Unicorn: What It Means in Investing, With ExamplesWhat exactly is a Unicorn?Unicorn is nothing but a privately held startup with a more than $1 billion valuation. It's common in the venture capital industry, and a venture capitalist named Aileen Lee popularised it. Unicorns are incredibly rare and need ingenuity. Because of their size, unicorn investors are frequently private or venture capitalists, making them inaccessible to typical investors. However, it is not mandatory; many unicorns eventually become public later.

By definition, "a unicorn is what most people in the financial industry refer to as a privately held startup with a more than $1 billion valuation". Achieving unicorn status is a difficult task. To become a unicorn, a company must have a unique idea, a clear vision for development, a sound business strategy, and a feasible means to communicate with venture capitalists and private investors. When it comes to departure strategies, unicorns have various possibilities, including: Keeping Things Secret Founders that wish to preserve control of their unicorns usually keep them confidential. However, this restricts the possibility of expansion. Therefore, they frequently must discover methods to give a return on investment to investors. Making it Public An initial public offering (IPO) provides companies with the funding they require to grow. Some unicorn leaders may hesitate to publicize their firms for fear of diluting ownership. Attracting a Buyer Company owners and executives can reach their objectives faster if they remain private rather than go public. In this way, the form often attracts new buyers to collect funding. The emergence of the UnicornThe name was coined by Aileen Lee, the founder of Palo Alto-based Cowboy Ventures, a seed-stage venture financing firm. She initially addressed the term in her book "Welcome to the Unicorn Club: Learning from Billion-Dollar Businesses", in which she highlighted some software startups launched in the 2000s and calculated that just 0.07% of them were valued at $1 billion. According to Lee, businesses that have reached this milestone are as challenging to find as the fabled unicorn. According to Lee, the first unicorns were made in the 1990s. She pointed out that Alphabet (GOOG)-then Google-was the unmistakable super-unicorn of the lot, with a valuation of more than $100 billion. Several unicorns were born in the 2000s; Meta (META), formerly Facebook, is considered the decade's lone super-unicorn. Other well-known unicorns established in the United States include home-sharing behemoth Airbnb, video gaming developer Epic Games, and financial businesses Robinhood and SoFi. While unicorns are firms with more than $1 billion valuations, decacorns are companies with more than $10 billion. Special ConsiderationsThe word is not only limited to the startup environment. In reality, it is frequently used to characterize human resources (HR) recruiting as well. HR managers may have high expectations for filling positions, pushing them to seek individuals with more excellent qualifications. In essence, they are looking for unicorns, which may minimize a large gap between their ideal applicant and those in the pool of accessible candidates. A medium-sized company, for example, may wish to hire someone with marketing, social media, writing, sales, and management expertise. They may also want someone fluent in three languages. While hiring one individual with all those abilities may be less expensive than hiring numerous people to perform various jobs, it may be too much for the new recruit to manage and can lead to disappointment. Values of UnicornsUnicorns' worth is often determined by how investors and venture capitalists believe companies will grow and develop over time. This indicates that their prices are unrelated to their financial success. In fact, many of these businesses only make money when they initially start off. However, investors and capitalists may face particular difficulties. Suppose no other rivals are in the field, making the startup unique. In that case, there may be no alternative business model to compare, making the procedure somewhat hard. Unicorns and Venture CapitalSince the publishing of Lee's piece, the word "unicorn" has come to refer to companies in the technology, mobile technology, and information technology sectors that have achieved exceptionally high values and are not backed by their underlying finances. The argument over whether unicorns in the technology industry represent a reinflation of the late-90s dotcom boom persists. According to experts, the growth in new firms valued at more than $1 billion is a clear symptom of market froth. Others suggest that the enormous number of firms with high values reflects a new wave of technologically driven productivity, analogous to the discovery of the printing press roughly 600 years ago. According to 2019 data, SV Angel made the most early-stage investments in firms valued at more than $1 billion. Others argue that since the Great Recession, globalization and central bank monetary policies have spawned massive surges of wealth flowing worldwide in search of unicorns. According to research, at least one in every three unicorns went public in 2019. Examples of UnicornsUnicorns aren't only mythical creatures; they are common in business and finance. In reality, as of now, there are over 1,000 unicorns on the planet, and they are worth more than $3,516 billion. The following are a few instances of well-known unicorns: NuroAn autonomous vehicle delivery firm formed by two engineers from Waymo, Google's self-driving car project, is one hot unicorn startup. Nuro, founded in 2016, became a unicorn startup after obtaining a $940 million investment from SoftBank Group, which helped the firm reach $2.7 billion. Nuro has carved itself a distinct niche in the autonomous vehicle sector by focusing on zero-emissions local delivery cars. Nuro has now evolved and acquired several firms, including Ike Robotics. The business now has many products, including its R1 and R2 generation of vehicles, testing medical supplies and groceries in Fry's Food and Drug and Kroger shops in California. Nuro was valued at $8.6 billion in March 2022. InstacartInstacart is a grocery delivery app that was created in San Francisco in 2012. It is also a unicorn with over $2.7 billion in investment. It has approximately 500,000 goods from local retailers such as Whole Foods, Safeway, Jewel-Osco, Costco, and Harris Teeter. By March 2022, the company's $39 billion valuation had been reduced by approximately 40% to around $24 billion. PhysicsWallah (PW)Alakh Pandey and Prateek Maheshwari founded PhysicsWallah in 2016 as a physics-focused competition prep YouTube channel. It has now evolved into a full-fledged ed-tech platform. After collecting $100 million in a Series A round from Westbridge and GSV Ventures, the business became India's 101st Unicorn, with a valuation of $1.1 billion. With several course offerings on its YouTube channel, website, and mobile app, the ed-tech platform concentrates only on competitive test prep for NEET and IIT/JEE. PW, as it is informally called, says that over 10,000 of its students cleared the NEET and JEE in 2020 and 2021. PhysicsWallah is also expanding its offline presence, launching 20 locations in 18 cities. With the current funding, the Noida-based ed-tech business plans to create 20 centres throughout the country. CarDekhoIt is a new and used automobile search and e-commerce portal in India. It also has a vertical in insurance. CarDekho, founded in 2007 by Amit Jain and Anurag Jain, claims to have partnerships with major auto manufacturers, over 4,000 automobile dealers, and multiple financing institutions to ease vehicle purchases. This vehicle marketplace became a unicorn in October 2021 after its parent company, CarDekho Group (formerly GirnarSoft), acquired $250 million in Series E funding. Leapfrog Investments led the round, including Canyon Partners, Mirae Asset, Harbor Spring Capital, and previous investors Sequoia Capital India and Sunley House. At the time of the funding, Amit Jain, cofounder and CEO of CarDekho, stated that the company is now planning to go public in the upcoming days. During the fiscal year ending March 31, 2021, GirnarSoft's revenue from operations was INR 884.3 Cr. Cure.FitCureFit, founded in 2016 by Mukesh Bansal and Ankit Nagori, offers physical exercise, mental fitness, and nutrition through an online-offline strategy. There is also a primary care vertical. Cure.Fit joined the unicorn club in the year 2021 after Zomato, the food-tech behemoth, invested in the firm. Zomato sold its Fitso exercise facility arm to Cure.Fit for $50 million and invested an additional $50 million in the health and wellness firm. Zomato bought a total ownership of 6.4% in Cure.Fit for $100 million through cross-selling. The Zomato-backed fitness firm, on the other hand, saw its sales income fall 67.4% in the fiscal year that ended March 31, 2021. Its overall income in FY21 was INR 294.9 Cr, compared to INR 567.4 Cr in FY20. What are the reasons for the high valuation of Unicorns?As of now, there are over 1,000 unicorns on the planet, worth more than $3,516 billion. The unusually high valuation is frequently justified by the following factors:

