What is the Full Form of PDCPDC: Post-Dated ChequePDC stands for the Post-dated Cheque. Post-dated cheques can be an instrument for negotiation that the payer writes for a particular date in the future, prior to which the drawee cannot present the cheque in the bank to obtain the amount desired. Whether the post-dated check can be cashed or put into the account prior to the specified date varies from country to country. The Canadian institution, for instance, can't process a post-dated check prior to the date specified, and should it happen, then it is regarded as an error, and the bank is required to correct the transaction. The US and UK post-dated checks can draw at any point, and the date specified is not important; however, for India and Australia, post-dated checks cannot be paid until the date that is written on the cheque is completed. This signifies that the person paying is bound to pay the amount but only at a later date. Post-dating only makes sense when the payee is sure that the recipient will not cash the check or deposit it into the bank prior to the date on the check. The primary purpose behind this type of check is to make a delay in payment.

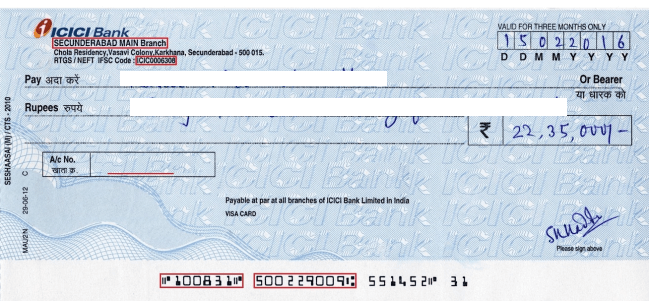

Example of a Post-Dated ChequeABC Ltd. is a private business that specializes in the manufacturing of computer accessories. The company needs to buy various components to make its final products. The company is short of cash and is expected to be able to pay its customers once the cash collection begins in the next month. In addition, the business needs to buy some raw materials from its suppliers so that the production process be carried out without any hindrance. So, the company buys raw materials from its suppliers at the cost of $10,000 and pays by means of two post-dated checks, each $5,000. The date stated in the initial cheque will be one month from today, and the date of the second is two months after the current date. The provider agrees to keep the check and only make them available on the designated dates, with the agreement of the business to ensure that both cheques will be honored and received by the bank on the dates specified. So, from the day the company has received the payment, it must not deduct cash or credit account receivables. This is due to the fact that post-dated cheques cannot be considered cash prior to the date specified in the cheque. Moreover, only at the time mentioned on the leaf of the cheque can it be considered cash and then deposited in the bank. How do you write a Post-Dated Cheque?A post-dated bank check is an instrument with a date for the future written on it. This means, for instance, that today's date is the 18th of August 2022, and we wish to issue a cheque, and the recipient must be paid the money within a month; we would write the 18th of September 2022. This cheque will be cashed or deposited into the bank after the 18th of September in 2022. You must be sure to have sufficient funds to honor the cheque at the specified time, so the check doesn't bounce. The same could cause the payment of insufficient funds fees or overdraft charges that banks can collect as penalties from the cheque issuer. In the United States and the UK, banks do not have to verify the date of the cheque unless the issuer has stated not to release the money prior to the specified date. However, this is not the case for India and Australia, as banks are not allowed to cash the cheque until the date stated in the check has been met. Post-Dated Cheques: Rules1. No fraud is allowed Although no law prohibits post-dated checks, making a cheque illegal if the recipient doesn't have sufficient cash to meet the cost stated in the statement. 2. Not a written agreement The payee can present their cheque at any point until the payer informs the bank that the cheque is not able to be cashed prior to the time specified. This applies to countries such as the US and UK in which, if necessary, the payee is able to present the cheque at any time, even when there is no request from the bank to the payer and the bank is required to honor the cheque. This implies that the bank has the right to transfer the money to the person who is getting paid regardless of when the date is mentioned. But these scenarios are not familiar, on the other hand, in countries like India and Australia, where banks are required by law to cash the check only on or following a specific date. 3. Confirm the information with your bank If a cheque with a future date is made, it doesn't guarantee anything. You must write instructions to the bank, and the bank will tell us precisely how to accomplish it. In addition, banks have their own rules for how long they'll monitor to prevent payment delays, which are dependent on the customer paying a certain amount of charge to monitor this process. Laws of Post-Dated ChequesUS national banks can cash cheques prior to the date stated on the leaf of the cheque. In accordance with US Banking laws, a cheque is a negotiable item, and the person who pays it can bargain it with the bank system at any time. Therefore, the date stated in the document is of no importance unless the person who is paying has sent a written directive to the bank concerning not allowing the possibility of the cheque being cashed before the specified date. In the UK as well, post-dating a check does not have any legal value and banks are able to cash it at any time. A cheque can be defined as an exchange bill. The bill is registered on the banker and payable on demand under UK bank laws. According to the Bill of Exchange and Banking Act 1882, a banker's bill is not invalid just because it's post-dated or ante-dated. Benefits

Next TopicFull Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share