Payoneer AlternativesThe world was already on the verge of choosing a completely digital payment or transaction route. However, the coronavirus pandemic situation acted as a catalyst and accelerated the process. With almost all types of businesses operating online, the world needs a secure and reliable payment processing system. It is where Payoneer shines. Payoneer is one of the best online payment transfer systems in India and most other countries. Foreign exchange is lower, and transaction fees are more modest, etc. However, being a freelancer, you know that not all freelancing platforms and clients support Payoneer. So it is logical to look at other Payoneer alternatives. Below we explore all the alternatives in detail- What is Payoneer?Payoneer is a financial services company that provides digital services like international payment transfer, requesting payments from merchants/customers, etc. In simple words, Payoneer streamlines your business or freelance services by allowing you to collect or send payments through a secure environment. Payoneer was founded in 2005, and since then, it has helped many businesses to expand domestically and internationally. And, not to forget, Payoneer proves to be a boon for freelancers and agencies. Believe it or not, in recent times, many organizations and platforms like Fiverr, Upwork, Amazon, Rakuten, C.J., Airbnb, etc., are using Payoneer. Why everyone likes Payoneer? (Advantages of Payoneer)Here are some of the most notable reasons that make Payoneer a top choice for online money transfer -

If you are an Indian, Payoneer will transfer funds from your wallet to your bank account daily. Why should you look for Payoneer alternatives? (cons of Payoneer)Payoneer offers a lot of benefits and resources. Here are some drawbacks that will drive you to look for Payoneer alternatives -

Just to be safe, I would suggest that you have an alternative to Payoneer. It can come in handy when your customer refuses to pay through Payoneer. That being said, now is the time to look at all the options in detail. 1. PayPalPayPal is synonymous with online payment transfer. Hence, PayPal has the right to appear at the top as the best alternative to Payoneer. Apart from being just a payment transfer platform, PayPal also acts as a payment processor or gateway for online transactions. For example, many businesses use PayPal's APIs and gateways to collect payments from their customers.

What Makes Paypal the Best Choice?PayPal offers the convenience of recurring payments. So you can quickly sell subscriptions or get recurring payments with PayPal. If you're a freelancer, PayPal allows you to easily create a unique "PayPal.me" business link that you can share with your customers to receive payments. PayPal also allows for the easy creation of professional invoices. You can share the invoice either through email or through its link to collect payment. PayPal Fees and Pricing The feature that makes PayPal one of the top Payoneer alternatives is that it is 100% free to sign up. There is no setup fee or monthly fee for using the platform. In addition, if you purchase a service or product, you will not be charged anything extra. If your business is located in the United States, you will pay 2.9% + $0.30 per transaction. Similarly, for Indian businesses, you will have to pay a fixed fee of 2.5%* + INR 3 for local payments. For international payments, you have to pay 3.4 - 4.4% + a fixed fee. Advantages and Disadvantages of Using PayPalPros of PayPal

Cons of PayPal

2. StripeAnother pioneer in the field of online payment transfer is Stripe. It has recently spread its wings and made itself available in 40+ countries with support for 135+ global currencies. What makes it an ideal alternative to Payoneer is the collection of domestic and international payments. And also use it as a payment gateway for online businesses.

What Makes Stripe the Best Choice?Unlike Payoneer, Stripe enables you to collect recurring payments. So if you have a business that uses a subscription/recurring model, Stripe would be an ideal choice. Stripe offers a lot of integration options. One of which allows freelancers to create invoices, draft contracts, e-signatures, etc., to collect payments. If you're a business owner, you can integrate Stripe's hosted payment pages to collect payments from your customers. Stripe Fees and Pricing Like other Payoneer alternatives, Stripe doesn't charge you a fee to sign up or if you buy something through Stripe. However, if you are a seller, you will be charged for each successful transaction. So, for example, businesses located in the United States will incur a transaction fee of 2.9% + $0.30 per card fee. If you are an Indian business owner, you will have to pay 2% of the transaction amount if the card used for the transaction is issued in India. Similarly, for international cards, you will be charged 3 - 4.3%. Advantages and disadvantages of Stripe Advantages of Stripe

Cons of Stripe

3. InstamojoIf you are an Indian freelancer, service provider, or business owner, you will love Instamojo. It is an all-in-one platform to sell products and services online, which also provides a payment gateway. You also get to receive payments through its payment gateway and payment links.

