Warren Buffett

Mr Warren Edward Buffett is an American business tycoon, philanthropist, and investor. He presently serves as Berkshire Hathaway's chairman and CEO. With a net worth of more than $98 billion as of July 2022, he was the eighth-wealthiest individual in the world and one of the most successful investors ever. Omaha, Nebraska, is where Buffett was born, dated on August 30, 1930. He was interested in business and investment when he was younger. When he was 19 years old, he transferred to the University of Pennsylvania's Wharton School to finish his studies. He eventually enrolled there. The University of Nebraska is where he obtained his degree. At Columbia Business School, where he finally earned an MBA, he developed his investment philosophy around the value investing idea made famous by Benjamin Graham. To focus his economics studies, he enrolled at the New York Institute of Finance, and soon after, he began collaborating with Graham on several business endeavours. He established Buffett Partnership, Ltd. in 1956. Then, using Berkshire Hathaway's name to create a diversified holding company, his company bought the textile manufacturer. In 1978, Charlie Munger was named Buffett's vice-chairman. Since 1970, Buffett has led the business as chairman and largest shareholder. The foreign press has referred to him as Omaha's "Oracle" or "Sage". Despite his vast wealth, he is recognized for his discipline and commitment to value investing. Buffett is a generous man who has committed to giving 99 percent of his fortune to good causes, mainly through the Bill & Melinda Gates Foundation. Together with Bill Gates, he established The Giving Pledge in 2010, under which millionaires promise to donate at least half of their fortune. Early Life and SchoolingLeila and Congressman Howard Buffett's only son, Buffett, was born in Omaha, Nebraska, in 1930. He was the second of Leila and Howard Buffett's three children. To begin his studies, he enrolled in Rose Hill Elementary School. Following the completion of his elementary education, Warren attended Alice Deal Junior High School after his family relocated as a result of his father's election campaign. Warren then graduated from what was then Woodrow Wilson High School in 1947 with the senior yearbook entry "likes math; a future stockbroker". Buffett wanted to bypass college and enter the business field right away after passing high school and seeing success with his side business enterprises and investment endeavours, but his father disagreed.

