, sole proprietors aren't really required to file for an employer code, or EIN, with the IRS. With an EIN, the above businesses can retrieve and pay employees separately from the filer's SS number, but as a self - employed person, you can use your Social Security quantity just like any other transfer of funds that requires it.However, you have the choice of applying for and utilize an EIN when you so desire.

When you first start and run a business, your funding may be limited. As a result, one of the most important benefits of being a sole proprietor is the capacity to save money on registration fees. As previously stated, laws mandate LLCs and other corporate entities to become registered before conducting business. Most states additionally ask LLCs to pay an annual fee to sustain their registration, which can quickly add up. Because sole proprietorships are free of these ongoing legal requirements, you will save money (as well as time and hassle) when compared to other corporate structures.

While you can conceivably operate a Limited company without a business paypal account, doing so nullifies many of the finance benefits that come with possessing an LLC in the initial place. You can create and accept analysis of the financial from your personal bank accounts as a sole proprietorship. You don't need to undergo the process of opening a business checking account, though you can if you want to separate your business and personal finances in this way.

To be sure, sole proprietorships render it simple to start a business. However, they also facilitate the ability to run a business. You don't have to worry about some of the additional components of a Limited partnership or company, such as company directors or registered agents, if you have a sole proprietorship. You have complete control over your company's decisions, finances, and everything else. Having said that, you don't have to stress about boards, officers, or any of the other roles usually required by other corporate structures, which means you can focus on your everyday activities and lengthy targets without needing to involve other stockholders or deal with handling employees to keep your company running. 2. Partnership A collaboration is a formal agreement between more than one party to manage and continue operating a business as well as share profits. There are various types of partnerships. In particular, all partners in a partnership firm share debts and profits equally, whereas partners in other businesses may have liability. There is also "silent partner," wherein one party also isn't involved with the everyday operations of the company.

There are several benefits and drawbacks to managing a company as a partnership organisation. One advantage is that there is usually a bigger pool of available capital, and the burden of the business is shared among some of the partners. Furthermore, the partners' collaborative efforts can frequently result in improved performance and outcomes. Furthermore, profits can be put back into the company without being taxed. A partnership organisation, unlike a sole proprietorship, is taken into account a independent distinct and distinct legal entity. The partners are jointly and severally liable for the business's debts and obligations. The partners also have complete authority over the company's operations. Several important factors must be considered when establishing a partnership organisation. These include establishing a formal system of laws, consenting on a plan for spreading the gains and losses, forming judgement processes, and agreeing on each partner's legal obligations. It is also recommended that a memorandum of understanding be drafted to clarify each party's rights and responsibilities. Because of the complexity of a partnership organisation. It is often best to consult with a fiscal or legal advisor before pledging to this sort of company structure. It is also worth noting that, when applicable, taxes and , supplemental regs taxes may be imposed. By forming a partnership, the partners can benefit from each other's labour, time, and expertise. Furthermore, a wise partner can provide supplementary viewpoints and perspectives that will help the business grow. Partnership Types A partnership could be defined broadly as any individual's performance jointly by various parties. Parties can be governments, non-profit organisations, enterprises, or private individuals. A partnership's objectives can also differ greatly. There are three types of partnerships in the specific sense of a profitable venture initiated by two or more individuals: general partnerships, limited partnerships, and limited liability partnerships. 3. Limited Liability Company (LLC) In the United States, a limited partnership is a corporate structure that shields its holders from personal liability for its liabilities and debts. Limited liability companies (LLCs) are blended entities that combine the features of a corporation along with those of a sole proprietorship or a partnership. Whereas the limited liability function is equivalent to that of a corporate entity, flow-through taxation is a feature of a collaboration rather than an LLC.

A limited liability company, or LLC, is a business structure that combines the advantages of operating as a corporation while application's user to manage the company more fluidly than traditional corporations. This implies that, unlike in a sole partnership or sole proprietorship, the company owners are not legally responsible for the company's debts or other obligations. As a result, entrepreneurs may be able to limit the amount of money and individual accountability they must bear when running a business. An LLC is a legal business entity that can provide its owners with limited liability protection. This means that, unlike in a sole proprietorship or partnership, the company owners are not legally responsible for the company's debts or other obligations. As a result, owners may be able to limit the amount of money and individual responsibility they must expose to danger when running a business. LLC's advantages include:

