Understanding the Cash Flow StatementWhat exactly is a Cash Flow Statement?The cash flow statement (CFS) refers to a financial statement that details a company's cash flow and cash equivalents (CCE) coming in and going out. The CFS helps assess a company's capacity for handling its cash position or how effectively it generates cash to pay debts and meet operating expenses.

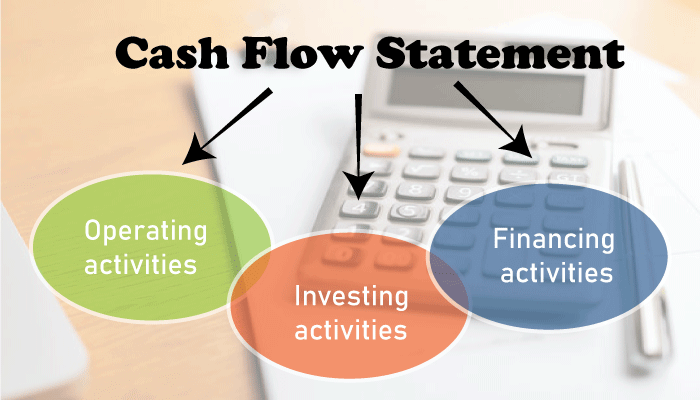

What are the components of the Cash Flow Statement?The main components of the cash flow statement are discussed below:

Cash from Operating ActivitiesIt comprises all financial flows and expenditures resulting from business operations. It reflects the monetary value of a company's products or services. Receipts from the sale of loans, debt, or equity instruments are accounted for in the case of a trading portfolio or an investment firm since they are a form of business activity. Cash from Investing ActivitiesInvestment activities encompass all the sources and cash applications created by a company's investments. This category comprises asset purchases and sales, vendor or customer loans, and payments associated with mergers and acquisitions (M&A). Changes in equipment, assets, or investments, in a nutshell, are linked to cash from investments. Cash-out items typically show changes from the investment when cash is utilized to acquire new equipment, buildings, or short-term assets such as marketable securities. When a corporation sells an asset, the transaction is termed cash-in, calculating the overall cash from investment. Cash from Financing ActivitiesCash received from investors and banks and cash given to shareholders constitute cash from financing operations. This includes dividends, stock buyback payments, and principal debt repayment (loans). When measuring changes in cash due to financing events, cash-in is when capital is generated, and cash-out is when dividends are paid. As a result, if a corporation issues a public bond, it will obtain cash funding. But nonetheless, when bondholders receive interest, the company's financial reserves are drained. Because interest is a cash-out item, it is shown as an operational expenditure rather than a finance expense. How is cash flow calculated?Understanding what a cash flow statement is and why it's important for financial analysis is crucial. There are two methods of calculating cash flow, such as: Direct Cash Flow MethodIt includes money paid to suppliers, collected from consumers, and distributed to employees. This CFS technique is easier for small enterprises that employ cash basis accounting. With this approach, values can also be computed by comparing the opening and closing balances of different asset and liability accounts. It is presented in an uncomplicated manner. Indirect Cash Flow MethodThe indirect technique computes cash flow by modifying net income by adding or removing non-cash transaction differences. Balance-sheet assets and liabilities that change over time are known as non-cash items. Consequently, the accountant will note any changes to asset and liability accounts that need to be added to or deducted from the net income number to compute the correct cash inflow or outflow. Changes in balance-sheet accounts receivable (AR) must be represented in cash flow from one accounting period to the next:

What about a company's inventory fluctuations? They are accounted for on the CFS as follows:

Taxes, salaries, and prepaid insurance all follow the same concept. If a person pays off debt, the amount owed yearly must be reduced from net income. All discrepancies must be added to net earnings if an outstanding balance exists. How to interpret a Cash Flow Statement?While examining any financial statement, it is important to analyze it from a business standpoint. Financial records give information about a company's financial health and condition. Cash flow figures may tell if a company is in its early stages or is mature and lucrative. It may help detect if a firm is going through a change or declining. With this data, an investor may conclude that a firm with uneven cash flow is too potentially dangerous to invest in or that a company with positive cash flow is poised for growth. Similarly, specific department heads may examine a cash flow statement to see how their specific departments contribute to the company's health and well-being and then utilize that information to change their departments' actions. Internal choices like budgeting and employing (or terminating) personnel are also influenced by cash flow. Cash flow is often shown as either positive (the firm receives more cash than it expends) or negative (the business expands more cash than it receives). Positive Cash FlowIt implies that a corporation has more money pouring into it than out of it during a particular period. This is a good position since having extra income allows the firm to reinvest in itself and its shareholders, settle debt payments, and identify new methods to develop the organization. Yet, positive cash flow only sometimes converts into profit. A company may succeed without a positive cash flow, and you can have a positive cash flow without earning a profit. Negative Cash FlowIt implies that the cash outflow exceeds your cash inflow within a given period. Yet, this only sometimes means a loss of profit. Alternatively, a mismatch between expenditure and income may be causing negative cash flow, which should be remedied as soon as feasible. A firm's choice to expand its operations and invest in future growth can also create negative cash flow. Therefore it's critical to examine variations in cash flow from one quarter to the next, as they can reflect how a company performs overall. Cash Flow Statement vs. Income Statement vs. Balance Sheet

What is the importance of a Cash Flow Statement?Cash flow statements are one of the most important financial records that a company creates, providing vital insight into the business's health. One may improve their financial accounting abilities and make better business and investment decisions by learning how to read a cash flow statement and other financial papers, regardless of whatever position one might be in. The Bottom LineA cash flow statement is a key measure of a company's health, profitability, and long-term prospects. A company may use a CFS to estimate future cash flow, which benefits budgeting. Still, this is a simple rule. Expanding a company's operations as part of its growth plan may sometimes result in a negative cash flow. Investors value the CFS because it reveals if a firm is financially sustainable. Consequently, investors might be able to utilize the statement to make more educated financial decisions.

Next TopicWhat Are Financial Statement Assertions

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share