What makes Instamojo the best alternative? If you start a fresh, you can entirely rely on Instamojo to sell your products, services, courses, software, music, etc. Instamojo allows you to embed a "pay" button on your website with just one line of code. Like other Payoneer alternatives for freelancers, Instamojo also offers payment link features. Using this, you can request money from your customers. Instamojo Fees and PricingSince Instamojo allows you to use its payment gateway and online store separately (and together), the modules are priced separately. Payment - If you receive payment by NEFT or Bank Transfer, you will not be charged anything. However, if you receive payment through UPI, NetBanking, Debit/Credit Card, or Wallet, you will be charged 2% + INR 3 per transaction. For payments through international cards, this charge increases to 3% + INR 3 per transaction. Online Store - Forever is the free plan which charges you 5% + INR 3 per transaction. A monthly subscription will cost you INR 799/month, and the fee will be reduced to 2% + INR 3 per transaction. Lastly, you can sign up for an annual plan for $7999/year with the same transaction fee. Advantages and Disadvantages of Using InstamojoPros

Cons

4. RazorpayRazor Pay is the best alternative to Payoneer for Indian freelancers and business owners if you are looking for an easy way to get paid. It is not only the cheapest but also the best option in terms of features. Speaking of which, the set of features offered by Razorpay includes a payment gateway, processor, multiple global currency support, invoicing, and so on.

What makes Razorpay the best choice?For freelancers, Razorpay offers a feature where you can set up automatic payment reminders for your clients. You can also collect recurring payments with Razorpay, as it supports the subscription billing model as well. Razorpay also lets you receive payments from your customers, even if they pay you through their PayPal account. Also, a cross-platform payment feature is possible in Razorpay. Razorpay Fees and PricingFor freelancers and business owners, you will have to pay the following transaction fees if you receive payment -

Advantages and Disadvantages of using RazorpayBenefits of Razorpay

Cons of Razorpay

5. SkrillSkrill is yet another alternative to Payoneer, which is known for its simple payment transfer process. It works on the concept of sending money from one Skrill to anyone's bank account. Even if the sending party does not have bank details, they can send them to your email address. From there, you'll have access to either transfer it to your bank account or use it if Skrill is accepted.

What Makes Skrill the Best Choice?Skrill is capable of supporting 40+ global currencies for international payment transfers. There are Android and iOS apps for Skrill that enable you to access and transfer money anywhere and anytime. This payment solution is also known for its competitive exchange rates. Skrill Fees and PricingThe best feature of Skrill is its no transaction fee policy if you receive funds in your Skrill account. If you pay using Skrill Wallet and send money to an international account with the Skrill money transfer feature, no transaction fees apply. Another notable feature that US-based freelancers will love is that it doesn't charge you anything. But in certain circumstances (for freelancers outside the U.S., etc.), up to 3.99% of the currency conversion fee is chargeable. Advantages & Disadvantages Of Using SkrillPros Of Skrill

Cons Of Skrill

6. Wise (TransferWise)Despite being a relatively new payment transfer platform, Wise has managed to get a lot of attention from freelancers and business owners. This popularity results from its simple transfer functionality and, most importantly, its highly transparent fee charges. Surprisingly, Wise won't charge you anything if you receive payments from anyone.

What makes wise the best choice?For money transfer, you need the bank details of the recipients. This way, your customers can send you money directly to your bank. Like some other Payoneer alternatives, Wise also offers mobile apps for Android and iOS devices. Wise Fees and PricingWise does not charge you any fee for receiving money. But it charges you a currency conversion fee of 0.35% - 3%. In addition, if you add money to your Wise Wallet, you will be charged 0.2% of the total amount. Advantages and disadvantages of using wiselyWise's Pros

Cons of Wise

7. World firstEnables WorldFirst ("World Account") to receive payments from local accounts offered in GBP, EUR, USD, CAD, CNH, HKD, JPY, NZD, SGD, and AUD. Their multi-currency accounts international business (e.g., FBA for Amazon, Shopify) and international import/export business. WorldFirst focuses on large transfers, with a minimum transfer amount of USD 1000. If you need to transfer a small amount, WorldFirst is not the option for you. It offers a variety of merchant services, including forwarding contracts and bulk payments. They don't charge any personal transfer fees, but they do charge between $10 and $30 on business transfers. However, they also offer a very competitive mark-up on the exchange rate. With WorldFirst, you can send and receive money only through your bank accounts. Other payment methods are not supported. However, you can make transfers both online and via phone calls. The "World Account" allows online sellers and businesses to receive and make payments in different currencies using matching currency accounts. Pros