Furthermore, there are no limits to the amount of members permitted in an LLC to satisfy large groups of entrepreneurs. LLC is a corporate entity that shields its owners from personal liability for the company's liabilities and debts. The government oversight of LLCs varies by state. An LLC can be formed by any entity or individual, with the rare examples of insurance companies and financial institutions. Profits earned by LLCs are not taxed directly. Earnings and losses are distributed to representatives, who review them on their personal tax returns. LLCs have the option of not paying federal taxes directly. Rather than, their earnings and expenses are revealed on the owners' personal tax returns. The LLC may elect to be classified as another type of entity, like a corporation. If a company commits fraud or violates its legal as well as reporting obligations, borrowers may indeed be able to pursue the members. Establishing an LLC Even though requirements for LLCs differ from state to state, there are some general similarities. The first step for owners or members is to select a name. The organization's articles of incorporation can then be demonstrated and registered with the state. These articles define each LLC member's rights, powers, responsibilities, liabilities, and other responsibilities. The documents also include the addresses and names of the LLC's representatives, the title of the LLC's registrant, and the statement of purpose of the business. The articles of incorporation are filed with the state, along with a fee. To obtain an identification number for your company, additional paperwork and fees must be submitted to the federal government. The primary reason that business owners choose to register their companies as LLCs is to restrict their personal liability as well as that of their collaborators or investors. Many people think of an LLC as a cross between an alliance, which is a simple contractual arrangement between multiple owners, and a corporate entity, which has specific liability provisions. Although LLCs get some appealing characteristics, they have a number of drawbacks. An LLC may be required to dissolve upon the passing or financial ruin of a member, depending on state law. A corporate entity can exist indefinitely. 4. Corporation A corporation is an organization or group of people or an association authorized to act as a single entity, usually recognized by law and created to operate a business venture and make a profit. A corporation can have one or multiple owners/shareholders, including private individuals, companies, and other organizations. Each of these owners contributes to the company's overall capital and has an interest in the company's profits.

A corporation is a business structure entirely separate from the people who own it (unlike a sole proprietorship or a partnership). This means the corporation's owners have limited liability: they cannot be held personally accountable for any debts, legal claims, or obligations the corporation incurs. This distinction is known as the "corporate veil," and it is one of the major benefits of a corporation. One of the most important decisions to be made when forming a corporation is the type of corporate structure chosen. The most common forms are the C corporation (or publicly-held corporation), the S corporation, and the Limited Liability Company (LLC). Each structure has different regulatory and tax implications, so it is important to research the best option for any business situation. Creating a corporation requires adherence to certain legal and registration processes. First, the owners must register the corporation with the state government, usually with the Secretary of State. This process normally requires filing articles of incorporation and paying a registration fee. The corporation must also designate a Board of Directors to oversee the business, establish company bylaws, corporate issue stock, and register with the IRS for tax purposes. Finally, the corporation must file corporate tax returns and meet with shareholders and the Board of Directors.

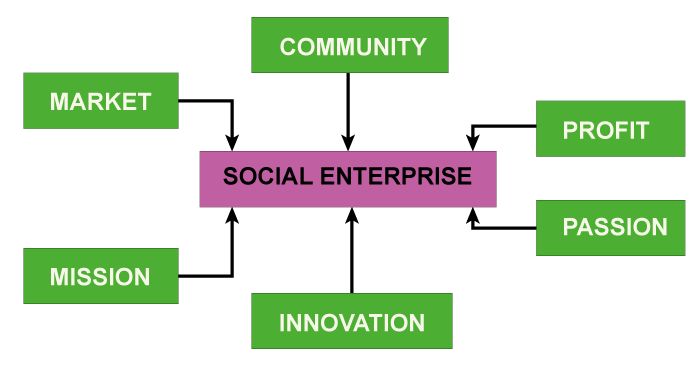

In short, corporations are one of the most common and efficient ways to organize and operate businesses. They offer several advantages, such as limited liability, simplified taxation, easy transfer of ownership, and more. However, it is important to understand all legal requirements associated with forming and operating a corporation before taking the plunge. 5. Social Enterprise Social enterprises tackle social and environmental problems by trading for a social purpose. These organizations aim to generate profits and reinvest those profits back into projects meant to benefit the communities in which the business operates.

Unlike traditional businesses, social enterprise organizations operate on a charitable and public service basis, working to improve the quality of people's lives rather than just making money. They are guided by social responsibility, use their profits to reinvest in the community, and create an impact on society and the environment. There are two main types of social enterprises: Non-profit, usually a charitable trust; and For-profit, usually a limited company, co-operative, or, increasingly, a social purpose business. Social enterprises can come in many forms, depending on the product or service they offer, who they target, and the culture within the organization. One example is a housing association. This type of social enterprise manages affordable housing, usually for vulnerable people, helping to reduce poverty and improve housing conditions. Another type of social enterprise is mutual. This kind of organization is owned and operated by its members. Profits are returned to members and volunteers or reinvested in the organization. Social enterprises are becoming increasingly popular in recent years as traditional businesses and organizations face economic, social, and environmental challenges. With their unique approach to business, society, and the environment, social enterprise organizations offer an alternative to the traditional money-making method. In addition to their social focus, these organizations often look at more sustainable business methods with better use of resources and money. Social enterprise organizations also promote public-private partnerships and offer better employment opportunities and improved livelihoods for their employees. Finally, social enterprise organizations also seek to create more inclusive and sustainable social business models that address inequalities and positively impact society and the environment. Social enterprises are becoming an important part of addressing the global challenges we face today by doing business on a social level and creating an impact. 6. Non-Profit Organisation A Non-Profit Organisation (NPO) is an organization whose primary objective is to benefit society and its members. Typically, NPOs are formed to serve some philanthropic, charitable, or religious purpose. Such organizations can be found in many sectors, and they often operate independently or alongside private companies and other governmental organizations.

