What Did Enron Do?Understanding Enron

One of the largest accounting scams in history was committed by the Houston, Texas-based energy trading and utility business Enron. The leaders of Enron used accounting techniques to exaggerate the business's revenues artificially, temporarily elevating it to become the seventh-largest firm in the U.S. The business swiftly fell apart when this scam was discovered, and in December 2001, it filed for Chapter 11 bankruptcy. In 1986, Houston Natural Gas Firm and Omaha-based InterNorth Incorporated merged to become the energy company Enron. Kenneth Lay, who had previously served as CEO of Houston Natural Gas, was named CEO and chairman of Enron following the merger. Lay transformed Enron into a trader and provider of energy very fast. Energy market deregulation made it possible for businesses to wager on future prices. Lay founded Enron Finance Corporation in 1990 and appointed Jeffrey Skilling as CEO after being pleased with his consultancy work for McKinsey & Company. Skilling was one of McKinsey's youngest partners at the time. Around the world, Enron offered a range of energy and utility services. Its business divided activities across several significant departments, including:

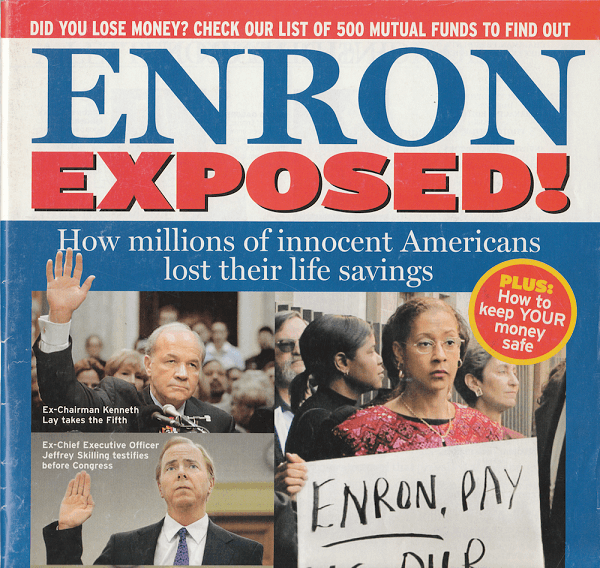

Enron soon became one of the world's most prosperous businesses by using special purpose corporations, special purpose vehicles, market-to-market accounting, and financial reporting loopholes. After the scam was discovered, the company went out of business. Shares of Enron reached a high of $90.75 before the fraud's discovery but fell as low as $0.26 during the subsequent sell-off. Enron's ScandalEnron was secretly forging financial documents and exaggerating the company's profitability before it was discovered. Despite the company's operational success in the 1990s, its wrongdoings weren't fully revealed until 2001. Pre-ScandalBefore the millennium, Enron's company seemed to be flourishing. In 1992, the corporation became North America's biggest natural gas supplier. A few months before 2000, Enron created Enron Online, a trading website allowing improved contract administration. A major factor in the company's quick expansion into foreign markets was its 1998 merger with Wessex Water. For most of the 1990s, Enron's stock price was largely tracked under the S&P 500. But as time went on, the company's hopes skyrocketed. The company's shares rose 56% in 1999. It climbed by a further 87% in 2000. Both returns significantly outperformed returns for the broad market, and the company soon traded at a 70x price-earnings ratio. Early Warning SignsKenneth Lay resigned as chief executive officer in February 2001, and Jeffrey Skilling took his place. August 2001, a little more than six months later, saw Skilling relinquish his position as CEO, and Lay retook it. Enron Broadband reported significant losses around this period. In the company's Q2 2001 financial report, Lay stated that "in contrast to our exceptionally excellent energy performance, this was a tough quarter in our broadband operations." The department of Broadband Services recorded a $102 million financial deficit for this quarter. Around this time, Lay also made a $2 million profit by selling 93,000 shares of Enron stock while continuing to urge staff to buy the stock via email and forecasting sharply rising share values. Ultimately, it was discovered that Lay had sold more than 350,000 Enron shares for a total gain of more than $20 million. Sherron Watkins had highlighted worries about Enron's financial reporting procedures at this time. She wrote an anonymous letter to Lay as an Enron vice president voicing her worries. When Watkins and Lay finally met to talk about the issues, Watkins presented a six-page report outlining her concerns. An independent law firm and Enron's accounting firm were consulted, and both concluded there were no problems. By the end of October 2001, Enron had recorded a third-quarter loss of $618 million. Enron said that it would need to restate its financial accounts from 1997 to 2000 in order to correct accounting problems. BankruptcyEnron's route to bankruptcy was virtually set in stone when credit rating agencies downgraded the company's credit rating to junk status on November 28, 2001. The day Enron was trying to combine with Dynegy, the other energy business, Dynegy made the decision to end all talks and reject any merger deal. By day's end, the price of Enron's stock had fallen to $0.61. Enron Europe was the first domino, declaring bankruptcy on November 30 following the conclusion of its business position. On December 2, the rest of Enron's businesses did the same.

