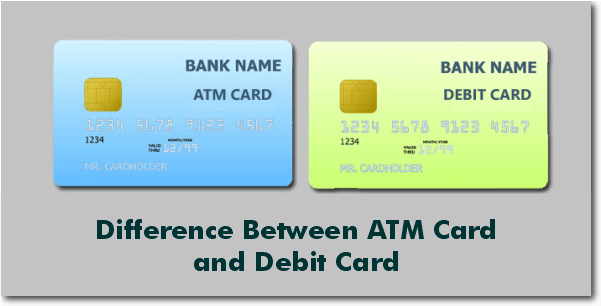

Difference Between Debit Card and ATM CardAs we move into the future, technology will help shape our operations. People used to take cash with them wherever they went in order to make payments in previous periods. As at that time, there were no devices like debit cards, credit cards, or ATM cards. This wasn't just inconvenient, but it was also dangerous because carrying cash puts us at constant risk of robbery. We now live in the age of ease brought on by cashless transactions, however, things have significantly altered. Debit cards and ATM cards are two examples of payment devices created by banks that have totally changed how consumers access their money.

Cash withdrawals no longer require a trip to the bank in person. You are not limited to merely cash withdrawals with a debit card or ATM card. Using a debit card or ATM card may be used for a variety of tasks, including making payments, grocery shopping, booking travel, and more. Though few people are aware of the distinction between debit cards and ATM cards, they are both commonly used. Continue reading to learn how to distinguish between a debit card and an ATM card. First, let us know about debit cards What is a Debit CardA debit card automatically debits (deducts) money from the user's account when it is used. They can be used to withdraw cash from an ATM or a company that lets you add extra money to a transaction, as well as to make purchases of goods and services. They are sometimes referred to as "check cards" or "bank cards."

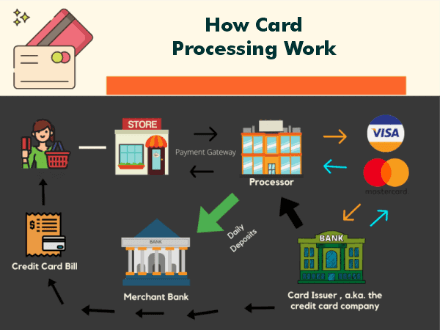

How Debit Card WorksDebit cards frequently come in rectangle shape and are made of plastic, just like charge cards. It's linked to the customer's checking account with a bank or credit union. The quantity of money that may be spent depends on the size of the account (the amount of funds in the account).

In a few aspects, debit cards are similar to a cross between credit and ATM cards. As in the second instance, they can be used to make purchases or, as in the first, to get cash from an automated teller machine at a bank. The basic, single-use ATM cards used by many financial institutions are increasingly being replaced with debit cards offered by important card-payment processors like Visa or Mastercard. These debit cards are delivered right away with a checking account. If you use your debit card to receive cash or to make purchases, the process is the same. The connected account is promptly debited of its balance. The amount in your checking account is the only money you may spend, thus your spending is limited to that sum. In addition, the exact quantity of money you have available to spend and the balance of your account fluctuate during the day. Debit cards commonly include daily purchase limits that prevent the use them for transactions that would exceed a certain amount in a 24-hour period. With a debit card, you may choose whether to use a PIN or not. If the card carries the logo of a prominent payment processor, it is usually feasible to use the card without one, just like it would be able to do so with a credit card. Advantages And Disadvantages of Debit CardBy using debit cards, users essentially make their transactions in cash, that is, with money they own rather than money they have borrowed from a credit card. Yet compared to cash, they are far safer. It is simple to "see where the money went" since every transaction done with a debit or check card will be shown on the account holder's monthly bill. Cash that is misplaced or stolen cannot be replaced, however, the bank may be notified if a debit card is lost or stolen, at which point it will deactivate the card, remove any unlawful transactions from the cardholder's account, and issue a new card.