Individuals, corporations, or governmental bodies can form NPOs. Generally, non-profit organizations are formed to benefit their local community, so many of their services are charitable. They may also provide education, healthcare, and affordable housing opportunities. Non-profit organisations, as charitable entities. This organisations have a huge influence in our society. Non-profit organisations can obtain funding from a variety of sources. Subscription and service fees are also used by some organisations to generate revenue. To ensure monetary sustainability and transparency, board members must make judgement calls about the organisation's culture, accosting efforts, and day-to-day operations. Non-profit groups must also adhere to local, state, and federal regulations. Non- profit organisations provide essential utilities that the government does not. NPOs have a wide range of structures and missions. There are, however, some critical elements for legal classification:

3. Benefits of OrganisationsTeam members can collaborate to create solutions when there are strictly delineated goals, objectives, roles, and channels of communication within an organisation.

Organizations are among the most effective means of increasing productivity and profit. Organizations are formed to achieve a specific goal, offering structure, resources, guidance, and accountability. Organizations also give employees a sense of belonging by allowing them to form and develop contact with others who do similar work, come from similar backgrounds, and have similar interests. This can include internet access, organisational resources, on-site learning, business skill development, and problem-solving seminars. Integrating an organization's structure may increase the stability of the team or business. A productive organisation structure can encourage open communication channels, task delegation, collaboration, and leadership, all of which can help the company's overall stability. Providing a secure place to work may also result in other benefits. Employees who believe they work in a stable environment, for example, may feel more secure about their job stability, which can lead to higher levels of employee satisfaction and retention. Belonging to an organisation fosters trust and mutual understanding by committing one to certain values, norms, and responsibilities. Organisations provide a support structure for their people employed. A well-defined organisational system can boost a team's or company's creativity. Employees with more defined duties can hone skillsets related to their leadership role, which allows them to handle extra or more complicated tasks. Employers frequently provide employees with resources and tools to help them find the information they need to fulfil their responsibilities. Another critical aspect of organisation is that a company with a well-structured organisational hierarchy may be better able to grow, scale, or adapt to change. It may appear that less organisation is an advantage for businesses seeking to evolve, a good organisational system actually aids development by providing an organized shape for which divisions can best grow or adapt to changes. Clear duties and properly required resources can provide senior executives with the versatility to further develop the business. 4. Challenges of OrganisationsIn today's fast-paced and competitive business environment, organisations face numerous challenges. Organizations must remain agile and responsive to remain competitive, from optimising resources and legitimising their purpose to dealing with environmental, ethical, and legal constraints. The following are some of the major issues that organisations must address:

Organizations must understand the needs of their workforce and create an attractive environment to keep them engaged and motivated. From offering adequate compensation and personal development opportunities to creating a culture of trust and transparency, organizations must ensure that their employees are supported and encouraged to grow both professionally and personally. Organizations must address these challenges to compete and remain successful in the long run. Organizations can develop strategies and practices to remain competitive and thrive in today's business environment by understanding the key challenges.

Feedback is the secret ingredient for increasing performance and motivation. One challenge that your organisation may face is a lack of feedback to allow individuals to enhance their performances and your organisation as a whole. This feedback includes supervisors' feedback to their teammates, employee feedback to the executive board, employee feedback to the HR team, and also more.

Instruction is where your staff will learn critical info and how you will communicate key concepts and abilities to them. A lack of instruction results in a lack of communication and development opportunities.

High turnover is an organisational issue in which individuals quit their companies commonly and in large numbers. To compensate, an organisation must constantly hire new persons to fill those positions. This can consume company assets and lead to workflow delays. High turnover rates can be caused by a variety of factors, including: Employees are dissatisfied with administration and their leaders. They are dissatisfied with their jobs and do not find them satisfying. Employees are low paid and seek additional money for their efforts. Employees do not believe their employer is listening to their opinions, ideas, and concerns. Team members do not see a path to advancement within the company. To resolve this challenge, organisations may benefit from reaching out to their staff members and soliciting feedback from them. ConclusionAn organization's success or failure is ultimately determined by the planning, mangers, and employee performance. Organizations are intricate systems that necessitate meticulous planning and management. They must open to listening to customer feedback, solve problems creatively, and take risks. An organization's goal is to create and deliver high-quality services, products, or interactions to customers while also making a profit. A straightforward and uniform mission, a corporate sustainability model, and effective leader are all requirements for effective organisations. The necessary to sustained achievement for any organisation is to constantly evolve and adapt. Organization's survival is dependent on its ability to continuously assess its achievement, adapt as needed, and remain attractive to competitors.

Next TopicOzone Layer Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share