Enron fired Arthur Andersen as its auditor at the beginning of the following year, claiming that the auditor had advised it to shred documents and destroy evidence. Prisma Energy, the company's final venture, was sold in 2006. The next year, in order to repay the remaining creditors and open liabilities as part of the bankruptcy procedure, the company changed its name to Enron Creditors Recovery Corporation. Criminal Charges in regard to BankruptcyThe new board of directors sued 11 financial institutions after Enron executives' unethical business practices were kept hidden in 2004 after the company emerged from bankruptcy. As part of the legal settlements, Enron received about $7.2 billion from these financial institutions. The Royal Bank of Scotland, Deutsche Bank, and Citigroup were among the banks listed under these institutions. Kenneth Lay entered a not-guilty plea to all eleven counts. He was sentenced to a maximum of 45 years in prison after being found guilty of six securities and wire fraud charges. Lay passed away on July 5, 2006, just before the sentence was to take place. In addition to additional allegations of insider trading, Jeff Skilling was found guilty on 19 of the 28 counts of securities fraud of which he was accused. He was given a sentence of 24 years and four months in jail, but in 2013, the U.S. Department of Justice and Skilling negotiated an agreement that reduced his sentence by ten years. Andy Fastow and his wife, Lea, entered guilty pleas to the allegations brought against them, including conspiracy, insider trading, fraud, and money laundering. Fastow was given a 10-year prison term with no chance of release in exchange for providing evidence against other Enron leaders. Since then, Fastow has been freed from jail. Why did the Enron scandal happen?Enron went to considerable measures to improve its financial reports, cover up its deception, and describe complicated organizational structures in order to mislead investors and hide information. The following elements are only a few of the ones that contributed to the Enron scandal: Specialized Automobiles or SPVs (Special Purpose Vehicles)Utilizing special-purpose vehicles, Enron created a complex organizational structure. By engaging in "transactions" with these organizations, Enron was able to borrow money without having to list it as debt on its balance sheet. By having a sponsoring firm own assets, SPVs do offer a legal way for businesses to temporarily protect a principal company. The sponsor firm might thus possibly get less expensive financing than the main corporation (assuming the primary company may have credit issues). This structure also offers tax advantages and legal protection. The usage of SPVs was not transparent, which was the main problem with Enron. For money or a note payable, the corporation would transfer its own shares to the SPV. The shares would then be used by the SPV to protect a valuable asset from Enron's balance sheet. As soon as the value of the company's stock began to decline, it ceased to offer enough security to be used as collateral by SPV. Inaccurate Financial Reporting PracticesMany customer contracts and relationships were misrepresented by Enron. It was able to record transactions improperly, not just against GAAP (Generally Accepted Accounting Principles) but also against agreed-upon contracts, by working with other parties like its auditing company. For example, Enron categorized one-time sales as regular revenue. Furthermore, in order to avoid recording a write-off during a specific period, the business often purposely kept an expired agreement/ contract through a specific time period. Negligently Designed Compensation AgreementsFinancial incentive agreements between Enron and its employees were frequently based on short-term sales and the volume of deals closed. Additionally, the actual cash flow from the sale was not taken into account in many incentives. While high management typically got large incentives connected to financial market performance, employees were also compensated depending on the success of the company's stock price. The extremely rapid growth in Enron's equity success contributed to this problem. The stock's price on December 31, 1999, was $44.38. On March 31, 2000, three months later, it closed at $74.88. The enormous profits some employees made when the stock reached $90 by the end of 2000 only stoked interest in acquiring ownership stakes in the business. Absence of Independent SupervisionAlthough many outside parties were made aware of Enron's dishonest business practices, they probably did nothing because of their financial links to the organization. Enron's accounting company, Arthur Andersen, was compensated financially and with several employments. Investment bankers received commissions from Enron's business transactions. In exchange for better ties between Enron and those institutions, buy-side analysts were often paid to advocate certain ratings. Market Expectations that aren't RealisticBecause of the development of the Internet and the rise in retail demand, Enron Energy Services and Enron Broadband were both expected to be profitable. However, Enron's overconfidence led to the company making unrealistically high promises about its services and delivery times. Inadequate Corporate GovernanceEnron's final demise was brought on by generally poor corporate leadership and corporate governance. Sherron Watkins, a former vice president of corporate development, is renowned for speaking out about different financial treatments as they were taking place. Top executives and management, however, purposefully disregarded and ignored complaints. This leadership style established the standard for accounting, finance, sales, and operations. Mark-to-Market Accounting's FunctionMark-to-market accounting contributed to the Enron catastrophe in another way. A way of valuing a long-term contract using fair market value is known as mark-to-market accounting. The value of the long-term asset or contract may change at any time; in such a circumstance, the reporting business would simply "mark" its financial records up or down to reflect the current market value.

