What is CVV code?In this article, we are discussing CVV along with its importance, benefits, and drawbacks. Here, we discuss some of the frequently asked questions for the CVV, and we will also mention how to protect the CVV number. Hope, this article will be highly beneficial for you to understand the facts about CVV. CVVCVV is the short form for "Card Verification Value". The CVV number written on a debit card or credit card is said to be a unique 3-digit number that is required to complete the transaction. Along with other numbers on your card, CVV number is also a vital number on your credit or debit card. Although the CVV number is required to perform the online transactions with cards, along with that CVV number also provides the added security against scams. Every credit card company has its own name for it like as follows - CID (stands for "Card Identification Number"), CSC (stands for "Card Security Code"), CVV2 (stands for "Card Verification Value Code"), CVC or CVC2 (stands for Card Verification Code). Note: Do not get confused if an online merchant asks for CIN, CSC, CVC, or even for CVV2. All these terms are the different names of the CVV number.The difference is not limited to the names, but also some companies use three-digit security codes, while some have four-digit. As an instance, VISA, Mastercard, and Discover use a 3-digit code, and American Express has a four-digit security code. Where can I find the CVV code?The Mastercard, VISA, and Discover cardholders have the CVV code on the backside of their card. On the backside of your card at the signature box, you can either see the complete 16-digit card number or just the last 4-digits of your card number followed by a special 3-digit code. This 3-digit code is your CVV number. For the American Express cardholders, there is a 4-digit code printed on the front-side of your card which is just above and to the right of card number. This 4-digit code is said to be the CID (i.e., Card Identification Number). In the below image, you can see the CVV number on the card -

Card's secret pin is not the CVV numberCVV number is present on the magnetic stripe on the backside of the card. CVV number is different from PIN (Personal Identification Number) number. We do not have to enter the CVV number while asking for entering the PIN number. PIN allows us to use our debit and credit card at an ATM, or it also allows us to make an in-person purchase with the debit card or a cash advance with a credit card. On the other hand, the CVV number allows us to make online payments.

What if someone swipes his/her card?It is fortunate to say that unlike other card details, the CVV number cannot be stored while swiping or punching online. Mainly, credit and debit cards are useful for online transactions or for other virtual payment gateways. It is good to say that these portals are not allowed to keep any data about CVV number. This is because saving the CVV information is against the Per Payment Card Industry Data Security Standards. So, even if the vendor has all the other card details, they still cannot access the CVV number of the cardholder. This makes it impossible for anyone to misuse the information of your debit or credit card. Therefore, if there will be a violation in the data security of card issuing company, the CVV number is not stored in the databases. This makes it impossible to make an online transaction by using your credit or debit card information without a CVV number. Therefore, it is difficult to use your account to make unauthorized purchases whether someone obtains your card number without the CVV number. What are the drawbacks of CVV number?Although the CVV number is an added layer of security that makes fraud difficult, but not impossible. The drawback of the CVV number includes that if the credit or debit card is completely replicated with the magnetic stripe and the fraudster has access to the CVV number, then, in this case, your card can easily be misused. CVVs are also susceptible to phishing attacks when scammers use duplicate websites or fraudulent emails to trick cardholders to get their card information and security codes. The most common scam that we see in our day-to-day life is spoofed texts or phone calls that look like they are coming from the credit card or debit card company, and they usually ask for the information of your CVV code to verify a recent purchase. If someone receives a similar communication, he/she must ignore it and have to call the card issuer. Now, let's see some of the ways to protect the CVV number. How can I protect my CVV number?Here, we are listing some of the ways to protect your CVV number.

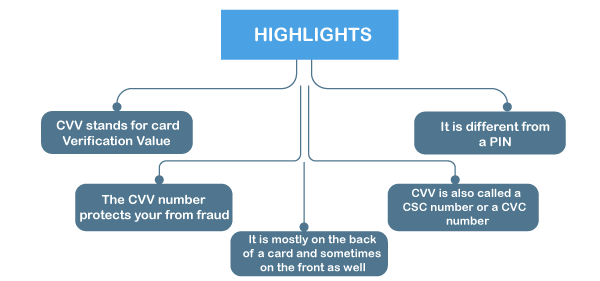

Points to rememberFrom this article, you are surely aware of the role that the CVV number plays on your debit card or credit card. We hope this article has been helpful to you with respect to the CVV number on debit or credit card. Now, let's see some of the highlights of the article in the below image.

In the above image, you can see the important points with respect to the CVV number. All of the points mentioned in the image are discussed in the article.

Next TopicWhat is Data hiding

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share