Buffett showed an early aptitude for business and investing. He borrowed the book One Thousand Ways to Make $1,000 from the Omaha Public Library when he was seven years old. Early in life, Buffett engaged in a lot of entrepreneurial endeavours. Selling chewing gum, Coca-Cola bottles, and monthly periodicals door to door was Buffett's first business venture. He was employed by the grocery owned by his grandfather. He delivered newspapers, sold golf balls and stamps, shiny cars, and more while he was still a high school student. Buffett and a friend put a vintage pinball machine they had purchased for $25 as a sophomore in high school in the neighbourhood barbershop during the year 1945. Within a short time, they had several machines at three barbershops throughout Omaha. Later that year, they sold their established business to war veterans for good money of $1,200. As a young boy, Buffett spent time in the customers' lounge of a local stock brokerage close to his father's own brokerage office, where he developed an interest in the stock market and trading. When he was ten years old, he visited New York City and saw the New York Stock Exchange. He bought six shares of Cities Service; preferred three for himself and three for his sister Doris Buffett. He was only eleven years old. At the age of 15, Warren began delivering Washington Post newspapers and made more than $175 a month. While still in high school, he invested in his father's business and bought a 40-acre farm run by a tenant farmer. When he was 14 years old, he used his savings of $1,200 to purchase the land. By the time Buffett received his undergraduate diploma, he had saved $9,800, around $112,000 in today's dollars. In 1947, Buffett enrolled in the University of Pennsylvania's Wharton School. His father convinced him to join even though he (Buffett) preferred to concentrate on his business endeavours. Warren spent two years there as a student and joined the fraternity Alpha Sigma Phi. He was transferred to the University of Nebraska when he was 19 years old and graduated with a Bachelor of Science in business administration. Buffett enrolled in Columbia Business School at Columbia University after being turned down by Harvard Business School and finding that Benjamin Graham was a professor there. In 1951, he received his Master of Science in economics from Columbia University. After graduating, Buffett enrolled in the New York Institute of Finance. The basic ideas of investing are to look at stocks as business, use the market's fluctuations to your advantage, and seek a margin of safety. That's what Ben Graham taught us. A hundred years from now, they will be the cornerstones of investing. - Warren Buffett Personal LifeBuffett fell over heels for a young woman in 1949 whose boyfriend played the ukulele. He purchased one of the instruments in an effort to compete, and he has been using it ever since. Despite the failure of the endeavour, Susan Thompson's life was greatly impacted by his interest in music, which ultimately led to their marriage. In addition to other occasions, Buffett frequently uses the instrument during stockholder meetings. Dave Talsma was contracted to make two unique Dairy Queen ukuleles because of his love for the instrument, and one of them was auctioned off for charity. In 1952, Buffett married Susan Buffett (formerly Thompson). Their three children, Susie, Howard, and Peter, were conceived. Although the couple separated in 1977, the pair remained wed until Susan Buffett passed away in July 2004. Susie, one of their children, works for a noble cause through the Susan A. Buffett Foundation, Omaha. At the age of 76, Buffett married Astrid Menks, a friend he had since his wife left him in 1977. At the time, she was 60 years old. Prior to her departure from Omaha to pursue her singing career, Susan set up a meeting between the two. Warren, Susie, and Astrid signed their Christmas cards to pals because they were all close. Just before she passed away, Susan gave a brief interview on the Charlie Rose Show in which she provided a tiny look into Buffett's personal life. Buffett disowned Nicole (adopted daughter of his son Peter) in 2006 after she had taken part in the Jamie Johnson film The One Percent, which highlighted the widening gap in wealth between the richest Americans and the rest of the population. In a letter to Nicole, Buffett claimed that neither he nor the rest of his family had "emotionally or legally adopted you as a granddaughter", despite the fact that Buffett's first wife had referred to Nicole as one of her "adored grandchildren."

