Advantages and Disadvantages of Buyback of Shares

In India, the Buyback of Shares is a relatively new idea recently gaining popularity. The SEBI (Buyback of Securities) Regulations of 1998, which establish the buyback process regulations, control the repurchase of shares. The SEBI (Buyback of Securities) Regulations, 2018, have recently updated the rules from 1998.

Definition of Buyback of Shares

A Buyback of Shares is a business move in which a corporation makes an offer to current shareholders to acquire back its shares. Typically, the buyback is started at a price above the going rate.

A Buyback of Shares is a firm purchasing its own previously issued shares. A corporation announces publicly a buyback offer to recover shares from current owners within a specific time frame. This is a corporate finance event.

Share repurchases or stock buybacks are other names for the Buyback of Shares. The offer price for the repurchase that the corporation discloses is often greater than the going rate for the stock.

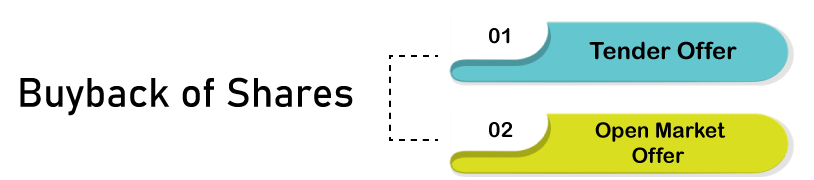

Types of Buyback of Shares

There are two ways for businesses to carry out a buyback:

- Tender Offer: Shareholders of corporations are sent a tender offer, in which they are asked to submit (or tender) all or a portion of the shares within a specific time limit. The offer includes a pricing strategy for the shares and the number of shares the corporation intends to repurchase.

Investors who agree to tender their shares do so by stating the number of shares and the price they are ready to accept. Following receipt of all proposals, the corporation selects the best combination to purchase the shares for the most affordable price.

- Open Market: A business may also purchase its stock here on the open market at the going rate, which is frequently the case. However, when a repurchase is announced, the stock price immediately increases since the market views it as a positive indicator.

Reasons for a Stock Buyback

The following are some factors that may prompt a corporation to start a stock repurchase scheme:

- Reduced share count: One of the main motives for a firm to pursue a buyback is to lower the total number of shares outstanding. This gradually increases market demand for the stock, which is advantageous for those who purchased it.

- Consolidate the business ownership: When you buy a share of any firm, you also own a portion of the business with certain rights. It might be difficult to get a unanimous result throughout the voting/decision-making process because of the enormous number of participants. A decline in the number of shares facilitates shareholder consolidation and decision-making, and it also ensures that the promoters don't lose a sizable chunk of their assets.

- Increasing a firm's current worth: When a corporation believes its value is too low, it frequently repurchases shares. This further assists the business not just in correcting its value but also in attracting investors' attention. Investors are more inclined to believe that a firm will expand if it buys back its shares at a higher price.

- Increasing the fundamental safety: When the corporation reduces its share count, its EPS (earnings per share) rises. This also enhances the company's other fundamental ratios as well. The share repurchase plan can thus enhance the company's basic health.

- A bonus for the stockholders: Every investment made by a shareholder aims to generate future returns. As a reward for their confidence and investment, buybacks return money to shareholders. The three-level tax on dividends does not apply to buybacks. Therefore, rewarding employees is a better alternative for the company regarding benefits and taxes.

- As a barrier to an aggressive takeover: If a hostile takeover is anticipated, the target company's management may, as a defensive measure, buy back some of its shares from the market. This defensive action aims to lessen the possibility that the acquirer would get a controlling interest in the target company.

Financing Elements of Buyback

Business performance mostly depends on enhanced and efficient money and finance management, which is the backbone of the industry. To buy back shares and securities in bulk, the corporation has to mobilize enormous resources and funds through one or more sources.

- Internal resources

- Adequate liquidity of cash

- Minimizing losses while selling temporary investments

- Increasing working capital requirements

- Issuing fixed deposits to raise money

- Obtaining funds through issuing loan bonds and debentures

- Commercial banks provide cash credit

- Commercial bank overdrafts, etc.

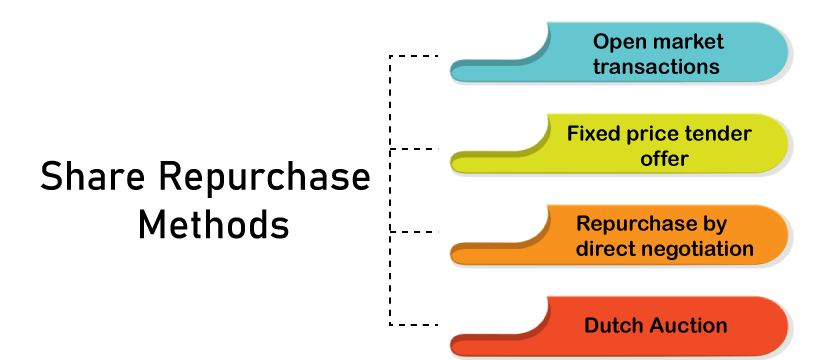

Techniques for Stock Buyback

Usually, a stock buyback can be conducted using the following:

1. Open market share repurchases

Unlike other strategies, open-market stock buybacks don't impose legal limitations on a business to carry out the Buyback of Shares. A business immediately purchases its shares from the market, and the company's brokers are used to carry out the transactions. As a significant share must be bought, the Buyback of Shares often takes place over an extended period.

