What Are Financial Statement Assertions?Understanding Financial Statement AssertionsAssertions made by companies regarding the accuracy of the information in their financial statements are known as financial statement assertions. Among these statements are the cash flow statement, income statement, and balance sheet. These declarations, also called management assertions, may be implicit or outright.

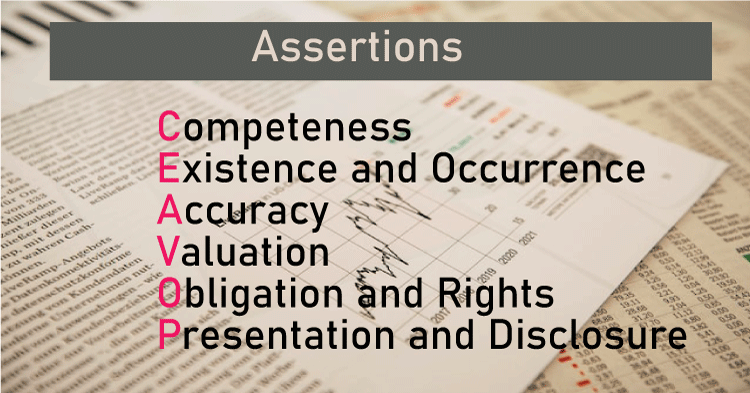

So, why are the assertions in corporate financial statements important? They serve as the formal declaration that the presented statistics accurately depict the company's assets and liabilities in accordance with the relevant rules for their measurement and recognition. In this post, we examine each claim and explain what it means. How do they work?As was already said, a company's financial statement claims serve as a seal of approval, certifying that the data in its financial statements accurately reflect its financial status. This applies to every asset and obligation that appears on the balance sheet, income statement, cash flow statement, and any other information contained therein. Investors need to pay attention to these claims. This is because data from these financial statements are utilized to calculate almost every financial indicator used to assess a company's stock. Financial indicators that analysts and investors frequently use to assess companies, such as the price-to-book ratio (P/B) or profits per share, would be deceptive if the statistics were wrong. In the US, accounting rules are set by the Financial Accounting Standards Board (FASB). Companies are required to adhere to these rules while creating their financial statements. The Generally Accepted Accounting Standards (GAAP) must be used to create financial statements for publicly listed corporations, according to the FASB. A company's statement preparer typically attests to five separate financial statement statements. They include claims of existence, completeness, rights and duties, accuracy and valuation, as well as presentation and disclosure. This article includes more information on each of these claims.

