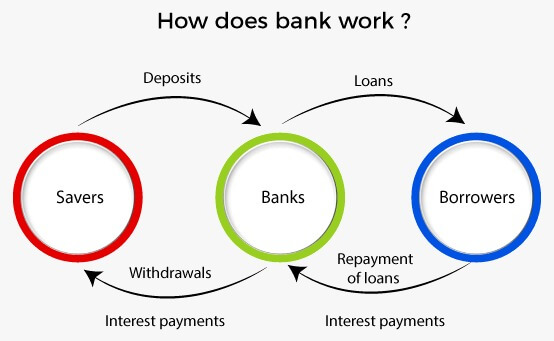

Top 20 Banks in IndiaA bank is a legal financial institution that accepts deposits from the public in the form of money and grants loans. The deposits accepted by the banks are demand deposits that mean they can be withdrawn when required. The bank can perform the lending activities directly or can use the indirect method of capital markets. A country's banking system has a significant impact on its economy and financial stability. The first bank in Indian history was the Bank of Hindustan which was set up in 1770. This bank was liquidated between 1829 and 1832. The oldest running bank of the country is State Bank of India.

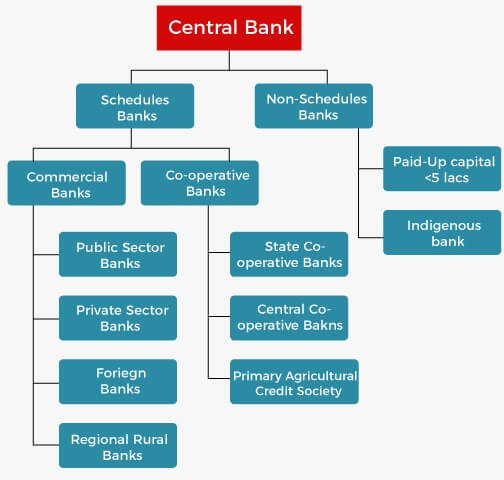

Types of Banks

There are the following types of the banks in India:

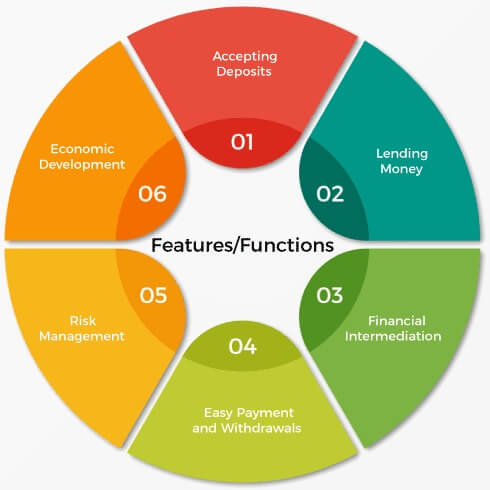

Functions of Banks

There are two types of baking functions that include: Primary Functions

Secondary Functions

List of Top 20 Banks in India

1. Central Bank of India: CBI is among the oldest and largest commercial banks in India. This public sector bank is owned by the Indian government. CBI was started on 21 December 1911 with its headquarters in Mumbai, Maharashtra. The bank has five offices in Singapore, Doha, Dubai, and London also. 2. Reserve Bank of India: The RBI is the central bank and is responsible to regulate the flow of money in the country's economy. It works under the Ministry of Finance's jurisdiction Government of India. The bank started its operation on 1 April 1935 under the RBI Act; 1934. It is headquartered in Mumbai, Maharashtra. In its primary function RBI is responsible for printing, issuing, and supplying the Indian currency and regulating the county's banking system. The bank also makes policies for the economic growth of the country. The highest designated officer of RBI is a Governor who is an IAS, IES, or ISS. 3. State Bank of India: SBI is a multinational, public sector Indian bank and financial service provider. Its headquarters are in Mumbai, Maharashtra, and it was created on July 1, 1955. SBI was the only Indian bank to get the place Fortune Global 500 list of the world's most powerful firms in 2020. SBI is the country's largest bank and the world's 43rd largest bank. 4. HDFC Bank: HDFC stands for Housing Development Finance Corporation. The bank was founded in August 1994 in Mumbai, Maharashtra, and has its headquarters there. In terms of assets, HDFC is the country's largest private-sector bank. In addition, as of March 2020, HDFC Bank is India's largest bank by market value. In the same year, HDFC Bank got the Euromoney Award as India's Best Bank. 5. Bank of Baroda: It is a banking and financial services company owned by the Ministry of Finance, Government of India. BoB was found on 20 July 1908 and its headquarters are situated at Vadodara, Gujarat, India. It stands at the third position in the list of the largest public sector banks in India. It has about 132 million customers and 100 overseas offices located worldwide. In Forbes Global 2000 list of 2019, the bank got the 1145th On 17 September 2018, the bank got merged with Vijaya Bank and Dena Bank. 6. Indian Overseas Bank: IOB is a major Indian bank that is owned by the Indian Government. The bank was established in February 1937 with its headquarters in Chennai, Tamilnadu. At present, the bank runs 3,400 domestic and 6 foreign branches. The scheme of the personal loan was first time ventured by IOB. The bank has its own IT development team that builds almost 80% of its software. 7. Punjab National Bank: PNB is a government-owned bank that has its headquarters in New Delhi, India. The bank was established on 12 April 1984. As per the business and network, this is the second-largest public sector bank in the country with a number of about 108 million customers. In the United Kingdom, Hong Kong, Dubai, Kowloon, and Kabul, PNB has banking subsidiaries. 8. IDBI Bank Ltd: Industrial Development Bank of India (IDBI) was set up in 1964 and has its headquarters in Mumbai, Maharashtra. IDBI is a subsidiary of LIC and also a development finance institution. Initially, the bank was owned by RBI but later RBI transferred the ownership to the Government of India. In the Forbes Global 2000 of 2013, IDBI Bank reserved 1197th 9. ICICI Bank: ICICI stands for Industrial Credit and Investment Corporation of India. The bank was established on 5 January 1994. The bank has its registered office in Vadodara, Gujarat and the corporate office in Mumbai, Maharashtra. ICICI is an Indian development finance institution that is privately owned. The bank's products and services cover various areas like asset management, life, and non-life insurance, investment banking, and venture capital. The bank has its branches in 17 countries. 10. Indian Bank: It is a financial service and banking company that works under the ownership of the Indian Government. The bank was founded in 1907 having its headquarters in Chennai, India. The bank became the seventh-largest bank in India after getting merged with Allahabad Bank. There are 227 Overseas Correspondent banks of Indian Bank are established in 75 countries. 11. Yes Bank: The bank is a private sector bank in India. It was established in 2004 with its headquarters in Mumbai, Maharashtra. The founders of the bank are Rana Kapoor and Ashok Kanpur. There are various retail banking and asset management services provided by the bank. Yes Bank is owned by SBI with a 30% stake in the company. The bank launched Yes Pay, a digital wallet in October 2017 for its customers. 12. Canara Bank: This is one of the largest bank in the country that is owned by the Government of India. The bank was privately established at Mangalore in 1906 but was nationalized in 1969. Its headquarters are located in Bangalore, Karnataka. On 30thAugust 2019, Syndicate Bank was merged with Canara Bank. The bank has also its branch in several foreign countries. 13. Union Bank of India: The Ministry of Finance under the control of Government of India owns this bank. It is among the India's largest banks. It was established on November 11, 1919, in Mumbai, Maharashtra where its headquarters are located. On 1 April 2020, when Corporation Bank and Andhra Bank amalgamated with Union Bank of India, the entity became the bank with the fourth largest branch network with around 9500 branches. UBI is the anchor bank of both other banks. 14. South Indian Bank: SIB Ltd. is one of the major private sector banks and the first private sector bank of Kerala. It was established on 29 January 1929 and is headquartered in Kerala, India. There are 871 branches of banks that have been established in overall India. In the list of the private bank with the largest branch network, SIB stands at the 8thposition in the country. 15. Axis Bank: The bank stands at the third number in the list of the largest private sector banks in India. The bank was started in 1993 with its headquarters in Mumbai, Maharashtra. Axis bank provides its financial services to SMEs, large and mid-size companies, and retail businesses. In 2011, the bank got 'The Banker Awards' and became the 'Bank of the Year', India. In 2015, the bank got the award of the best security provided by a private bank. The award was given by the Data Security Council of India (DSCI). 16. Oriental Bank of Commerce: The bank is a completely owned subsidiary of PNB. It was founded on 19 February 1994 by Susheel Kumar Pal. The bank's headquarters are located in Gurgaon, Haryana. On April 1, 2020, the OBC was merged with the United Bank of India to form Punjab National Bank and then it became the country's second-largest public sector bank. 17. IndusInd Bank: This is an Indian Bank of the new generation. The bank was started in April 1994 in Pune, Maharashtra. The bank provides commercial, transactional, and electronic banking products and services to its customers. Its name is drawn from the Indus Valley Civilization. The largest numbers of branches of the bank are located in Mumbai followed by New Delhi and Chennai. 18. Kotak Mahindra Bank: This is an Indian Bank of the private sector with its headquarters in Mumbai, Maharashtra. It provides its products and services to the retail and corporate customers in the fields of life industry, personal finance, wealth management, and investment banking. The bank was founded in February 2003 by Uday Kotak. As of February 2021, Kotak Mahindra Bank is the third-largest Indian bank in the private sector with market capitalization. 19. Federal Bank: Federal Bank Limited was set up on 23 April 1931 but as Travancore Federal Bank. Later on 2 December 1949, it was converted into Federal Bank. This is a major Indian bank with its headquarters in Kochi, Kerala. The bank had a sponsorship of NorthEast United FC in the 2019-20 season of the Indian Super League. There are more than 1,200 branches of the bank are located throughout India. 20. IDFC First Bank: IDFC First Bank or IDFC Bank is an Indian private bank. It was set up in October 2015 with its headquarters in Mumbai, Maharashtra with a demerger from IDFC Limited. IDFC Bank serves private and corporate customers including the infrastructure sector. The bank got a license of universal banking from the RBI in July 2015 and became the part of NSE and BSE on 6 November 2015. In 2020, Mr. Amitabh Bachchan became the first brand ambassador of the bank. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share