Mark-to-market accounting has two conceptual problems, both of which Enron exploited. First of all, mark-to-market accounting primarily relies on management judgment. Consider a lengthy, intricate contract that calls for the international distribution of several energy sources. It was simple for Enron to artificially inflate the contract's worth since these contracts were not standardized to be like other contracts, and it was challenging to accurately estimate the market value. Second, mark-to-market accounting mandates that businesses regularly assess the worth and probability of revenue collection. Companies that don't regularly assess the contracts worth risk overestimating the amount of money they may anticipate bringing in. Mark-to-market accounting allowed Enron to recognize multi-year contracts in advance and record all profits in the year the contract was signed rather than when the service would be rendered or the money would be collected. Enron was able to seem far more lucrative than its actual cash flow because of the reporting of unrealized gains that bloated its income statement. What occurred with Enron?With assets totaling $63.4 billion, the Enron bankruptcy was the biggest ever. The company's demise shook the financial markets and almost caused the energy sector to collapse. Financial and legal experts stated that even if senior corporate officials designed the false accounting systems, they could never have gotten away with it without the assistance of outsiders. Credit rating companies, investment banks, and the Securities and Exchange Commission (SEC) were all charged with aiding Enron's fraud. The SEC, which the U.S. Senate found culpable for its systemic and catastrophic lack of oversight, was first the target of a lot of the finger-pointing. According to the Senate's investigation, the SEC would have seen the warning signs and possibly stopped the enormous losses suffered by employees and investors had it looked at any of Enron's annual reports published after 1997. Prior to assigning an investment-grade rating to Enron's bonds just before the company filed for bankruptcy, the credit rating agencies were discovered to be equally complicit. In the meantime, the investment banks had assisted Enron in receiving favorable stock analyst reports, which promoted its shares and attracted billions of dollars in investment into the company. Enron paid the investment banks millions of dollars in exchange for their assistance. The CEO's Role at EnronJeffrey Skilling was the CEO of Enron when the company began to fail. Skilling was crucial in transitioning Enron's accounting from a traditional historical cost accounting method to mark-to-market accounting, for which the company received official SEC approval in 1992. Skilling directed the firm's accountants to remove debt from Enron's balance sheet, creating a false gap between the debt and the business that incurred it. Enron continued to utilize similar accounting methods to conceal its debt by moving it on paper to its subsidiaries. Regardless, the corporation continued to report income from these subsidiaries. As a result, despite major breaches of GAAP laws, the general public, and especially investors, were led to believe that Enron was functioning better than it was. Skilling resigned unexpectedly in August 2001, less than a year after taking over as CEO and four months before the Enron affair erupted. According to sources, his departure surprised Wall Street experts and aroused suspicions, despite his assurances at the time that it had "nothing to do with Enron". In 2006, Skilling and Kenneth Lay were both charged with and convicted of fraud and conspiracy. Other CEOs have also pleaded guilty. Lay died in jail shortly after his sentencing, while Skilling received the longest term of any Enron defendant, which was for twelve years. The Enron LegacyFollowing the Enron scandal, the term "Enronomics" came to refer to innovative and frequently fraudulent accounting techniques in which a parent company engages in fictitious, paper-only transactions with its subsidiaries in order to conceal losses incurred by the parent company through other business activities.