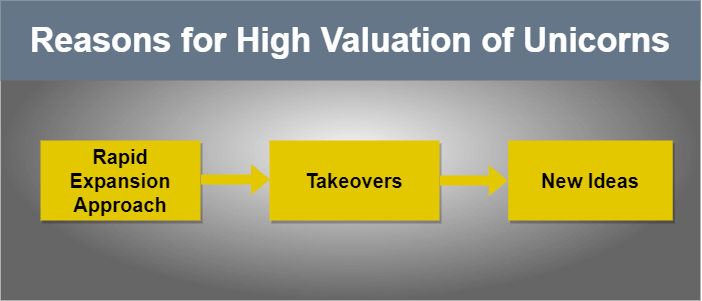

1. Rapid Expansion ApproachTo develop a business, venture funders now primarily rely on fast-growth tactics. Such techniques promote significant sums of money to be invested in each round of financing to gain the most effective potential market share as quickly as possible and prevent the creation of substantial competitors in the market. As a result, the worth of a unicorn firm skyrockets with each round of funding. 2. TakeoversMany potential firms currently need to fulfil the conditions for an IPO. Instead, internet behemoths like Facebook and Google purchase several startups to diversify their operations and prevent potential competitors from entering the market. Large corporations gain from the transactions since they may purchase existing technology rather than constructing something identical from the beginning. Because of the tremendous rivalry among the tech titans, they must give a considerable premium, which raises the valuation of target firms and creates unicorns. 3. New IdeasTechnological advancements enable firms to develop more quickly. Unicorn firms can reach their consumers faster and reduce the time necessary to attain mass manufacturing by exploiting new technology. Which sectors produce the most Unicorns?Specific industries, such as SaaS and other internet software applications like Slack, eCommerce marketplaces and financial technology, are increasingly popular for startup innovation. These industries provide easy chances to monetize and profit from a product or service by selling physical things or developing subscription-based services on which businesses rely. The success of firms like Uber has generated a spike in on-demand operations, and many others now strive to create 'the next Uber'. In this area, other unicorns include Uber's competitor Lyft, meal delivery service Deliveroo, and grocery delivery service Instacart. Healthcare, surprisingly, is a popular and lucrative industry. With advances in technology, such as artificial intelligence, there are now many possible ways for exciting new methods to cure ailments, locate treatments, and even extend lives. Successful firms include cancer detection inventors, GRAIL and DNA testing, & genetic analysis provider 23andMe. The Bottom LineUnicorns are often startup companies that grow rapidly with their unique innovation, product, or service. Because of the unique experience they offer, private investors or venture capitalists make moderate-sized investments in such startup companies. However, if these unicorns decide to go public and launch an IPO, the investors should keep a close eye on their growth. According to 2019 data, SV Angel spent the most money on early-stage companies, totalling more than $1 billion. Others believe that, since the Great Recession, a lot of money has been flooding into unicorns worldwide due to globalization and the way central banks manage capital. |

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share