Buffett's annual income in 2006 was around $100,000, which was low when compared to senior executive pay at similar businesses. He received $175,000 in total compensation in 2008, with a base salary of only $100,000. He kept residing in the same home in Omaha's central Dundee neighbourhood, which he had purchased in 1958 for $31,500-a small portion of its current market worth. He also had a second home in Laguna Beach, California, which he had bought in 1971 for $150,000. In 2018, he sold it for $7.5 million. Buffett gave the private plane he purchased with almost $6.7 million from Berkshire Hathaway the nickname "The Indefensible" in 1989. Buffett enjoys playing bridge (a trick-taking card game) with fellow admirer Bill Gates and is said to devote 12 hours a week to it. In 2006, he supported a bridge match for the Buffett Cup. Five male teams and one female team were provided by each country, and the teams were chosen based on invitation. It was modelled on the golf Ryder Cup, which occurred in the same city the day before it. He has been a lifetime, devoted fan of Nebraska football and went on to as many games as his schedule would allow. After the 2007 season, he backed the hiring of Bo Pelini, saying, "It was getting pretty desperate around here." After being appointed an honorary assistant coach, he watched the Nebraska sideline during the 2009's matchup with Oklahoma. Buffett later joined the American Philosophical Society as a member. Buffett collaborated with Christopher Webber and Andy Heyward, the head of DiC Entertainment, on the animated series "Secret Millionaires Club". Munger and Buffett appeared in the show, which helped kids learn wise financial practices. Buffett was brought up as a Presbyterian but now considers himself an atheist. According to a report from December 2006, Buffett did not own a computer for his desk, did not carry a mobile phone, and drove his own vehicle, a Cadillac DTS. In contrast, he declared he used Google as his favourite search engine during the 2018 Berkshire Hathaway shareholder meeting. He had a dated Nokia flip phone in 2013 and had never sent more than one email. Buffett is renowned for fusing humour and business talk in his lectures. Buffett attends Berkshire Hathaway's annual shareholder meeting every year, which is held in Omaha, Nebraska's Qwest Center and attracts over 20,000 people from domestic and international visitors, earning it the moniker "Woodstock of Capitalism". Berkshire's annual reports and letters to shareholders, which are frequently covered in the financial press, are written by Buffett. Buffett is noted for including references to the Bible and Mae West in his books. He also frequently includes jokes and offers advice in a folksy, Midwestern tone. Buffett, a shareholder in the corporation and a devoted Coca-Cola user, consented to have his image used on Cherry Coke goods in China in April 2017. Buffett received no money in exchange for this advertisement. Health of BuffetDuring a regular assessment on April 11, 2012, Buffett was recognized as having stage I (one) prostate disease. Midway through July, he declared he would start a two-month course of daily radiation therapy. In a letter to investors, Buffett expressed that he felt "extraordinary, as though he was in his typical magnificent wellbeing, and his energy level was 100 percent." Buffett later declared that he had finished the entire 44-day radiation treatment cycle on September 15, 2012, adding "it was a terrific day for him" and "he was very delighted to say it was over." Business CareerEarly Career in BusinessBuffett worked as a securities analyst and investment salesman at "Graham-Newman Corp." from 1954 to 1956, a general partner at "Buffett Partnership, Ltd." from 1960 to 1970, and chairman and CEO of "Berkshire Hathaway Inc." from 1970 to present. Buffett learned that Graham served on the GEICO insurance company board in 1951. He rode the train to Washington, D.C., where he waited for a steward to open the door of the GEICO corporate office after he repeatedly knocked on it. He met the vice president of GEICO there, named Lorimer Davidson, and the two spent hours talking about the insurance industry. Davidson, who later remembered meeting Buffett for only fifteen minutes, would go on to become Buffett's long-time friend and a significant influence. In the wake of getting back to Omaha, Buffett began functioning as a stockbroker and signed up for a Dale Carnegie public talking school. He was prepared to use what he had learned to instruct a "Venture Principles" night class at the University of Nebraska-Omaha. On average, his students were twice as old as he was. He made the disastrous side investment of buying a Sinclair petrol station around this time. In 1952, in the Dundee Presbyterian Church, Susan Thompson and Buffett were united in marriage. The following year, they had Susan Alice as their first child. In 1954, Buffett consented to join Benjamin Graham's partnership. His beginning pay was $121,000 (about $12,000 in today's dollars). Walter Schloss was a close collaborator of his there. Graham was a strict employer. After assessing the trade-off between a stock's price and its actual value, he was adamant that stocks offer a significant margin of safety. The Buffett family welcomed Howard Graham, their second child, in the same year. Benjamin Graham ended his partnership and retired in 1956. With about $174,000 in personal funds at the time (equivalent to $1.73 million today), Buffett founded Buffett Partnership Ltd. Buffett ran three partnerships in 1957. He spent $31,500 on a five-bedroom stucco home in Omaha, where he now resides. Peter Andrew Buffett was the third child born to the Buffett family in 1958. In that year, Buffett ran five partnerships. In 1959, the business expanded to six partnerships, and Buffett met Charlie Munger, a future business partner. Buffett ran seven partnerships by 1960. He requested one of his partners, a physician, to locate ten additional physicians eager to contribute $10,000 each to their business. Eventually, eleven of them came to an agreement, and Buffett combined their funds with his own initial commitment of just $100. As per Buffett, the Sanborn Map Company represented 35% of the organization's resources in 1961. In 1958, Sanborn stock was only sold for $45 per share, but the company's investment holdings were valued at $65 per share, he said. This indicated that the worth of Sanborn's map company was "minus $20". After being elected to the board of directors and paying out 23 percent of the company's outstanding shares as an activist investor, Buffett collaborated with other irate shareholders to take control of 44 percent of the stock. To prevent a proxy fight, the board suggested repurchasing shares at fair value using a portion of its investment holdings. A total of 77% of the outstanding shares were converted.

