Working Capital DefinitionWorking capital, often known as net working capital, is the distinction between a business's current assets and current liabilities. A company's working capital is a gauge of its liquidity and immediate financial stability. If a company's current assets to liabilities ratio are lower than one, it has negative working capital (or it has more current liabilities than current assets). A corporation with sufficient working capital is able to finance its ongoing operations and its expansion plans. It's only sometimes a good thing to have a high working capital. That can mean that the company has too much inventory, isn't spending its extra income, or needs to take advantage of opportunities for low-cost debt. Estimates of working capital are based on the variety of assets and liabilities on a company's balance sheet. A corporation can better comprehend what kind of liquidity it will have in the near future by focusing just on current debts and offsetting them with the most liquid assets. Working capital is another indicator of a business's operational effectiveness and immediate financial stability. A corporation may have the ability to invest in growth and expansion if it has a sizable positive NWC. A corporation may struggle to expand or repay creditors if its current assets do not surpass its current liabilities. It may even file for bankruptcy. Often, the industry a company operates in will determine how much working capital it has. Because they don't have the quick inventory turnover needed to produce cash on demand, some industries with longer production cycles may have greater working capital requirements. In contrast, retail businesses that deal with thousands of consumers every day may frequently raise short-term financing considerably more quickly and have fewer working capital needs. Components of Working CapitalThe balance sheet of a corporation contains all of the working capital components, even if a company may not need all of the components described. For instance, a service provider that does not maintain inventory will omit inventory from its working capital calculation entirely. Cash, accounts receivable, inventory, and other assets that are anticipated to be sold or converted into cash in less than a year are listed under current assets. Accounts payable, wages, taxes owed, and the current portion of long-term debt that is due within a year are all examples of current liabilities. Current AssetsThe business anticipates receiving economic gains in the upcoming 12 months are known as current assets. The calculation of working capital assumes that the company will convert all of the below-listed assets into cash in the hypothetical case where it has a claim or right to obtain the financial benefit.

Current LiabilitiesThe debts a corporation owes or will be due within the next 12 months are collectively called current liabilities. The main objective of working capital is to understand whether a firm will be able to pay off all of these loans with the short-term assets it already has on hand.

Shortcomings of Working CapitalWorking capital can be a useful indicator of a business's immediate health. Unfortunately, the method has significant drawbacks that can render the statistic occasionally inaccurate. First of all, working capital is dynamic. When a business is fully operational, several, if not most, current asset and current liability accounts are likely to alter. As a result, by the time financial data is gathered, the company's working capital position has probably already altered. Working capital disregards the particular kinds of underlying accounts. Consider a business where all of the current assets are accounts receivable. Despite having a solid working capital position, the company's financial stability depends on whether or not its customers will pay and whether it can generate short-term cash. Similarly to that, assets can rapidly lose value. If a key client declares bankruptcy, the value of the accounts receivable balances may decrease. Inventory is vulnerable to theft or obsolescence. Real money is also vulnerable to theft. Hence, factors outside of a company's control could influence its working capital. Finally, working capital is predicted on knowing all debt obligations. Agreements may be overlooked, or invoices may be processed erroneously in mergers or businesses that operate at a high pace. Correct accounting procedures are crucial for maintaining working capital, particularly those related to internal control and asset protection. Calculation of working capital

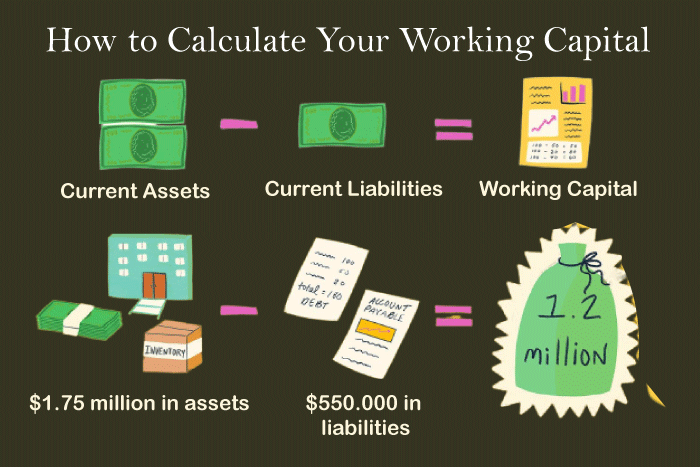

A company's current assets are multiplied by its current liabilities to determine its working capital. For instance, a company's working capital would be $20,000 if its current assets were $100,000 and its current liabilities were $80,000. Current assets can come in cash, accounts receivable, and inventory. Accounts payable, payments on short-term debt, and the current share of deferred revenue are a few examples of current liabilities. Need of Working CapitalWorking capital is crucial for businesses because it keeps them afloat. Theoretically, even profitable companies can go out of business. After all, a company cannot rely on paper profits to pay its debts; these debts must be settled with readily available cash. Let's say a business has $1 million in cash on hand as a result of its retained earnings from prior years. The company might need more current assets to cover its liabilities if it invested $1 million. Tips to Improve Working CapitalIncreasing current assets will help a business' operating capital. This includes putting money aside, increasing inventory reserves, paying costs in advance, especially if doing so results in a cash discount, or carefully deciding which clients to provide credit (to reduce its bad debt write-offs). Moreover, a business might increase working capital by lowering its short-term debt. The business can obtain the best credit conditions and avoid incurring debt when it is unnecessary or expensive. The business can be careful with its expenditure on external vendors and internal workers.

Next TopicAlgae Definition

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share