Enron's parent company disguised its debt by transferring it (on paper) to wholly-owned subsidiaries, many of which were named after Star Wars characters, but it continued to generate profits from the subsidiaries, giving the impression that Enron was operating much more efficiently than it was. Another word inspired by Enron's downfall was "Enron" slang, meaning "being badly impacted by improper activities or choices by high management". Any stakeholder, such as workers, shareholders, or suppliers, might be "Enron". For example, someone has been "Enroned" if they lost their job because their employer was shut down due to illegal activities in which they had no part. In the aftermath of Enron, officials established a raft of additional precautions. The Sarbanes-Oxley Act of 2002, for example, seeks to increase corporate transparency and prosecute financial malfeasance. The Financial Accounting Standards Board (FASB) guidelines were also toughened in order to reduce the use of dubious accounting techniques, and company boards were expected to take on greater responsibility as management watchdogs. What acts of unethical behavior did Enron commit?Mark-to-market accounting and special purpose organizations were employed by Enron to conceal debt from its balance sheet and inflate revenue. Additionally, while knowing that its publicly declared financial condition was inaccurate, it disregarded internal advice against these activities. What was the size of Enron?Enron was originally valued at roughly $70 billion, with shares trading for around $90 each. The corporation employed nearly 20,000 people prior to its bankruptcy. In addition, the corporation generated net sales of more than $100 billion (though this figure has since been determined to be incorrect). Who was responsible for Enron's demise?Several prominent members of the management team are frequently blamed for Enron's demise. Among the executives are Kenneth Lay (founder and former Chief Executive Officer), Jeffrey Skilling (former Chief Executive Officer who succeeded Lay), and Andrew Fastow (former Chief Financial Officer). Is Enron still in business?Enron declared bankruptcy in 2004 as a result of its financial crisis. The entity's name was officially changed to Enron Creditors Recovery Corp. as part of the bankruptcy process, and the company's assets were sold and reorganized. Its most recent investment, Prisma Energy, was also sold in 2006. The Bottom LineAt the time, Enron's downfall was the greatest corporate bankruptcy to ever affect the financial world (since then, the failures of WorldCom, Lehman Brothers, and Washington Mutual have surpassed them). The Enron scandal exposed accounting and corporate fraud, as shareholders lost tens of billions of dollars in the years leading up to the company's bankruptcy, while employees lost much more in pension benefits. Increased regulation and monitoring have been implemented to help prevent business scandals on the scale of Enron. However, many businesses are still being affected by Enron's collapse.

Next TopicWho Was Adam Smith

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share