Pandemic COVID-19Buffet bemoaned that most people are unaware that the COVID-19 pandemic's economic impact has negatively affected "hundreds of thousands or millions" of small businesses in a June 2021 interview with CNBC. He then continued saying that the markets and the economy are likely to remain unstable far into the post-pandemic recovery period. Despite the US Federal Reserve and the Biden administration having a plan in place, he claimed that COVID-19's impacts and unpredictable nature were still being felt. Investment EthicThe writings of Warren Buffett include his annual reports and other publications. As seen by his yearly letters to shareholders, Buffett is regarded by communicators as a fantastic storyteller. He has issued a warning regarding the harmful impacts of inflation: The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital. It makes no difference to a widow with her savings in a 5 percent passbook account whether she pays 100 percent income tax on her interest income during a period of zero inflation, or pays no income taxes during years of 5 percent inflation. - Buffett, Fortune (1977) Buffett tested the effective market speculation, which asserts that beating the S&P 500 was "unadulterated possibility", in his article "The Superinvestors of Graham-and-Doddsville" by referring to the accomplishments of different supporters of the Graham and Dodd esteem money management way of thinking. Along with mentioning himself, Warren Buffett also mentioned Stan Perlmeter, Walter J. Schloss, Tom Knapp, Ed Anderson (Tweedy, Browne LLC), William J. Ruane (Sequoia Fund), Rick Guerin (Pacific Partners Ltd.), and Charlie Munger, his partner at Berkshire Hathaway (Perlmeter Investments). Wealth and Charitable DonatingWith an estimated net worth of close to $62 billion, Buffett was ranked as the richest person in the world by Forbes in 2008. With a net worth of $37 billion in 2009, Buffett was the second wealthiest person in the United States, behind only Bill Gates, after giving vast sums of money to charity. By September 2013, his net worth has increased to $58.5 billion. John Templeton and Peter Lynch were beaten out for the title of finest money manager of the 20th century by Buffett in a 1999's survey by the Carson Group. He was recorded by Time magazine as one of the main 100 world forces to be reckoned with in 2007. He got the Presidential Medal of Freedom from President Barack Obama in 2011. Buffett and Bill Gates were listed as the two most influential global thinkers in Foreign Policy's 2010 study. Buffett has written numerous times about his conviction that in a market economy, the wealthy receive disproportionately large rewards for their abilities. Not a lot of his fortune will be passed down to his children. He once said, "I want to give my kids just enough so that they feel like they can do anything, but not so much that they feel like doing nothing". In June 2006, Buffett announced a new proposal to donate 83 percent of his fortune to the Bill & Melinda Gates Foundation (BMGF). Buffett has previously indicated his intention to donate his money to charity. The best cause commitment in history was made by Buffett to the Bill and Melinda Gates Foundation, who got around 10 million Berkshire Hathaway Class B shares (esteemed $30.7 billion as of June 23, 2006). One of the founders of philanthrocapitalism is Buffett. The foundation will receive 5% of the amount each July beginning in 2006. The pledge is subject to the following three conditions:

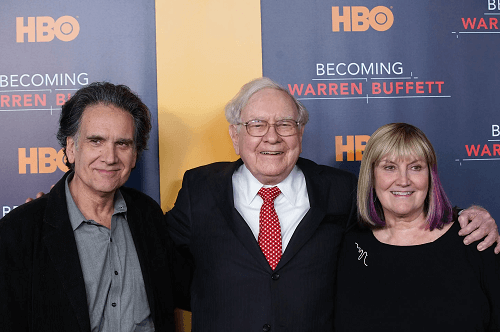

Television and MoviesBuffett has made several television appearances on different news programmes in addition to appearing in a great deal of fiction and documentary movies and TV shows. Among other movies and TV shows, his acting credits include Wall Street: Money Never Sleeps (2010), The Office (U.S.), All My Children, and Entourage (2015). He has appeared on Charlie Rose (a television-based interview talk show) numerous times, the BBC series The World's Greatest Money Maker and the HBO documentary Becoming Warren Buffett (2017).

Next TopicAristotle

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share