Accuracy and Valuation Financial Statement AssertionsThe accuracy and valuation assertions are two key financial statement assertions related to the account balances of an organization. These assertions are critical to ensuring the accuracy and reliability of financial statements, and they provide stakeholders with confidence in the financial information presented. Accuracy AssertionThe accuracy assertion confirms that the ending account balances presented in the financial statements are accurate and compliant with GAAP. This assertion is critical because inaccuracies in account balances can lead to misstatements in the financial statements, ultimately resulting in stakeholders' incorrect decision-making. Organizations typically employ various controls and procedures to ensure the accuracy of account balances. These may include regular reconciliations of accounts, review, approval of journal entries, and use of automated accounting systems to minimize errors. Valuation AssertionThe valuation assertion confirms that the values assigned to assets, liabilities, and equity balances in the financial statements are valid and in compliance with GAAP. This assertion is critical because the valuation of account balances can have a significant impact on an organization's financial statements and, ultimately, on its reputation and valuation, impacting overall decision-making by stakeholders. Valuation requires careful consideration of various factors, such as the historical cost of assets, the fair market value of assets and liabilities, and the accounting policies used to calculate values. Different accounting policies can result in different valuations of assets and liabilities, so it is important to use consistent and appropriate policies to ensure accurate valuations. To support the valuation assertion, organizations typically use a range of controls and procedures, including regular reviews of accounting policies, independent experts to evaluate values, and ongoing monitoring and assessment of the market conditions that affect asset and liability values. ExistenceThe existence of financial statement assertion confirms that the assets, liabilities, and equity balances presented in the financial statements exist and are valid. This assertion is critical because it assures stakeholders that the organization has the assets, liabilities, and equity balances it claims to have and that they are not fictitious or fraudulent. To support the existence assertion, organizations typically use a range of controls and procedures, including physical verification of assets, review of supporting documentation for liabilities, and confirmation of account balances with external parties such as banks, suppliers, or customers. For example, organizations may conduct physical inventory counts to verify the existence of inventory, or they may obtain confirmation from banks to verify the existence of cash balances. Existence assertions are particularly important for assets that have a physical existence, such as inventory, property, and equipment. It is also important for financial assets, such as investments or accounts receivable, which can be more difficult to verify. In both cases, organizations may use additional procedures, such as third-party evaluations of investments or review of customer payment histories, to verify accounts receivable. When supporting the existence assertion, it is important for organizations to maintain appropriate documentation and record-keeping, such as purchase orders, invoices, receipts, and bank statements. The valid documentation provides evidence that assets, liabilities, and equity balances actually exist and are valid. CompletenessThis claim or assertion confirms that the financial statements are complete and contain all information that must be disclosed for a certain accounting period. The claim of completeness further emphasizes that the total inventory number shown on a financial statement includes a company's entire inventory, including goods that may be momentarily in the custody of a third party. When a financial statement is described as being "complete", it means that it includes all of the transactions that occurred during the accounting period it covers and that all of the transactions that are contained in it occurred during that period. One may run specific tests to make sure that everything is complete. Among these include reconciling payables to supplier statements and reviewing accounts. Rights and ObligationsAccording to the fundamental claim of rights and obligations, all assets and liabilities listed in a financial statement belong to the corporation delivering the statement. In other words, the company certifies that it is fully authorized by law and possesses all rights to the assets and liabilities disclosed in the financial accounts. According to the rights and obligations statement, the corporation owns and holds all recognized assets' ownership rights or usage rights. It is a statement stating that, in the event of liabilities, all obligations included in a financial statement belong to the company and not to a third party. Reviewing legal papers, such as deeds and borrowing agreements for loans and other debts, can allow you to verify this claim's veracity. Presentation and DisclosureThe final assertion in a financial statement is presentation and disclosure. This is the assertion that states that a company's financial statements are accurate and easy to comprehend and that they include all required disclosures and information. Another way to describe this claim is as an assertion of comprehension. Using specific checklists, several professionals investigate and assess the accuracy of this assertion. This enables verification that the financial accounts under scrutiny adhere to the norms and standards of accounting. What do assertions in Financial Statements mean?Companies who testify that the data on their financial statements is genuine and correct make financial statement assertions. Corporate balance sheets, income statements, and cash flow statements provide data pertaining to such allegations. There are mainly five assertions: existence, completeness, rights and obligations, presentation and disclosure, and accuracy and valuation. Which accounting assertions are most often made?The creators of financial statements often make five accounting claims/ assertions. These are existence, completeness, rights and obligations, accuracy and valuation, and presentation and disclosure. Accounting Management Assertions: What are they?Financial statement preparers might make statements that are either implicit or explicit in their accounting management representations. These assertions certify that the preparers followed applicable laws and accounting standards in compiling the financial statements. Do the financial accounting assertions made by the auditor really matter?Financial accounting claims/ assertions are an essential part of auditing because there are no other means of holding people responsible for financial statement creation accountable. By signing and attesting to the accuracy of the claims in the statement, the person who prepares the paper essentially grants his/ her endorsement. The Bottom LineFinancial statement assertions are an essential component of financial reporting and auditing. They provide a framework for organizations to ensure that their financial statements accurately and fairly represent their financial position and performance. The existence assertion confirms that assets, liabilities, and equity balances presented in the financial statements actually exist and are valid. The assertion of completeness attests to the inclusion of all transactions and account balances required for the financial statements. Account balances are correctly declared and valued thanks to the accuracy and valuation assertions. These claims give interested parties the ability to make decisions that are well-planned and supported by trustworthy financial data. By focusing on financial statement assertions and supporting procedures, organizations can maintain transparency and accountability, promote effective decision-making, and build trust and credibility with stakeholders.

Next TopicWhat Is Accounting Fraud

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share