Price Skimming Definition: How It Works and Its LimitationsWhat is Price Skimming?Price skimming is a method of product pricing in which a company sets its starting price as high as its target market would bear before gradually lowering it. The company reduces the price to appeal to a different, more price-sensitive portion of the population when the demand of the initial clients is met and rivals enter the market. The "skimming" of successive layers of cream, or client groups, as prices decline over time, gives the skimming technique its name.

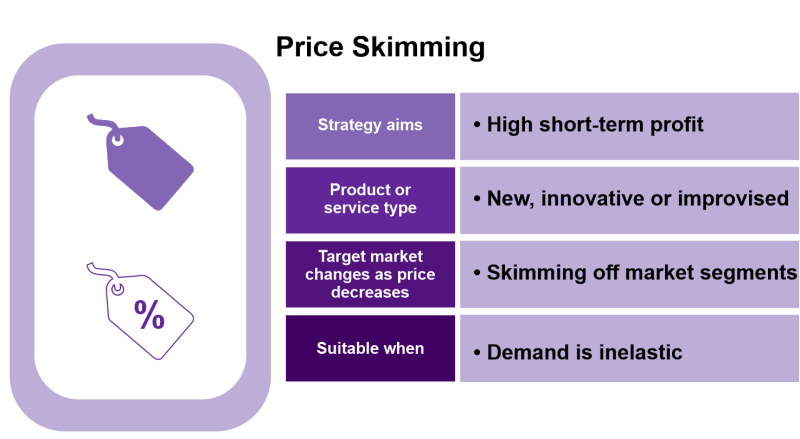

When offering a product and service for the first time, a company might use price skimming as a pricing strategy. A company may profit from a greater price in the market and faster recover its sunk costs by using this price skimming strategy and taking the additional profit before new competition emerges and drives down the market price. In a developing and new market, it has become usual for managers to start their pricing high and gradually lower them. The process of price skimming is often referred to as riding down the demand curve. A price skimming strategy initially seeks to seize the consumer surplus in the product's life cycle to take advantage of a monopoly position or the inventors' low price sensitivity. Key Takeaways

How does Price Skimming work?

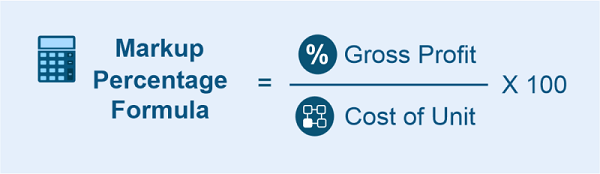

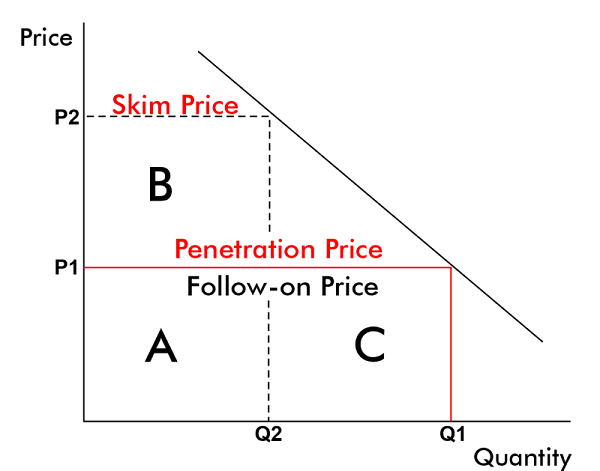

Price skimming is frequently employed when a new product enters the market. The objective is to make as much money as possible when customer supply is high, and there isn't much competition in the market. Once those objectives are achieved, the original product's developer can drop pricing to appeal to more budget-conscious customers while still maintaining competition with any lower-priced copycat products that could be released on the market. The vendor is typically forced to drop the price to fulfil the market's demand at this point when sales volume starts to decline at the greatest price they may ask for. The penetration pricing model, in contrast, emphasizes the release of a product at a lower price to capture as much market share as feasible. This method works well for cheaper goods, including everyday home necessities, when most customers' manufacturing decisions may be influenced by price. Companies frequently utilize skimming to recoup their development costs. Skimming is an effective tactic in the following situations:

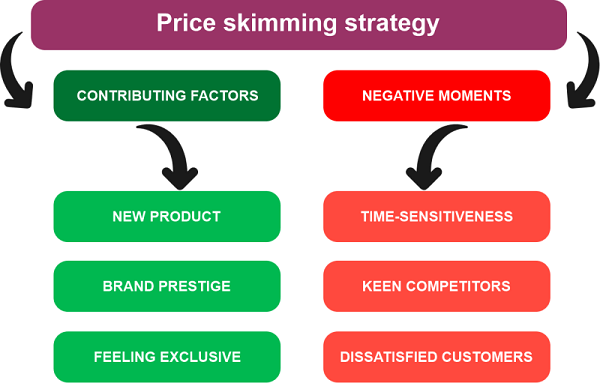

The cost of a new product, such as a new home technology, might influence how customers perceive it. Products with greater prices frequently imply uniqueness and excellence. This may also provide effective word-of-mouth marketing campaigns and attract early adopters who are ready to pay extra for a product. Limitations of Price Skimming