Cons

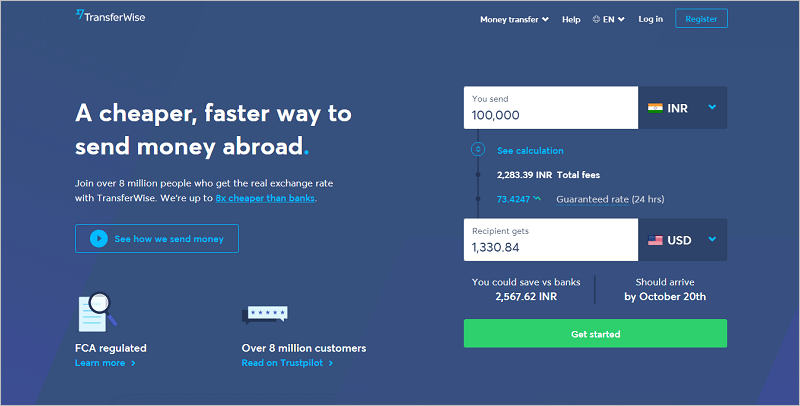

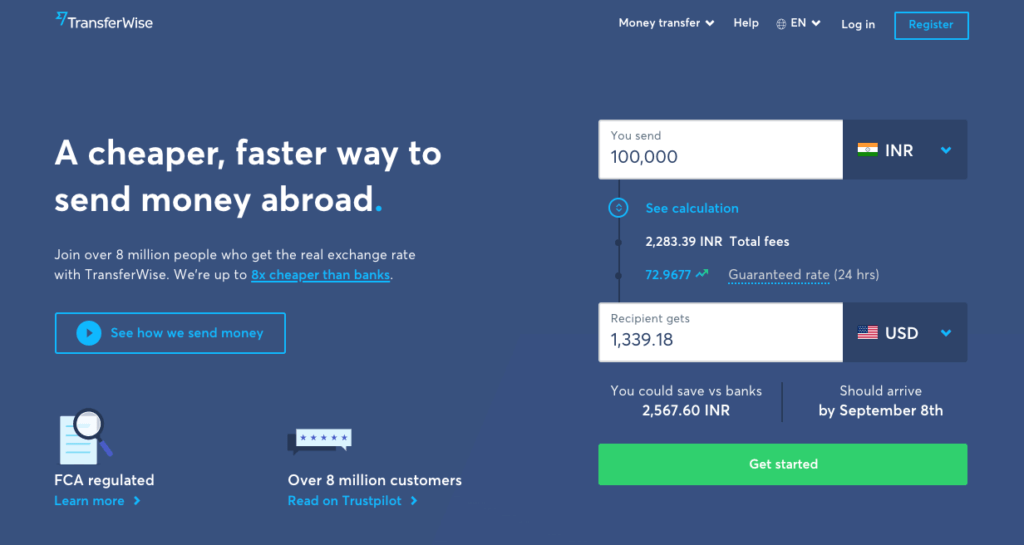

For larger businesses that need to transfer funds (to a bank account), WorldFirst (see "World Account") may be your best option, given their meager transfer fees and their roots in money transfers. In addition, WorldFirst can most effectively handle large amounts (above 7000 USD) and get all the critical customer support (we wrote about in their review) that is needed with banks in different countries and regulations. May occur while dealing. 8. NetellerNeteller offers a suite of products that are similar to Payoneer. It provides both online payment processing and international transfer services. A virtual Neteller account lets you pay anyone with just one email address. Plus, you can send money to anyone, even if they don't have a Neteller account. Neteller charges 1.45%, minimum USD 0.50 for remittance fees. If you haven't made a deposit to your Neteller account or made a deposit using Paysafecard, Skrill, or BitPay, you may need to pay a one-time fee of 20%, a minimum of USD 30. For all money transfers involving currency conversion, you pay 3.99% above the average interbank rate. There are also different fees for withdrawing money depending on the payment methods you use. Even today, Neteller is well-known as a payment method for casinos and online betting. Available in over 200 countries and 22 currencies (BGN, AUD, CAD, EUR, DKK, GBP, HUF, INR, JPY, DKK, MYR, MAD, MXN, NOK, RON, RUB, PLN, SGD, SEK, TWD) is. TND, CHF, USD) 9. TransferWiseTransferWise was established in 2011. Since then, it has managed to climb its way to become the best Payoneer alternative. Like Payoneer, it offers simple payment storage and sending functionality. But the feature that makes it better than Payoneer or any other alternative is its transparent pricing and fee structure. You'll love knowing that TransferWise doesn't charge you any fees when you receive a payment (more on this below).

