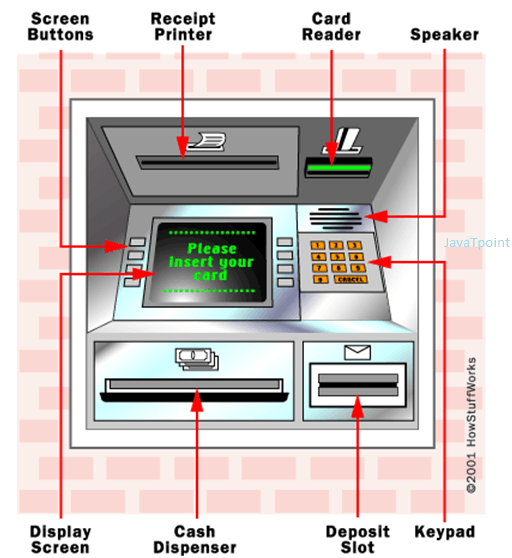

What is the full form of ATMHere, you will get the answer to the following ATM-related questions: what is the full form of ATM, what does ATM stand for, what is the meaning of ATM, how ATM works and what does ATM? ATM : Automated Teller MachineATM stands for Automated Teller Machine. ATM is an electro-mechanical machine that is used for making financial transactions from a bank account. These machines are used to withdraw money from personal bank accounts. This makes the banking process very easy because these machines are automatic, and there is no need for a human cashier for the transaction. The ATM can be of two types; one with basic functions where you can withdraw cash and another one with more advanced functions where you can also deposit cash. Basic ATM PartsThe ATM is a user-friendly machine. It features various input and output devices to enable people easily withdraw or deposit money. The basic input and output devices of an ATM are given below: Input Devices:Card Reader: This input device reads the data of the card, which is stored in the magnetic strip on the back side of the ATM card. When the card is swiped or inserted into the given space, the card reader captures the account details and passes them to the server. On the basis of account details and the commands received from the user, the server allows the cash dispenser to dispense the cash. Keypad: It helps the user to provide the details asked by the machine-like personal identification number, amount of cash, receipt required or not, etc. The PIN number is sent in encrypted form to the server. Output Devices:Speaker: It is provided in the ATM to produce the audio feedback when a key is pressed. Display Screen: It displays the transaction-related information on the screen. It shows the steps of cash withdrawal one by one in sequence. It can be a CRT screen or an LCD screen. Receipt Printer: It provides you with the receipt with details of transactions printed on it. It tells you the date and time of the transaction, the withdrawal amount, the balance, etc. Cash Dispenser: It is the main output device of the ATM as it dispenses the cash. The high-precision sensors provided in the ATM allow the cash dispenser to dispense the correct amount of cash as required by the user. How ATM worksTo start the functioning of the ATM, you have to insert plastic ATM cards inside the ATM machines. In some machines, you have to drop your cards; some machines allow the swapping of cards. These ATM cards contain your account details and other security information in the form of a magnetic strip. When you drop/swap your card, the machine gets your account information and asks for your PIN no. After the successful authentication, the machine will allow financial transactions. What ATM doesNow a day, ATM has a lot of functionalities along with its basic use of cash dispensing. Some of them are:

The first ATM was used to dispense cash for customers by a Chemical bank in New York (USA) in 1969. ATM deposits are also growing in popularity. If their bank permits it, account customers can deposit money and checks. Note: PIN is a 4 digit security number provided by the bank with the ATM card. PIN number is changeable, you can change it according to your convenience.Important/Interesting Facts about ATMInventor of ATM: John Shepherd Barron. ATM Pin Number: John Shepherd Barron thought to keep a 6 digits PIN for the ATM, but it was not easy for his wife to remember a 6 digits pin, so he decided to prepare a 4-digit ATP PIN. World's first floating ATM: State Bank of India (Kerala). First ATM in India: Installed by HSBC (Hongkong and Shanghai Banking Corporation) in 1987. First ATM in the World: It was installed on 27 June 1967, at the Barclays Bank of London. First Person to use ATM: The famous comedy actor Reg Varney was the first person to withdraw cash from the ATM. ATM without an Account: In Romania, which is a European country, one can withdraw money from an ATM without having a bank account. Biometric ATM: Biometric ATM is used in Brazil. As the name suggests, the user is required to scan his or her fingers at these ATMs before withdrawing money. World's Highest ATM: It is installed in Nathu-La mainly for army personnel. Its height is 14,300 feet above sea level and is operated by the Union Bank of India. ATM Machine and ATMLet's see the image of an ATM.

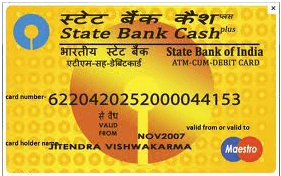

Let's see the image of the ATM card.

What to watch out for regarding ATM feesBoth your bank and the bank that owns the ATM may charge fees if you use one that is not in your bank's network or not owned by it. The RBI has given banks permission to impose interchange fees of 17 rupees (₹17) for each financial transaction and 6 rupees (₹6) for non-financial transactions at all centres beginning on August 1, 2022. Banks charge service fees for ATMs in order to cover the escalating expenses of ATM installation and maintenance. Only utilising ATMs in your bank's network and getting cash back when you make purchases at a grocery store or another business are two ways to avoid paying ATM fees. limits on ATM withdrawalsBanks have restrictions on the amount of money you can withdraw from an ATM each day, as we have already indicated. Put your hand or some other body part as a cover so nobody can see you type your PIN. This can help prevent fraud. Additionally, since each ATM can only hold a certain amount of money, capping the amount per withdrawal enables the bank to control the movement of cash. Place and SecurityUsing ATMs that are situated in well-lit public areas is one way to prevent being a victim of crime when doing so. When you get your money, do not count it at the ATM; instead, wait until you are in a more private setting, like your car. The bottom line is that ATMs frequently make it handy to have access to cash around-the-clock without having to visit a teller or other bank employee. They frequently also let you check your balance, deposit money, and move dollars across accounts. Once you are aware of things like withdrawal limitations and techniques to prevent paying fees for using ATMs, utilising an ATM makes your cash more accessible and is quick and simple.

Next TopicBBA Full Form

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share