Price skimming is only successful when a corporation deals with an inelastic quantity demanded. Price modifications won't be necessary to bring about market equilibrium if the long-run demand curve is elastic (as shown in the picture to the right). In this situation, penetration pricing is a better tactic. If one company alters its prices, other companies will try to follow it, which will cause the industry's volume to rise quickly. A low-cost producer who follows a penetration strategy will often win most of the market share. Price skimmers must be cautious around the law. In many areas, price discrimination is prohibited, while revenue management is not. Pricing skimming can be viewed as either a kind of yield management or a sort of price discrimination. Price discrimination adjusts prices based on market factors (such as price elasticity), whereas yield management does it based on product attributes. Since market attributes nearly always have a strong correlation with product qualities, marketers consider this legal difference to be archaic. To be on the legal side of the law when adopting a skimming technique, a marketer must talk about and understand the importance of product attributes. For skimmed items, the inventory turnover rate may be quite low. The distribution network of the manufacturer can have issues as a result. Giving merchants more profits can sway their enthusiastic handling of the goods. Price skimming can reduce the inelasticity of the demand curve by attracting more competitors to the market due to businesses offering their products and being attracted by the large profit margins. The distribution and acceptance of products are slowed down by skimming. As a result, there is more unmet demand, which gives rivals more opportunity to copy the product or outdo it with innovation. As fewer consumers get or are aware of the product being marketed, the slow adoption rate may also impact brand loyalty. If the producer cuts the price too quickly without making major product modifications, they risk getting bad press. Some early buyers could feel taken advantage of. They'll think it would have been wiser to hold off and get the item at a much lower price. This unfavourable perception will spread to the manufacturer and the business.

High margins might render the company ineffective. Less motivation will exist to keep expenses in check. Competing on value or cost will be challenging since inefficient methods will become established. Because of the item's lesser quantity demand, a company might not be able to benefit from economies of scale. When applied temporarily, the price skimming approach works best, enabling the early adopter marketplace to saturate without permanently losing price-conscious customers. If a price decrease occurs too late, customers could switch to cheaper rivals, resulting in lost sales and income. Price skimming could only be as successful for follow-up items from other companies. Because the earlier market of early investors has been reached, future consumers might only buy a rival product at a higher cost with materially improving it over the original. Reasons for Price Skimming

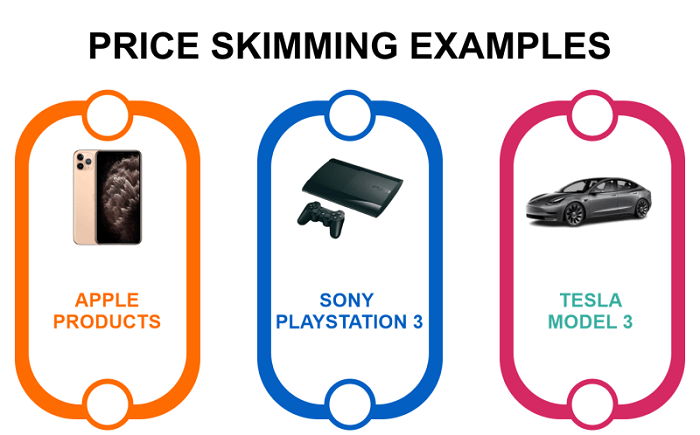

Price skimming may also be used in the early stages of the product life cycle when a product is still relatively new, has a small supply, and has a short shelf life since certain buyers are prepared to pay more to be the first to purchase the product. The price will decline following a predetermined selling window, often known as market departure time. For instance, price skimming happens in luxury cars and consumer electronics markets. Due to ongoing decreases in production costs and increases in product quality, consumer electronics often experience considerable price deflation. For instance, a $200 printer today would have managed to sell for a much higher price ten years ago. Examples of Price Skimming

There are several instances of price skimming in the real world, particularly in the technology sector. The Sony PlayStation 3 console first went on sale in the United States in 2006 for $599. The price of the PlayStation 3 was steadily lowered till it can now be acquired for less than $200 throughout the course of competing systems (such as the Xbox 360 and Wii) and the debut of next-generation consoles (such as the Sony PlayStation 4 and Sony PlayStation 5 in 2020). ResearchMartin Spann, Marc Fischer, and Gerard Tellis examined the use and preferences of dynamic pricing techniques in empirical research, examining a complex branded market that included 663 devices that were sold under/ over 79 different brand names for digital cameras. They discovered that market pricing predominates in practice despite several suggestions in the literary works for skimming or penetration pricing. The authors specifically identified five patterns, including penetration (20% frequency), three variations of marketing trends (60% frequency), and skimming (20% frequency), when new items were introduced at market prices. Skimming pricing raises the price of the new goods, about 16% above the going rate, before lowering it later from the going rate. Penetration pricing initially lowers the new product's price by 18% and then gradually raises the market price. Companies use a variety of these pricing strategies throughout their portfolios. Specific pricing strategies are correlated with market, company, and brand attributes, including fierce competition, market innovation, brand recognition, and experience impacts.

Next TopicWhat Is Insurance

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share