You are qualified for a debit card so as long as the bank permits you to have an account. Debit cards don't need to go through an application procedure as credit cards do. Due to the low cost of debit cards, merchants don't establish minimum purchase restrictions for them as frequently as they do for credit cards. Please take note that in comparison to credit cards, debit cards often don't come with as many benefits or fraud precautions. For starters, you lose money right away if a person using your identity steals into your actual bank account and withdraws money. It might be difficult to get your money back. Additionally, the amount you can spend on the debit card is restricted to what you have in your bank account. Also, owing to regular bill payments, automatic deposits, and ATM withdrawals, it may be tricky to remember how much money is in a checking account at any one time, making it difficult to utilize a debit card for purchases. You run the risk of having your card denied or having an overdraft fee assessed. What is an ATM Card?Automated Teller Machine is referred to as ATM. Similar to a debit card, an ATM card is a PIN-based card that a bank issues to account holders for use at ATMs.

Account holders can use it to make purchases by keying in their PIN in addition to using it at ATMs (PIN). In most cases, debit cards are ATM cards. How to Use an ATM Card?

Advantages and Disadvantages of ATM Card

Advantages of Atm card1. There are no yearly feesMost banks don't levy yearly fees, however occasionally a modest sum may be removed as a service or maintenance fee. The fees might differ from bank to bank. 2. No Interest FeesAs the money is deducted straight from your bank account, ATM cards do not incur interest fees like credit cards do. 3. ProtectionYou must input your PIN number before each transaction, they are highly safe. Also, most banks offer customer care around-the-clock. You may instantly get in touch with your local bank and block the card in the event of loss or theft. 4. EmergencyYou may simply withdraw money from any ATM since ATM cards are directly connected to your bank account. 5. The Practice of BudgetingYou may purchase anything with a credit card, even if you are short on cash. However, since you are spending money directly from your bank account when using an ATM card, there are restrictions. Hence, before a user swipes the card, this always places a restriction on them. 6. Smart ChoiceOne benefit of an ATM card is that you can only spend money that is in your bank account; there are no fees, interest charges, or negative effects on your credit score. In comparison to credit cards, the ATM card is unquestionably a wise decision. Disadvantages of ATM Cards1. It cannot give services in rural region in our nation although banks are present in the villages. 2. Customers are reluctant to use it because they lack adequate knowledge of how it works. No withdrawals of rupees are permitted if an ATM card is lost. There is possibility of misusing and hack the ATM card. 4. If there is an ATM dispensing error, the account will be debited even though no rupees were received. 5. Personal touch of customers-employee interaction is lacking. 6. Due to leaking of PIN, fraud might take place simply. 7. Initial cost of hardware, software, and installation location is quite high. 8. Limitations on money withdrawals. Debit Card vs Credit CardLet's compare the wider factors now that we are aware of the essential distinctions between an ATM and a debit card. A comparison of an ATM card and an ATM card is provided in the table below.

1. Basic UseWhile ATM cards can only be used to withdraw money from ATMs, debit cards have a variety of features and can be used for online and offline purchases. 2. AcceptanceDebit cards are accepted by merchants and online payment processors, making for a hassle-free shopping experience. In-store purchases cannot be made with ATM cards. 3. Fund TransfersYou cannot transfer money using ATM cards, but you can link your ATM card to third-party applications to start a transfer. 4. Online purchases and DiscountsWith debit cards, you may purchase products and services online and pay your utility bills as well. You may even be eligible for discounts on your card on online purchases and bill payments. But these facilities are not available with ATM cards. 5. Overdraft FacilityBanks rarely offer overdraft facilities with ATM cards, despite the fact that some debit cards do, and some debit cards do offer an overdraft facility. 6. EMI ChoicesYour ATM card can be used to pay EMIs on any of your loans, particularly consumer purchase loans provided by online retailers. You cannot, however, avail yourself of the ATM facility with debit cards. 7. Extra AdvantagesMany banks in India offer a few extra advantages that can demonstrate exceptionally beneficial to the charge cardholder. These include free insurance, access to airport lounges, reward points and cash back, discounts on gas, and other perks. With ATM cards, no extra advantages are given. Tabular Difference

ConclusionWith India's vast ATM network, an ATM or ATM card means easy access to cash anytime. This eliminates the need to carry cash, which increases our security. While the benefits of an ATM card overlap with all the benefits offered by an ATM card, both cards are equally useful on their own. The differences between an ATM card and an ATM card are quite significant in terms of use. As such, they are not interchangeable. Therefore, you should make sure that you open a bank account that offers the benefits of both ATMs and debit cards. Both cards are an essential part of our banking needs today and make bank transfers incredibly easy.

Next TopicDifference between

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share