Important Features of TransferWise

Transfer pricing and chargesTransferWise does not charge you any fees on receiving the payment. But it charges you a currency conversion fee of 0.35%-3% and 0.2% when you add money to your account for transfer. Furthermore, it is entirely free to use. Advantages and Disadvantages of TransferWisePros -

Cons-

10) Google Pay A fast and secure mobile payment app, Google Pay is a payment solution hosted by Google. When you use a debit card to make purchases in a store or through a service, there are no additional fees. However, there is a 2.9% fee for credit card payments. Power of Google Pay

Google Pay Vulnerabilities

11. Braintree

Braintree is a PayPal service but operating independently of PayPal. Their pricing is simple and relatively straightforward. Paying with Braintree is a breeze as it accepts all kinds of payment methods, including PayPal, as an option to fund transactions. In addition, freelancers can create recurring billing for their clients. 12. Zoom X

Xoom is a PayPal service and an excellent Payoneer alternative for freelancers in India. It is easy for Indian freelancers to send and receive money using Xoom. Customers can either create a separate Xoom account or use PayPal details to pay freelancers through Xoom. Zoom deposits money directly into local Indian banks. 13. Remitly

Remitly is a payment method similar to XOOM and is a good option for Indians to receive payments. It provides express and economical ways to send money. The dispatch can be done in a few hours. However, there are very few customers who prefer to use Remitly as compared to PayPal or Payoneer. Enables WorldFirst ("World Account") to receive payments from local accounts offered in GBP, EUR, USD, CAD, CNH, HKD, JPY, NZD, SGD, and AUD. Their multi-currency accounts international business (eg, FBA for Amazon, Shopify) and international import/export business. WorldFirst focuses on large transfers, with a minimum transfer amount of USD 1000. If you need to transfer a small amount, WorldFirst is not the option for you. It offers a variety of merchant services, including forwarding contracts and bulk payments. They don't charge any personal transfer fees, but they do charge between $10 and $30 on business transfers. However, they also offer a very competitive mark-up on the exchange rate. With WorldFirst, you can send and receive money only through your bank accounts. Other payment methods are not supported. However, you can make transfers both online and via phone calls. Pros

Cons:

For larger businesses that need to transfer funds (to a bank account), WorldFirst (see "World Account") maybe your best option, given their very low transfer fees and their roots in money transfers. In addition, WorldFirst can most effectively handle large amounts (above 7000 USD) and get all the critical customer support that is needed with banks in different countries and regulations. 16: NetellerNeteller offers a suite of products that are similar to Payoneer. It provides both online payment processing and international transfer services. A virtual Neteller account lets you pay anyone with just one email address. Plus, you can send money to anyone, even if they don't have a Neteller account. Neteller charges 1.45%, minimum USD 0.50 for remittance fees. If you haven't made a deposit to your Neteller account or made a deposit using Paysafecard, Skrill, or BitPay, you may need to pay a one-time fee of 20%, a minimum of USD 30. For all money transfers involving currency conversion, you pay 3.99% above the average interbank rate. VIP members only pay 1%. Additionally, if you do not make any transactions in 12 years, you will have to pay a monthly administrative fee of USD 5 on your account. There are also different fees for withdrawing and uploading money depending on the payment methods you use. Pros

Cons

17. 2Checkout

Non-US users are offered better rates when accepting payments from customers through 2Checkout. In addition, users can send money in 87 currencies, eight payment types, 15 languages , including credit card, debit card, and PayPal. In a way, 2Checkout has a high level of fraud detection as each transaction has to go through more than 300 security checks. ConclusionAll the options mentioned above are already being used by many freelancers and business owners across the globe. And, registering with some other payment transfer platforms is only going to strengthen your business. If one of your payment channels gets suspended, you rely on other channels as well. The URL will help you to make your account in Payoneer: Click on the below link: http://share.payoneer.com/nav/8-Ui8lD9Tx-IUv3SbfXH7DahfAKc40aM79OCbwvhXLJEZr0z_GP3g7VvODmY8powLQa1odJZ8hp68fASxRo3WA2

Next TopicHow to Create a Payoneer account

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share