What are Commodity and Understanding its Role in the Stock MarketA commodity is a basic good used in commerce that is interchangeable with similar goods. Commodities are most commonly used as contributions to the development of various labor and goods. Following that, a commodity usually refers to a natural substance that is utilized to make finished goods. On the other hand, an item is the finished good made available to purchasers. The essence of a specific commodity may vary somewhat, but it is essentially identical between manufacturers. When products are transferred on a transaction, they should also meet certain minimum requirements, otherwise known as a premise grade.

Key Feature

Understanding CommodityCommodities are the raw data sources used in product creation. They might also be necessities such as specialized rural things. The significance of a commodity is that there is little, if any, the distinction between the commodities of one creator and those of another. A barrel of oil, regardless of manufacturer, is essentially the same thing. A bushel of wheat or a large amount of metal is the equivalent. Contrary to popular belief, the quality and features of a specific customer item will usually differ greatly depending on the manufacturer (e.g., Coke versus Pepsi). Commodities commonly used include cereals, gold, hamburger, oil, and petroleum gas. The concept has been expanded to cover monetary objects, such as unfamiliar forms and documents. Mechanical advancements have also resulted in exchanging of new types of goods in the commercial hub. For Example, PDA minutes and transmission capacity. Commodities can be exchanged as monetary resources on particular exchanges. There are also advanced subsidiary markets where you may buy contracts on such commodities (e.g., advances, prospects, and choices). Some experts believe that financial backers should keep at least a portion of their portfolio in commodities since they are not inextricably linked to other monetary resources and can operate as an expansion hedge. Commodity Buyers and ProducersCommodity transactions and acquisitions are frequently aided by prospect contracts on deals that standardize the quantity and type of the commodity being traded. For example, the Chicago Board of Trade (CBOT) defines a wheat contract as being for 5,000 bushels and specifies which grades of wheat can be utilized to fulfill the agreement. There are two sorts of traders that trade commodity futures. The first group consists of commodities buyers and producers who utilize commodity futures contracts for the intended purposes. For example, a wheat rancher who creates a yield can protect against the risk of losing money if the cost of wheat declines before the crop is gathered. The rancher can sell wheat prospect contracts when the yield is planted, ensuring a predetermined price for the wheat when it is harvested. When the fates contract expires, these merchants make or accept delivery of the true commodity.

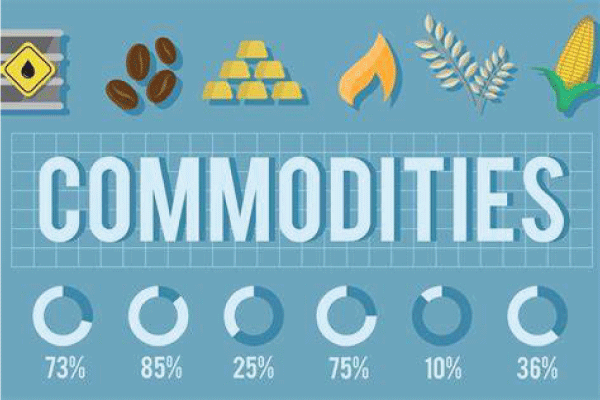

Commodities SpeculatorsThe examiner is the second type of commodities merchant. These are traders who trade commodities solely to profit from erratic price changes. When the futures contract ends, these merchants have no intention of producing or receiving actual products. Many potential marketplaces are incredibly fluid and have a high daily reach and unpredictability, making them extremely appealing business sectors for intraday traders. Many of the file destinies are used by financiers and portfolio managers to balance risk. Furthermore, because commodities often do not trade in tandem with the value and security markets, a few commodities can be utilized to diversify a speculative portfolio. Extraordinary ReflectionsCommodity costs usually climb when growth accelerates, so financial backers frequently flock to them for protection during expanded expansion - particularly shocking expansion. The cost of labor and goods rises in tandem with the increase in demand, and commodities are utilized to generate these goods and services, because commodity prices usually rise with economic growth, this resource class can frequently serve as a buffer against the cash's lost buying power. What Is the Relationship Between Commodities and Derivatives?The advanced commodities market relies heavily on ancillary securities such as futures contracts and forward agreements. Purchasers and merchants can execute successfully and in massive numbers without expecting to exchange actual commodities. Many buyers and dealers of commodity derivatives engage in speculation over the price changes of undiscovered commodities to achieve goals like risk mitigation and expansion insurance. What Determines Commodity Prices?Commodity costs, like other resources, are not determined by market interest. For example, a booming economy may increase the cost of oil and other energy commodities demand. Financial shocks, catastrophic catastrophes, and financial backer hunger may all impact the organic commodities market (financial backers might buy commodities as an expansion fence on the off chance that they anticipate that expansion should rise). Commodities of Various Types1. Agriculture

2. Energy Energy commodities include crude petroleum used in transportation and plastics production, combustible gas used in power generation, and gasoline, which powers light-duty trucks and automobiles. 3. Metals Metals include gold, which is used to make diamonds; silver, which is also used for ornamentation and a variety of other contemporary functions; and copper, the most widely used form of electrical wire.

Exchanges of CommoditiesCommodity exchanges play an important role in the economy, and it is unlikely that the United States would have had as much financial development over the twentieth century without them. The goal of exchanges is to provide an integrated commercial hub where commodity manufacturers - the plugs - may sell their commodities to those who want them for assembly or use. The benefit of a commodities prospective exchange is that it makes it easier to connect buyers and sellers. A corn rancher, for example, may lock in a price for their harvests long before they're harvested. This cycle increases rancher business longevity, and the exchanges often assure each dealer has a buyer. How do Commodities Trade?The majority of commodities are traded on commodity exchanges such as the New York Commercial Exchange (NYMEX), the Chicago Trade Exchange, the Chicago Leading body of Choices Exchange (CBOE), the Kansas City Leading group of Exchange, the Minneapolis Grain Exchange, and the Chicago Leading group of Exchange (CBOT). Financial backers may choose for anomalous openness via equities, exchange-exchanged reserves, and pooled reserves.

Differentiated ItemsCommodities and Differentiated products are traded on commodity markets, but they vary in several ways, as shown below. It is possible to exchange commodities, and it makes no difference where they are produced and what kind. This means that unrefined petroleum from one manufacturer is equivalent to raw petroleum from another. The merchandise can be linked without changing the character of the product. On the other hand, differentiated things are notable objects or those who despise the nonexclusive form of goods. Normal gasoline, for example, is evaluated consistently across all oil companies. Nonetheless, if they create supercharged fuel, the item ends out to be better than what the competitors are supplying. Role of Commodity in the Stock MarketA commodities market allows you to trade basic things, but the stock market allows you to swap stock businesses that provide manufactured goods to purchasers. Consider fundamental commodities the manufacturers of the raw materials required to create the products they sell to customers. Regular assets, for example, oil, are considered a characteristic of the items since they are raw assets supplied to producers and merchants before stirring things up in the local market.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share