Translation ExposureWhat is Translation Exposure?Translation exposure is the risk that, with the alteration of exchange rates, influences the worth of a company's equity, assets, obligations, or income. This happens when a company has a portion of its equity, assets, obligations, or revenue denominated in a foreign currency. Other names for it include "translation risk" and -accounting exposure".

Accountants employ various strategies to protect businesses against these dangers, including consolidation approaches for the company's financial statements and the adoption of the best methods for cost accounting review. In many circumstances, the translation risk is represented in accounting records as an exchange rate gain (or loss). Understanding the Concept of Translation ExposureMultinational firms are especially vulnerable to translation vulnerability since some activities and assets will be in based in foreign currency. Even if a company has not made any commercial contacts with the nation in question, it may impact businesses that make goods or provide services for export. The assets and liabilities of the entire organization must be converted into the local currency to accurately reflect the firm's financial status. Translation exposure results from the fact that an exchange rate might fluctuate significantly quickly, which is uncertainty or risk. This risk exists regardless of whether an asset's value rises or falls due to the exchange rate fluctuation. Translation risk can cause what looks to be a gain or loss in money due to changes in the asset's current value (while assets are the same) due to exchange rate variations. For instance, if a corporation has a facility in Germany valued at €1 million and the exchange rate between the US dollar and the euro is 1:1, the asset would be recorded as €1 million. The asset would be valued at $500,000 if the exchange rate fluctuates and the euro-to-dollar ratio rises to 1:2. Although the corporation is still in control of the same asset it had previously, this would show up on financial accounts as a $500,000 loss. Transaction vs. Translation ExposureTransaction exposure and translation exposure are very different. When a commercial transaction is set up in a foreign currency, there is a chance that the worth of that currency might alter before the operation is finished. This is known as transaction exposure. If the foreign currency appreciates, the price in the company's native currency will increase. A foreign asset's value may fluctuate due to a shift in the exchange rate between its home currency and another country's currency. This is what is meant by -translation exposure". It basically considers the fluctuations in the value of the asset and not the currency itself. Measurement of Translation ExposureWhenever foreign currencies drop significantly relative to the local currency, translation exposure can frequently reflect a skewed portrayal of a company's worldwide assets. Accountants have a variety of alternatives for translating overseas holdings' values into local currency. They can convert at either the going rate or the rate that was in effect when the account was created. Yet, companies must adhere to the accounting concept of consistency and employ whatever rate they decide to for several years. To preserve consistency in the books of account, businesses must consistently employ the same accounting methods. Whenever a new method is used, it must be explicitly stated in the financial statements' footnotes. In particular, there are four notable ways to gauge translation exposure: 1. Current/Non-Current Method

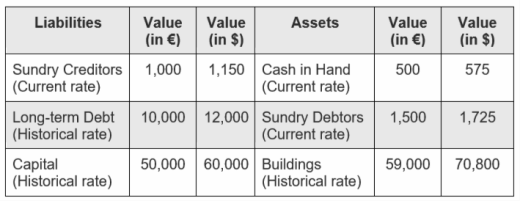

At the currency rate in effect on the date mentioned on the balance sheet, the amounts of current financial assets and liabilities are exchanged accordingly. This is the way of measuring translation exposure in the current method. In contrast, the conversion rate for non-current assets and liabilities is based on historical data. Current items refer to those items that are written off or turned into cash within twelve months on a balance statement. These typically include short-term loans, invoices receivable and payable, and other creditors and debtors. Non-current items include machinery, buildings, long-term loans, assets, and any item on the accounting records that remain for more than a year. Consider that the current rate is €1 = $1.15, and the historical exchange rate is €1 = $1.20. Based on these rates, translation risk would look like the following balance sheet for any company with example data: 2. Monetary/Non-monetary Method

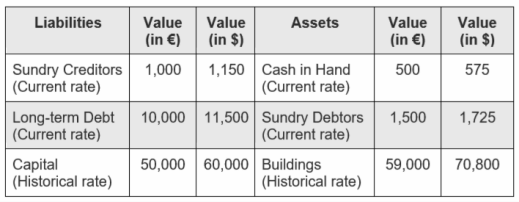

While non-monetary accounts are turned at a historical rate, all monetary accounts are converted at the present currency rate. Monetary accounts reflect a sum of money that will be received or paid. Cash, creditors, debtors, and loans are all examples of monetary accounts. Examples of non-monetary goods include capital, industrial equipment, and buildings since their market values may differ from those indicated on the balance sheet. For the same example data, the balance sheet would look like this when following the monetary/non-monetary method: 3. Current Rate Method

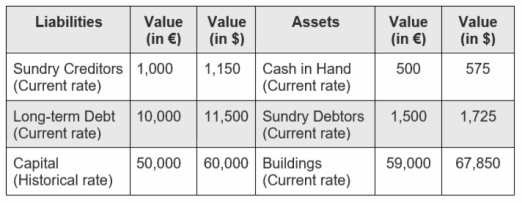

The current rate method is the simplest, which converts all balance sheet values aside from capital using the current exchange rate. The capital stock is assessed at the effective rate when the capital is granted. For the same example data, the balance sheet would look like this when following the current rate method: 4. Temporal MethodThe only difference between the monetary/non-monetary and temporal methods is how inventory is handled. When converting the inventory's worth, the historical rate is often used, but the current exchange rate is used if the balance sheet reflects the inventory at market price. In the example mentioned above, if an inventory of products is documented in the accounting records at its historical value, which can be, for example, €1,000, its worth in dollars upon translation will be $(1,000 x 1.2), or $1,200. But, if the inventory of items is valued at, say, $1,050 in today's market, then its overall worth will be $1,207.50 ($1,050 multiplied by 1.15). However, if the inventories of items are valued at the current market rate of, say, €1,050, then their worth will be $(1,050 x 1.15), or $1,207.50. There is an imbalance between the total assets and liabilities after conversions in each technique mentioned above. Accounting professionals frequently employ hedging to eliminate this risk since exchange rate fluctuations can significantly skew quantities used to calculate income and net profit. Hedging Translation RiskSeveral systems or techniques are available that enable a business to employ hedging to reduce the risk brought on by translation exposure. Businesses might try to reduce translation risk by hedging using futures contracts or buying currency swaps. A business may also demand payment from customers in the local currency of the nation where it is headquartered. In this method, the client, who must convert their money before doing business with the firm, carries the risk connected with local currency volatility rather than the corporation. Translation Exposure Management

Translation account exposure management describes the procedures employed when a corporation reiterates all investments, liabilities, earnings, costs, profits, and losses represented in international currencies in the monetary system in which a company publishes its financial information. Profits and losses in foreign exchange are recorded due to this currency conversion procedure. There are many approaches to managing translation account exposure. However, current/non-current is the most common technique. The non-current technique translates financial assets and obligations at the historical exchange rate. In contrast, all current assets and liabilities denominated in foreign currencies are translated at the current exchange rate. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share