Therefore, a firm can terminate the share buyback plan anytime it feels necessary. The major advantage of open-market share buybacks is that a firm may buy its shares back at the current market value without paying a premium.

2. Fixed-price tender offer

A firm makes a tender offer to purchase back the shares from the shareholders at a certain price and date. The corporation will then receive the number of shares that the shareholders who want to sell their equity have offered for sale. A premium is usually included within the tender offer compared to the current share price. Generally, a tender offer with a fixed price may enable a stock repurchase to be completed swiftly.

3. Dutch auction tender offer

A company offers to purchase back shares from owners in a Dutch auction and provides a range of possible values, with a minimal price range set above the current market rate. The shareholders submit their proposals by stating the lowest price and the shares they are willing to sell. To complete the share repurchase plan, a firm assesses the shareholder proposals and selects the suitable price within a defined price range.

The main advantage of the Dutch auction is that it lets a company get immediate shareholder opinion on the repurchase price. Another advantage of this strategy is that the share buyback plan may be completed quickly.

4. Direct negotiation

A corporation contacts one or more large owners directly and offers to buy back its shares from them. The share purchase price, in this instance, includes a premium. This strategy's key benefit is that a firm may directly bargain the buyback price with a shareholder. This makes this operation, in some cases, quite cost-effective. However, direct conversations with shareholders can take some time.

Advantages of Buyback of Shares

- Flexibility: The nature of the share repurchase is flexible. Unlike cash dividends, which must be paid right once, the share repurchase plan is carried out over an extended period. Additionally, the corporation is not required to implement the Buyback of Shares and can change or terminate it based on its requirements. Additionally, the stockholders are not required to buy back the shares. Depending on their preferences, people may decide to keep the shares.

- Tax Advantage: Some nations have lower capital gains tax rates than the rates on dividends. Therefore, when choosing between dividend forms in such nations, investors would choose share repurchase over cash dividends. Taxes will be due on the share repurchase under the capital gains tax bracket.

- Buyback of Shares as a Signal: Because the firm believes its shares are undervalued and is confident in its growth prospects, the share repurchase is often viewed positively. It's also possible that the corporation is repurchasing the shares because it lacks viable investing possibilities. For growth investors, this can be a warning sign. Investors can examine this activity and its intended outcome to determine the firm's direction. The underlying notion is that deeds speak more clearly than words.

- Better Financial Ratios: Since the profit is unaffected by a decrease in the number of shares, higher ratios like EPS, DPS, and ROE will result. As a result, this will lead to higher share profitability.

Benefits to Stakeholders

- With this buyback, you may purchase fewer shares, sell them back for more, and quickly realize a profit on your investment.

- The company is repurchasing shares at a lower cost than the current market price. As a result, the price of this corporation will probably keep increasing in the future. Therefore the overall market outlook for the company may be favourable despite the current low market price.

- Investors who get dividend payments totalling more than Rs 10 lakh annually are subject to taxation. They can be subject to reduced tax returns instead of paying dividends.

- Following the demand-supply principles, the firm's price may increase following the buyback since the number of shares on the market will be reduced. As a result, the shares' liquidity is increased.

The benefit to a Company

- A corporation or promoter can demonstrate their trust in the market by submitting a buyback request if they are certain their company's credit is significantly greater than the market price.

- The company's share capital declined following the buyback, although the incident had no impact on the business. As a result, even though the company's income is the same, fewer stockholders get it. The stock of the corporation rises as a result.

- After a buyback, the company's market value frequently increases significantly. (For instance, the market price for Infosys is substantially greater than the buyback price from the prior year.)

Government Benefits

- The government will soon attempt to use buybacks to reach its investment goal-the yearly investment goal of Rs 80,000 crore and the assurance of more buyback opportunities in the future.

- The government can raise a lot of money this way for development, and the buyback of several government-owned corporations demonstrates this.

- For instance, Indian Oil, ONGC, and Bharat Electronics recently initiated a buyback plan. Along with the government, regular investors might profit from this initiative.

Use of money wisely - Cash Management

- Sometimes a company's cash reserves are not required for a new initiative. In this situation, the business can purchase back the shares from the shareholders and restore the idle capital to them.

- This can occasionally be seen negatively in the market. However, it also suggests that the problem is not with a new incremental project. But in most buyback situations, investors have faith in the firm.

Disadvantages of Buyback of Shares

- Judgment Error in Valuation: Despite improved access to firm information, management risks misjudging the company's value. The entire repurchase procedure will be fruitless if the corporation overestimates prospects while doing the buyback to justify the undervaluation.

- Through Ratios, an Unrealistic Picture: EPS, ROA, ROE, and other ratios are improved by share repurchases. This ratio improvement is caused by a decline in the number of outstanding shares rather than an increase in profitability, and it is not a natural increase in profit. Thus, the repurchase will provide a positive image inconsistent with the company's economic reality.

Other drawbacks of the Buyback of Shares include:

- Reduces the company's financial flow.

- Concern about share price manipulation.

- It could take money from profitable investments made by the corporation.

- Buybacks may bring on a lack of shares.

- The company's final option for using funds is to buy back its stock.

- Buybacks are not without risk.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now